|

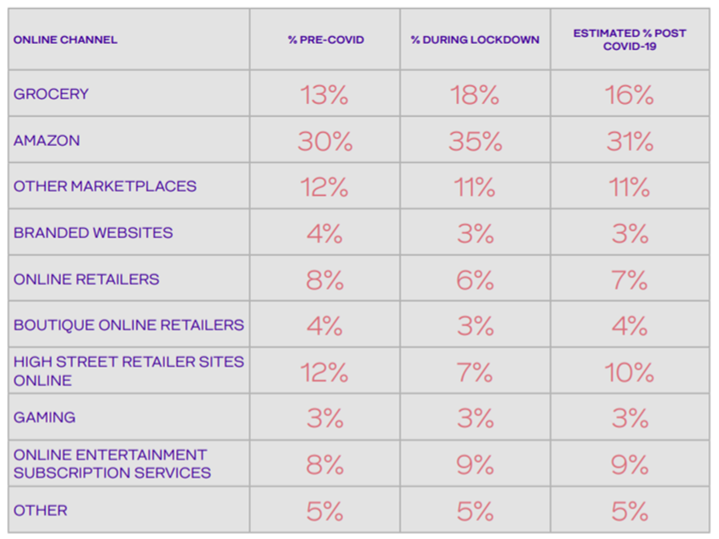

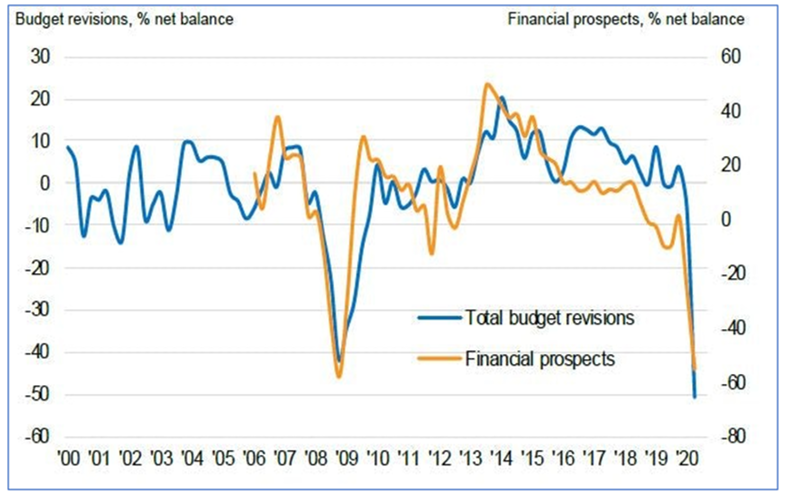

Today’s Clear Digital Digest reviews a recent survey on changing customer attitudes as well as the latest IPA Bellwether marketing spend report. The MP3 is 25 years old this week and although not widely used these days, as the key tech that paved the way for streaming its influence can often be understated, as we explore below. Plus a look across the Channel at a new, unique way to watch films… CONSUMER ATTITUDES AND MARKETING SPEND Amongst the latest insights that emerged this week, Wunderman Thompson’s “Covid, Commerce and the Consumer” report stood out, based on a survey of 2000 UK consumers in early June. Some key highlights include:

MP3 TURNS 25 There was an important but fairly unheralded digital milestone this week, as the MP3 file turned 25.

AND FINALLY...

With cinemas closed until recently and only gradually re-opening now, one new trend has been the emergence of drive-in cinemas to bring some US retro flavour to cinephiles who are seeking more than another Netflix binge. Venues as varied as Brent Cross Shopping Centre car park and Alexandra Palace will be accommodating such yearnings this summer. However, Haagen-Dazs are adding a new flavour in Paris with their “Cinema Sur L’Eau” concept: a socially distanced cinema where customers will sit in boats rather than cars. Further investigation reveals they will be showing a film entitled Le Grand Bain (English title: Sink Or Swim), about a group of men who start their own synchronised swimming team. Certainly a wiser choice of movie to show in this environment than Jaws or Titanic.

0 Comments

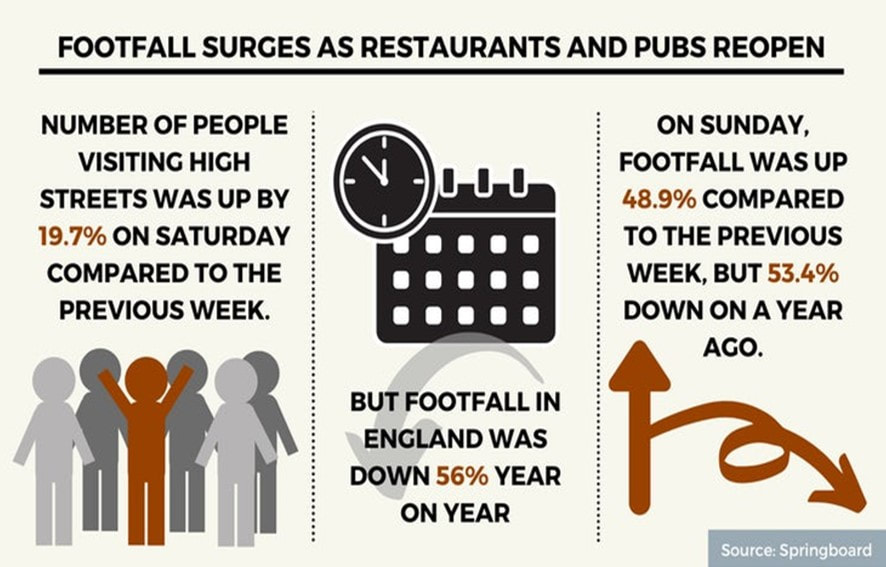

Today’s Clear Digital Digest looks at the early impact of the lockdown slightly easing last week, some updated ecommerce sales trends, Ofcom’s research regarding online usage habits and perceptions plus perhaps the scariest sports supporters seen for many a year. HAIRCUTS BEFORE HEINEKEN One of the biggest changes in the UK in the last week has obviously been the lockdown easing last Saturday (4th July) for both pubs and restaurants as well as for some other service retailers, most notably hairdressers.

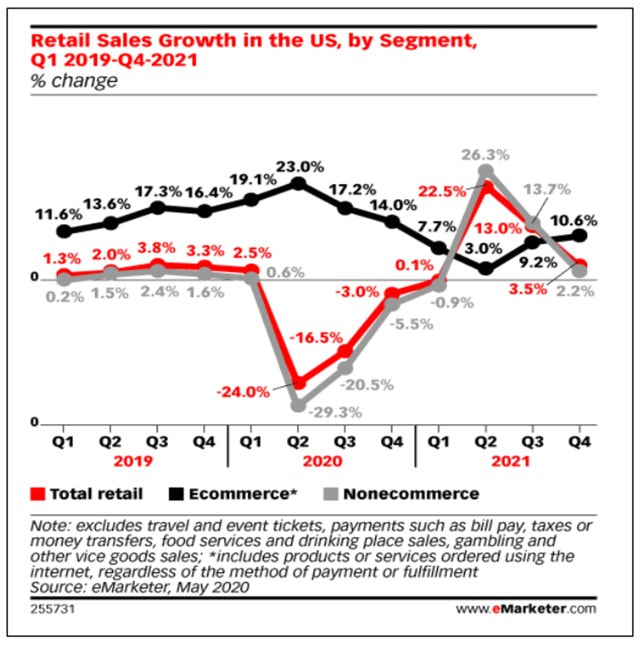

ECOMMERCE SALES UPDATES

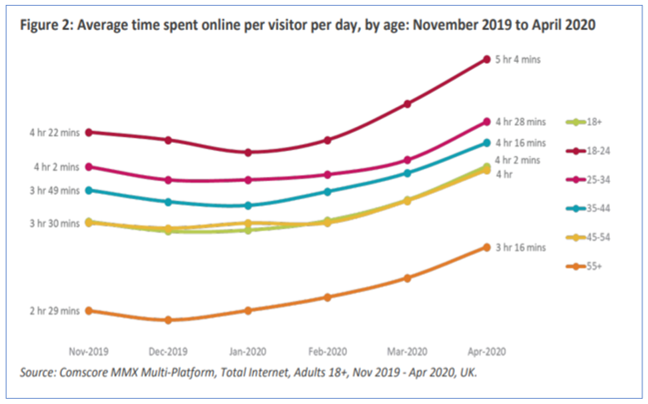

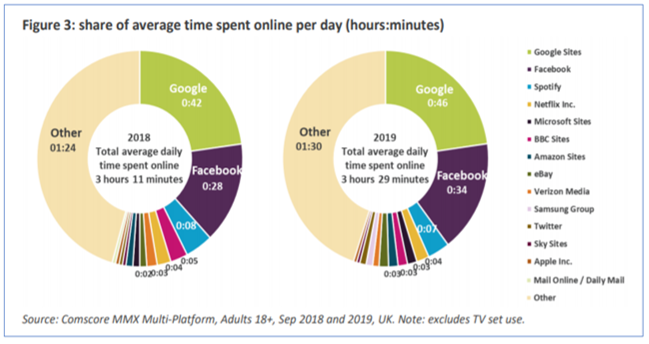

ONLINE NATION Ofcom last week released their latest report “Online Nation” that looks at what people are doing online as well as their attitudes to and experiences of using the internet.

AND FINALLY… In the week that cricket was the latest sport to return behind closed doors, its sporting cousin baseball showed off an imaginative replacement for supporters in the stadium. Japanese baseball team Fukuoka SoftBank Hawks unleashed 2 different types of robotic fans for their match against Rakuten Eagles on Tuesday, who arguably look scarier than Millwall fans from the 1980s… Hi and welcome to the first Clear Digital Digest for a while, as the Clear Digital blog returns. More about that here but as before, these summaries will select a range of recent interesting, insightful and sometimes quirky ecommerce, marketing and media stories and break them down into handily digestible form. Today we’re looking at some new research on the world’s largest brands, the increasingly polarised nature of the UK retail market plus a novel way to socially distance ahead of lockdown restrictions further easing this weekend… AMAZON REMAINS THE WORLD’S MOST VALUABLE BRAND, BUT FACEBOOK FALLS

Methodology: Kantar’s BrandZ valuation process takes the financial value created by a brand in US dollars and multiplies it by brand contribution, to calculate its Brand Value: the worth in dollars that each individual brand is tangibly worth.

RETAIL’S CONTINUING DIVIDE It’s been another unfortunately contrasting week of winners and losers in the retail space.

AND FINALLY…

As Clear Digital returns this week, I’ve just published two deeper dives as well, both examining the marketplace sector. This is an area that has actually benefitted to some degree from the present turmoil, with recent stories including Etsy doubling its sales in April and music marketplace Discogs seeing usage levels increase by 65%.

And finally, with (some) pubs set to reopen this weekend – and mixed views as to what this will bring – I did like this novel solution from across the Channel that I discovered on Twitter this week… Hi and welcome back to the Clear Digital blog, my newly reborn space to talk, discuss, review and speculate about the worlds of digital, ecommerce, marketing and media. Clear Digital was originally set up in late 2015 as an interim project before I then re-entered the world of permanent work in June 2016, as Head of Ecommerce at Wyevale Garden Centres. The blog has lain dormant since then, but having left Wyevale last year due to its break up and sell-off by its private equity owners, I’ve now decided to bring back Clear Digital. As before, I’ll be focusing in particular on my main personal areas of interest in the digital world, filtered through the lens of my 15 years working in the industry with brands such as Argos, Bupa and Wyevale. Of course, one significant change from four years ago is the tumultuous times we are living through in 2020, so this will obviously have some impact on what I cover. Generally, these will be the main themes explored by Clear Digital:

To kick things off, I’ve just published two pieces of related research looking at the UK marketplace sector. Covid19 has led to steep recent online sales growth, and marketplaces (including the twin headed Amazon/eBay beast) have also benefitted from this significant change in customer behaviour. However, this hasn’t been just due to the forced closure of many traditional shops, but also because a growing number of marketplaces offer a real sense of community, usefulness and fun – with a personal favourite of mine being Discogs, the record collector hub and marketplace. Therefore, I’ve taken a look at the UK marketplace sector as a whole, as well as a deeper dive on Discogs and the UK music sector, including the significant size of the under-reported used records market… The UK marketplace sector – and the role of community The UK marketplace sector is responsible for a third of all ecommerce sales - and 2020's unfortunate events have seen a large rise in sales and sellers. This blog examines the sector's size, dynamics and the increasing success of community-driven marketplaces. Discogs – the digital success story of the vinyl revival Discogs is a digital brand with a difference; it’s thriving in the hugely competitive music sector, by catering to a niche but dedicated sector of music enthusiasts and record collectors. This blog reviews the current music market as a whole, delves deeper into the second hand vinyl market and then examines Discogs’ offering and recent success. All future posts will be shared via the @clrdigital Twitter feed, as well as my personal LinkedIn account, so please follow to get all the latest updates too… CLEAR DIGITAL CONSULTING Another reason for re-establishing the Clear Digital blog is more pragmatic; I’m also currently personally available for new assignments, having started searching for fresh opportunities at the worst such time in living memory. Therefore, as well as being open for permanent roles, I can assist on an interim and consulting basis, utilising my past experience but also a wider network of contacts out there if necessary, specialising in a wide range of ecommerce, digital and marketing disciplines. My Consulting section has more details on how I can help, particularly in these areas: I’d love to hear from you and catch up to see if there’s anything I can help you with or even just share and exchange some thoughts…

|

Jim ClearLead blogger and founder of Clear Digital: talking about ecommerce, digital, marketing and media. Categories

All

Archives

December 2020

|