|

My final Clear Digital blog of 2020 rounds up in one place all the deep dives and Digital Digest summaries that I’ve written over the last 6 months… Deep DivesTHE UK MARKETPLACE SECTOR - AND THE ROLE OF COMMUNITY Marketplace sites are responsible for a third of the UK ecommerce sector with sales of £26.2bn in 2019. As well as Amazon and eBay, community-driven marketplaces are also experiencing significant growth. Exploring the dynamics of the UK marketplace sector, this article examines the winners and what we can learn from them. DISCOGS - THE DIGITAL SUCCESS STORY OF THE VINYL REVIVAL The specialist marketplace Discogs is a digital brand with a difference; it’s thriving in the hugely competitive music sector, by catering to a niche but dedicated sector of record collectors. This article reviews the current music market, delves deeper into the second hand vinyl market and then examines Discogs and its recent success. THE GROWTH OF DIRECT TO CONSUMER, SHOPIFY - AND DEVELOPING MULTIPLE CHANNELS This article explores the size and dynamics of the UK DTC sector, as well as examining Shopify (and similar ecommerce solutions) in order to understand more about DTC winners and their growth drivers, including expanding onto other channels. Clear Digital Digests20th November 2020: Here Comes A Very Different Christmas

30th October 2020: Ad spend, Black Friday, TikTok, Royal Mail and Woolworths 6th October 2020: Bagel cities, online grocery, Instagram is 10 and a chocolate orange hotel 18th September 2020: Subscription coffee, Amazon ads, retail sales update and cricket data 4th September 2020: Ocado, eBay, Discogs, Netflix and authorised handball 21st August 2020: 5 big shifts, retail round-up and retro gaming 11th August 2020: Turn on, tune in and check out 3rd August 2020: Argos catalogue RIP, retail tie-ups, Q2 updates and soccer supervillains 17th July 2020: MP3, marketing spend and movies sur l'eau 10th July 2020: Online habits, haircuts and robot fans 3rd July 2020: Brands, baskets and bears

0 Comments

It’s now been 5 months since we entered lockdown and then slowly started to re-emerge as restrictions began to ease, bit by bit. It would be trite to say the world has changed in a way previously unrecognisable to all of us; of course it has and constantly so. In fact the pace of change makes it increasingly difficult to keep up, especially with a seemingly never-ending deluge of data and information and data being provided. Looking at these awful events from an ecommerce perspective, I’ve highlighted 5 key trends from these last 5 months to help understand the seismic shifts we’ve been experiencing with regards to how customers have been shopping during this unique period:

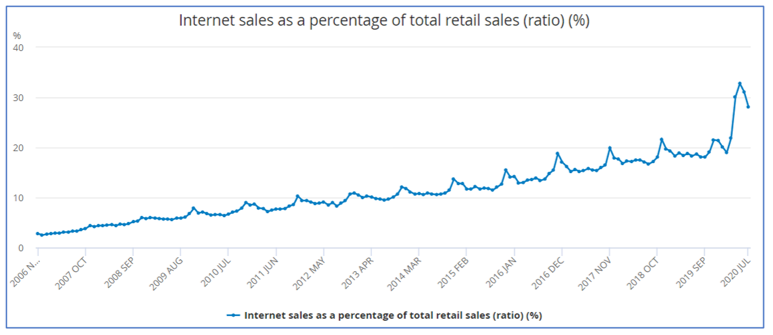

This Clear Digital Digest takes a look at each of these trends in turn, as well as providing some retro gaming light relief at the end… 1. ONLINE SALES HAVE ACCOUNTED FOR AS MUCH AS A THIRD OF TOTAL RETAIL SALES DURING LOCKDOWN This insightful chart from the Office for National Statistics (ONS) shows the huge growth in ecommerce sales during lockdown, with internet sales peaking at 32.8% of all retail sales in May.

2. ECOMMERCE DROVE £658M OF ADDITIONAL GROCERY SALES JUST LAST MONTH

According to Nielsen’s head of retailer and business insight Mike Watkins:

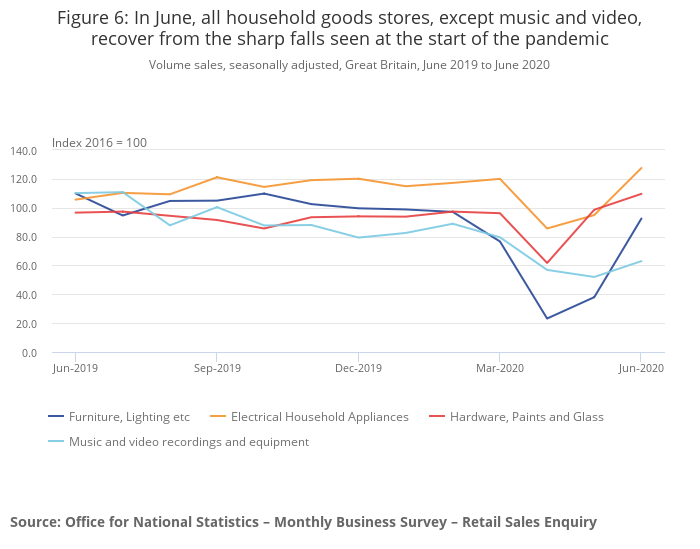

3. SUCH DYNAMIC ECOMMERE GROWTH IS SPEEDING UP SECTOR INNOVATION This step change in customer behaviour is seeing a never faster pace of innovation within the market, with recent developments including:

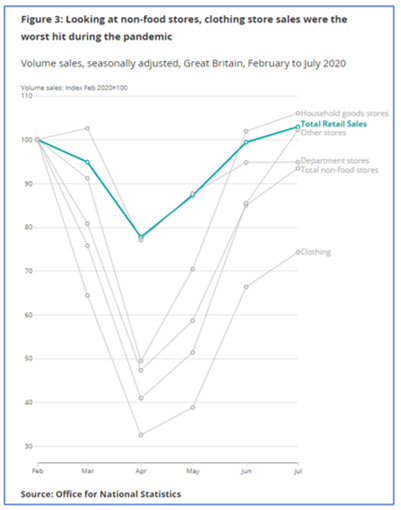

4. SPENDING IS VERY SQUEEZED IN OTHER SECTORS, ESPECIALLY CLOTHING AND MID-MARKET BRANDS

5. AS WELL AS ECOMMERCE INNOVATION, OTHER NEW CHANNELS ARE BEING INTRODUCED, SUCH AS PRODUCT RENTAL

AND FINALLY… As an 80s kid that loved arcade gaming and a 90s student who used part of his student loan to buy a Sega Mega Drive, before then becoming involved professionally as a PS2/Xbox buyer in the 00s, I really enjoyed watching the new Netflix video games history docuseries “High Score” - well the first two episodes I have thus far encountered anyway… It’s now just 3 weeks to go till Euro 2016 kicks off in France on Friday 10th June, and while the tournament itself will have some way to go in order to match the still incredible story of Leicester City’s domestic Premier League triumph, the extra home nation interest this year will undoubtedly see passion levels run high once Euro 2016 actually starts. Summer football events such as the Euros are now also an established part of the marketing and promotion calendar for many brands – for both official sponsors and other companies – so I’ve taken a look at how some of them have so far embraced this opportunity. It was estimated that the 2014 World Cup contributed £2.5bn to UK consumer spending and it is believed that Euro 2016 will generate a similar amount, with food, drink, retail and betting sectors seeing the greatest benefits. Over 60% of pubs are predicting like for like sales increases of more than 10% through June, with the England v Wales group match on Thursday 16th June unsurprisingly highlighted as a particularly large opportunity. The nature of big sporting tournaments like Euro 2016 lends itself to a variety of different objectives for brands, in particular:

OFFICIAL SPONSORS: CARLSBERG EARLY PACE-SETTERS UEFA have 10 official sponsors for Euro 2016; ranging from the usual suspects such as Adidas, Coca-Cola and McDonalds to emerging brands which won’t be as familiar to European consumers. These include the Chinese consumer electronics company Hisense and the seemingly aptly named Socar. Socar is actually the State Oil Company of the Azerbaijan Republic, so in reality this organisation is perhaps not such a natural fit for football tie-ins as Carlsberg for example. Amongst official sponsors, Carlsberg have certainly been to the fore with their activation plans, with a range of initiatives all following the “if Carlsberg did…” strapline, seemingly both in domestic markets and pan European too. This week, Carlsberg have been trailing online a new ad campaign starring Marcel Desailly, one of France’s World Cup 98 and Euro 2000 winning heroes. “If Carlsberg Did La Revolution” will undoubtedly feature heavily in June during TV coverage, with many hidden references in there for football geeks as well. Amongst the standard ticket giveaway competitions, Carlsberg have also been using more creative methods ahead of the tournament in the UK, including Chris Kamara looking at what would happen “if Carlsberg did substitutions” and rewarding generous Tube travellers with tickets to the Euros. Other UK focused campaigns include experiential activity, with Carlsberg rebranding 19 English pubs as the patriotic “The Three Lions”. Some other selected highlights from official sponsors include:

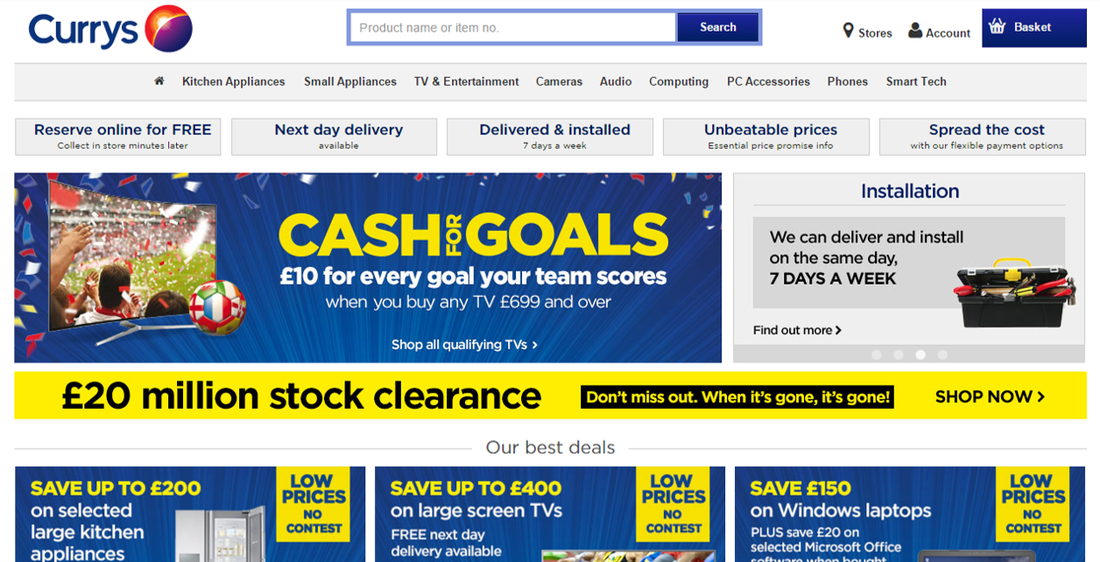

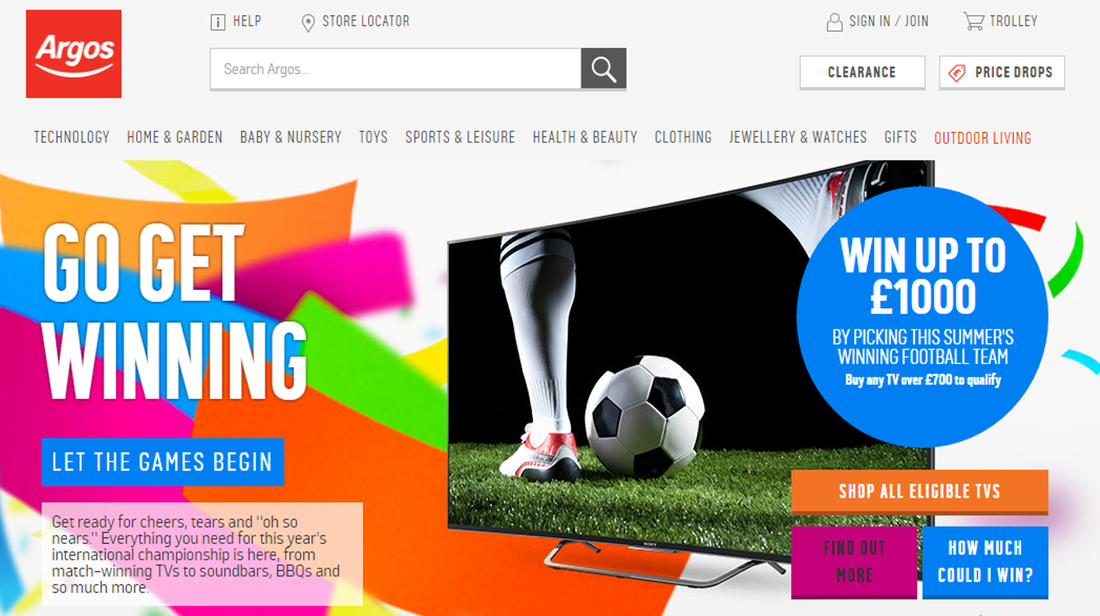

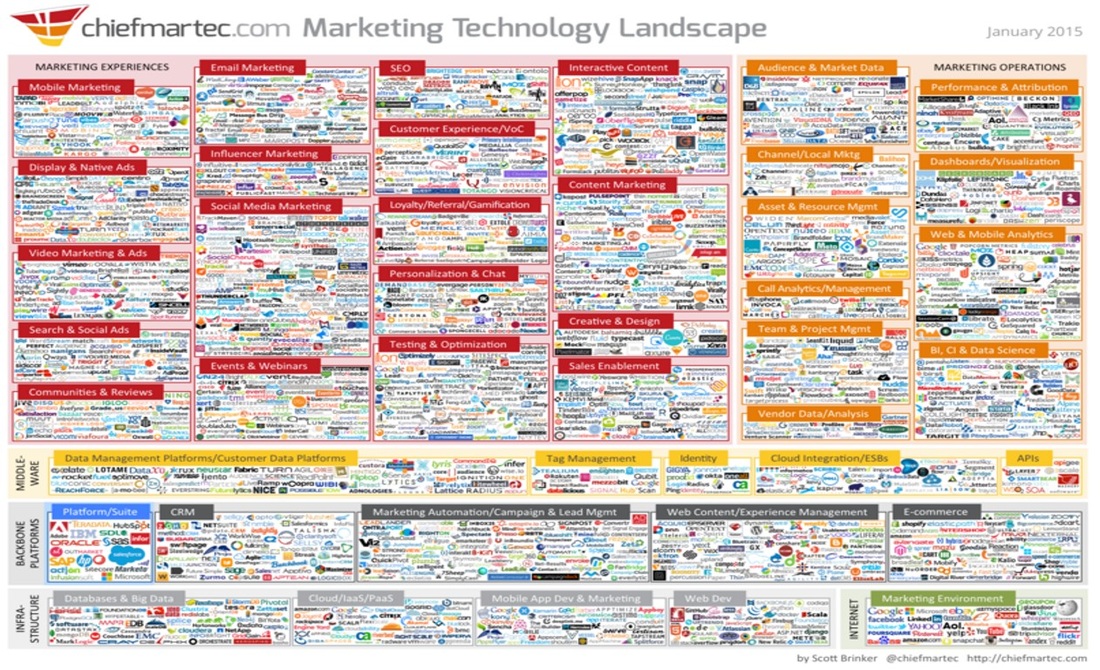

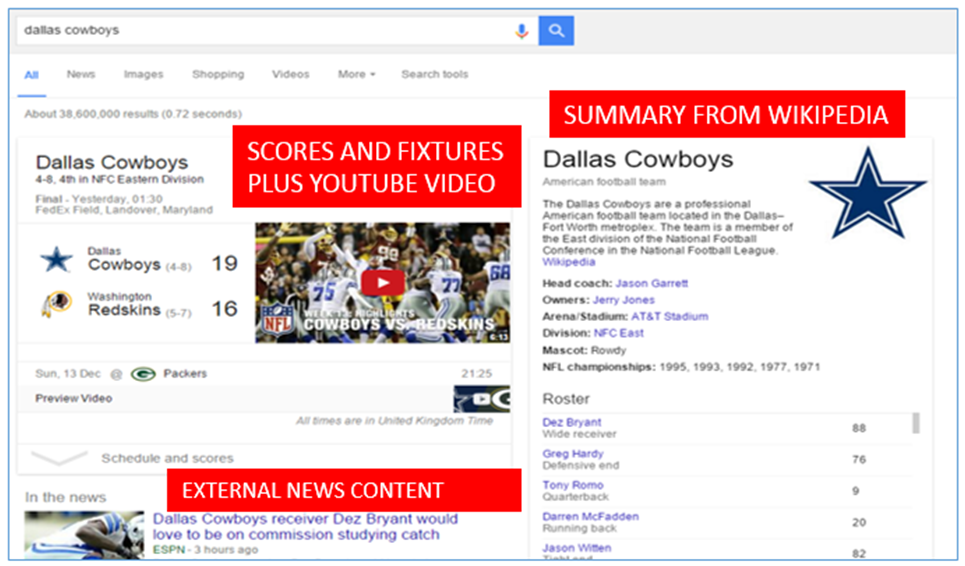

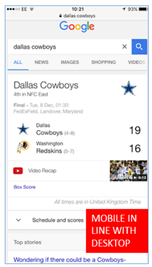

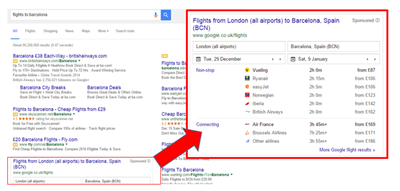

“UNOFFICIAL” CAMPAIGNS: PREDICT THE WINNER 3 weeks out and it may be a bit early to stock up on essentials like food and drink if planning a barbecue party, but it is the perfect time for more considered purchases to enhance your Euro 2016 viewing pleasure, such as a shiny new TV. And full disclosure here: I did once buy a new TV in time for Euro 2004, so this does actually happen! However, with governing bodies such as UEFA monitoring and protecting their trademark rights to enhance the aforementioned sponsorship deals, this tends to result in some creative descriptions by the vast majority of brands that are not filling UEFA’s coffers; leading to the use of many generic campaign titles such as the “summer of sport" rather than the trademarked "Euro 2016" or similar. A couple of good examples here are provided by Currys and Argos, both of whom are offering TV promotions with a prediction element based around "this summer’s big football tournament" (aka Euro 2016). To the fore on Currys’ homepage is their “Cash for Goals” promotion, backed up by a range of accompanying media both online and offline. This is a deal that Currys have run in similar form during previous summer football tournaments, and means that should you spend over £699 on a TV, Currys are offering £10 cashback for each goal that either England, Wales, Northern Ireland or Republic of Ireland score during the tournament. Customers can pick their team and with more choice amongst British Isles teams than usual, it will certainly be interesting to see if customers patriotically pick their own home nation, or go for another team based on their perceived chances. Argos are also focusing on upper end TVs by offering customers a chance to win up to £1000 by “picking this summer’s winning football team” when you buy a TV over £700 in their “Go Get Winning” promotion. Further investigation shows that for those heartened by the Leicester fairytale, you can win £1000 back if you plump for an outsider like Albania or Slovakia (or Northern Ireland/Wales), down to £100 for France, Germany or Spain. An England win, unlikely as it may seem, would net you £250 cashback. AND FINALLY… As well as official Euro 2016 sponsors maximising their activity with glossy campaigns and giveaways, plus retailers looking to sell appropriate seasonal products, multi-national sporting events generally also see a few more esoteric tie-ins as well. Expect to see some of these to the fore as the tournament approaches, but as a tasty example, the Amazon listing below provides some food for thought… So, as the festive period approaches, it is now the custom to both look back at the last year as well as forward to what the next year holds. I’ve personally decided to look forward to next year (with a nod to 2015 too) and outline 6 interesting trends that I think we’ll see during 2016 in the worlds of digital, marketing, ecommerce and media. By no means comprehensive (that would take a list of 16, if not 216), but hopefully an interesting list nonetheless. I’d also love to hear what you think too via comments below or on Twitter… 1. DIGITAL MARKETING TECHNOLOGY WILL CONTINUE TO CONSOLIDATE Next month is likely to see the latest update of Scott Brinker’s always helpful Marketing Technology Landscape; principally helpful to form an indicative view of how just how many different providers and channels/categories are out there due to its sheer scale. Typically updated annually, January 2015’s update featured a huge 1876 companies, double the 947 featured in January 2014. However, despite this growth in marketing tech providers, there is also an increasing rise in usage of the enterprise suites (“all in one/many in one” solutions from Adobe, IBM, Salesforce etc) as many businesses are understandably adopting a less is more approach and trying to simplify their marketing tech stack as far as they can, especially in pursuit of the nirvana of the ultimate multi-channel single customer view. Adobe for one expect this to continue into 2016, recently forecasting revenues from its digital marketing cloud to grow by 20% next year. IMPLICATION/PREDICTION: With a fair bit of merger and acquisition activity in the sector, I would expect 2016’s Marketing Technology Landscape “Supergraphic” to feature perhaps a similar number of companies; I’ll certainly be very surprised if the number doubles again from last year! More interest will come from the categorisation used and any key changes there year on year. In any case, I fully expect to see consolidation continue on both fronts; with the enterprise suites continuing to grow by acquisition/new product development and businesses themselves striving to use a smaller amount of powerful tools to help with simplicity and also greater data integration. In essence, the desire is obviously there to spend more time not worrying about the tools themselves and their implementation, but to focus instead on maximising what these tools can do now and for future development; easy to say, often harder to do! 2. GOOGLE CONTINUES TO DEVELOP ITS ECOMMERCE AND MEDIA AMBITIONS Any digital list looking forward to the New Year of course has to have an opinion on Google (and in particular search innovation) so here is mine. As ever, Google have of course rolled out a plethora of developments during 2015, with the news that Google are now indexing in-app content amongst the most interesting along with the usual ongoing algorithm updates, including April’s change to encourage mobile friendly websites. However, the area I’m going to highlight is the increasing amount of real estate and utility on Google’s main search page itself. Google’s Knowledge Graph continues to provide an increasing amount of information (and so take up an ever larger part of the SERP) helped no doubt by the recent RankBrain update, thus reducing the need to visit other websites; as an example, have a look at the search results below, returned for the “Dallas Cowboys” NFL team. All the likely most popular information from this general search term is freely available within this one Google page: latest result, upcoming fixtures, even video highlights from the last match (via YouTube of course). Additionally, Wikipedia content here is providing a summary of other key information/history etc directly on the SERP, which is actually leading to declining traffic to Wikipedia itself.  IMPLICATION/PREDICTION: Looking into the ecommerce space, Google Shopping changes and the increasing prevalence of PLAs over the past couple of years have very much encroached onto the main SERP and other new developments such as the recent launch of Google Compare for products like mortgages will see this continuing to spread to most if not all key ecommerce sectors. For example, how long will it be before the “Google flight results” section of this search for “flights to Barcelona” rises to the top and above the 3 standard PPC ads? The way that Google Shopping has hugely reduced the popularity of price comparison sites like Kelkoo and Pricerunner means that all ecommerce businesses obviously need to be aware of changes to the Google “shop window”. Google are certainly keen to own more and more of the customer experience where they can up to the point of distribution (for now!). This means that the need to provide a strong and unique customer experience remains ever more important, as I also expanded on in this recent blog. 3. COULD MOBILE (AND THE “BUY BUTTON”) DRIVE THE SECOND COMING OF SOCIAL/F-COMMERCE? “F-Commerce” (ie: "Facebook Commerce"). Now there is a phrase to drive dread into my heart. Rewind 5 or more years and with Facebook’s huge user growth at the time coupled with its then “new kid in town” status, there was a stampede from retailers (and tech providers too) to see if/how Facebook itself could drive sales directly. Most typically, this was by offering a cut down version of an ecommerce site within Facebook itself, which I always thought was a bit like setting up a market stall in a busy pub despite having a great store 3 doors down. Anyway, as a launch partner around that time for the short lived Facebook Deals initiative, I have to say pretty much everyone in ecommerce was jumping on the social/Facebook bandwagon. Therefore, it is fair to say that I have a certain amount of cynicism about selling on social networks (albeit a big fan of “social commerce” in the form of customer reviews etc but that’s for another day). However, perhaps this was just at the “peak of inflated expectations” on Gartner’s Hype Cycle and maybe we are now moving into the “slope of enlightenment” where there may actually be a way to drive sales via Facebook and other social channels, with Pinterest in particular also coming to mind. I say this not just because of the ongoing introduction of the “buy button” to Facebook, Twitter etc, but also because of the continuing shift to mobile usage too (and with its accompanying heavier social media usage, especially via apps). Indeed, this logic seems to be behind Facebook’s recent announcement “Connecting People to Brands and Products on Mobile” and purchasing directly from your news feed rather than being heading elsewhere may prove attractive – at least for some customers and some brands. IMPLICATION/PREDICTION: This will be an interesting one to watch. As Facebook in particular starts to resemble more and more the portals of “Web 1.0” (see my point 5 below too) with it moving beyond simply sharing photos and gossip with friends and developing further into a one stop shop for areas such as news and discovery, it would be foolish to neglect the increasing time that your customers may be spending there, especially on mobile. However, for retailers, their different dynamics such as product, price etc will all need careful consideration – buying an impulse buy of some music or a small gift from your news feed, compared to a more considered purchase such as a TV or laptop, will of course be fundamentally different. The opportunity may actually be greater for smaller retailers with minimal mobile/app presence, as Facebook may offer a more streamlined payment procedure too, which can often be a challenge to get right on mobile. Watch this space then. 4. NATIVE ADVERTISING WILL CONTINUE TO GROW IN LINE WITH ITS SIBLING, CONTENT MARKETING

IMPLICATION/PREDICTION: Although this extreme Pepsi example may be a bit too sickly for many UK brands, the blurring between branded and non-branded content will continue to blur as publishers and media owners continue to diversify their revenue streams out of necessity. The ongoing difficulty to maximise advertising effectiveness both digitally, due to factors like the rise in ad blocking, and also with TV, due to increasing usage of streaming services like Amazon Prime as well as more watching via PVRs such as Sky+, means that brands are equally keen to make use of these new opportunities. Indeed, household names such as Stella Artois and Samsung are already taking advantage of product placement in Netflix original programming such as House of Cards. 5. ARE FACEBOOK AND OTHER “FRENEMIES” SPEARHEADING THE RETURN OF THE PORTAL? Remember the “early days” of the Internet (I’m talking mid to late 90s here)? For the mainstream, there could often seem to be only about 20 websites, most of which were large one stop shop portals: the likes of Yahoo, AOL and MSN, all with multiple news/sports/entertainment etc channels, as well as a range of “Partner” shopping channels featuring a selection of most large retailers. Then, Google’s search revolution at the start of the millennium and the rise of the open web led to a decline in popularity of these “walled gardens”. However, could we be seeing a return to the portal in the guise of Facebook in particular? Actually, could it be argued that we are already there? The Huffington Post’s new CEO Jared Grusd thinks so, recently commenting: “Companies like Facebook and Snapchat are saying: ‘We have already attracted one billion people in the world to our platform. Rather than refer them back to your site, we actually want to keep them…So post-social is, in many respects, coming full circle to where we began in the old days when people would go to AOL and Yahoo and you would just consume all your content on their portals.” IMPLICATION/PREDICTION: As outlined above in points 2 and 3, the big beasts of the internet are keen to increasingly own more and more of both consumers’ quest for information (a threat to media and content companies) and more of the purchase cycle, which ecommerce companies need to carefully consider. Often referred to as “frenemies”, a core presence on Google, Facebook etc is of course essential to pretty much any business due to their scale, but the need to add something additional to your customer’s experience of your brand therefore becomes ever more important. Here, examples such as The Guardian’s membership scheme and accompanying live events plus Hamleys’ plans to create even more excitement and entertainment in-store help to demonstrate ways forward to compete. 6. THE “AGE OF THE CUSTOMER” AND INCREASING COMPETITOR THREATS MEANS A NEED FOR EVER GREATER CUSTOMER OBSESSION

Perhaps not just new for 2016, but the ever increasing demands of the customer, helped by social media’s democratisation of information flow, mean that the need to provide a much better experience for your customers than ever before is paramount. I expanded on these developments (defined as the “age of the customer” by Forrester) at the end of this recent blog. Also, as we’ve seen above, the competitor set is ever widening – be that content distributors increasingly becoming content providers too, or large digital hubs wanting to own more of the ecommerce journey. In addition, the likes of Uber and Airbnb saw the much used term of “digital disruption” bandied about in 2015, a term that is unlikely to go away in 2016, as start-ups will continue to look for innovative business models as well as gaps to exploit in established markets. IMPLICATION/PREDICTION: This particular prediction is really pulling together a lot of the earlier forecasts so tough to summarise in a paragraph. That said, understanding and validating your customer needs and wants, keeping close to market and competitor trends, along with embracing and implementing the right levels of change (technology, product development, new channels etc) all remain key to a successful year in 2016. Oh yes and a couple of final predictions to finish off with: Ipswich Town to be promoted via the play-offs and Leicester City to win the Premier League. Well, one can dream… What do you think too? Would love to know any thoughts or comments, either below or via Twitter @clrdigital |

Jim ClearLead blogger and founder of Clear Digital: talking about ecommerce, digital, marketing and media. Categories

All

Archives

December 2020

|