|

With just five weeks until what will be a very different Christmas this year, this Clear Digital Digest examines:

LOCKDOWN 2.0 Although not the cheeriest subject, this is the first Clear Digital Digest since we went into a second lockdown on 5th November.

BLACK FRIDAY: ONE WEEK TO GO As well as the lockdown, online sales in November will be further boosted to some degree by Black Friday next week.

DELIVERY: SANTA WILL BE INCREASINGLY BUSY THIS YEAR One topic that we will likely hear more about in the coming weeks is the problems caused by these inflated online sales when it comes to actually delivering the orders.

CHRISTMAS ADVERTISING Of course, to many it wouldn’t feel like Christmas without the high prestige TV led campaigns we are now accustomed to expect, which have really increased in profile over the last week with the launch of both the John Lewis ad plus a new series of ITV ratings winner “I’m A Celebrity Get Me Out Of Here”.

AND FINALLY…

As alluded to above, forecasting accurately for 2021 is going to pose more challenges than for any year in living memory. So I liked this take on strategic planning from Tom Fishburne, the ever entertaining Marketoonist…

0 Comments

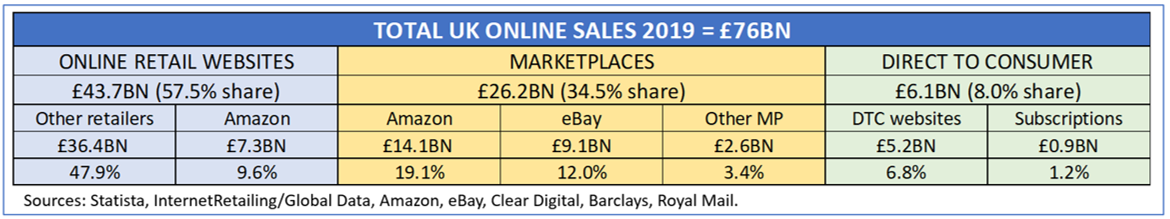

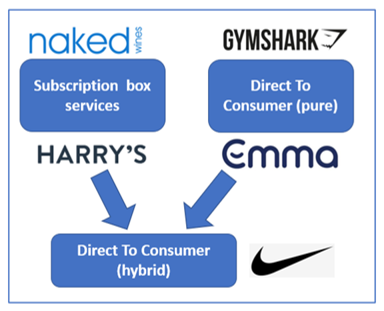

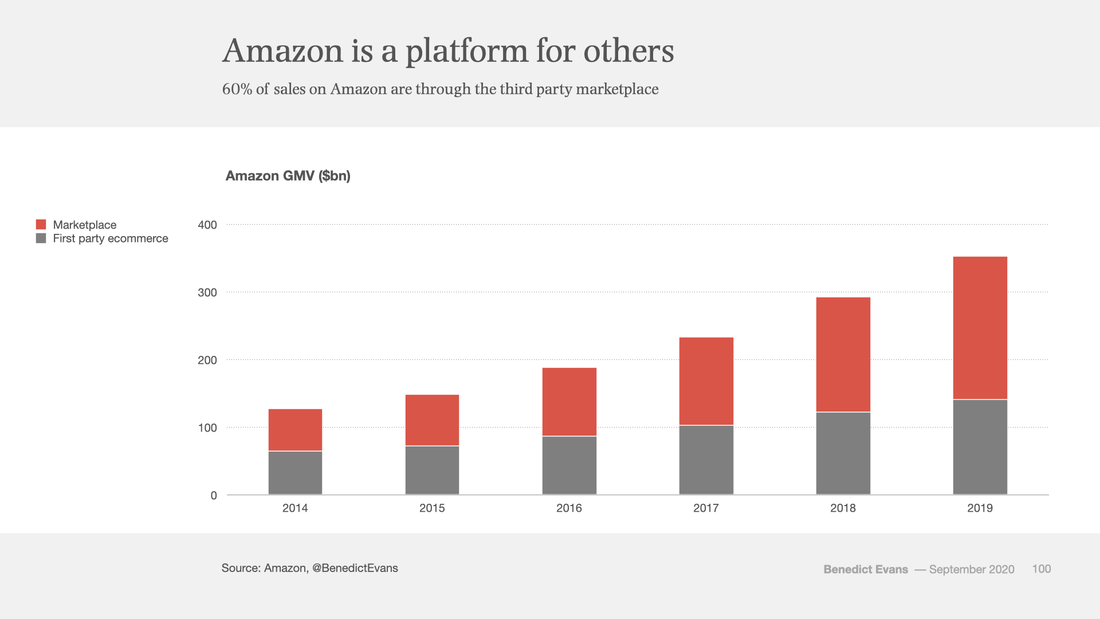

One of the most talked about developments for both ecommerce and general retail in recent years has been the rise of “Direct To Consumer” (DTC), whereby brands are bypassing traditional retail outlets/websites and selling direct to customers. 2020’s unfortunate events have led to a well documented large increase in home deliveries, including DTC brands generating record sales across sectors as diverse as food kits, mattresses and sportswear. The rise in marketplace sites (especially Amazon and eBay) has certainly played a part in increasing DTC sales, and Clear Digital recently explored this in the deep dive “The UK marketplace sector – and the role of community”. However, DTC websites are also rapidly expanding, particularly on the Shopify ecommerce platform. This blog explores further the size and dynamics of the UK DTC sector, as well as examining Shopify (and similar ecommerce solutions) in order to understand more about DTC winners and their growth drivers, including expanding onto other channels...

THE UK DIRECT TO CONSUMER (DTC) MARKET

SHOPIFY, AMAZON AND DEVELOPING MULTIPLE CHANNELS

CLOSING THOUGHTS

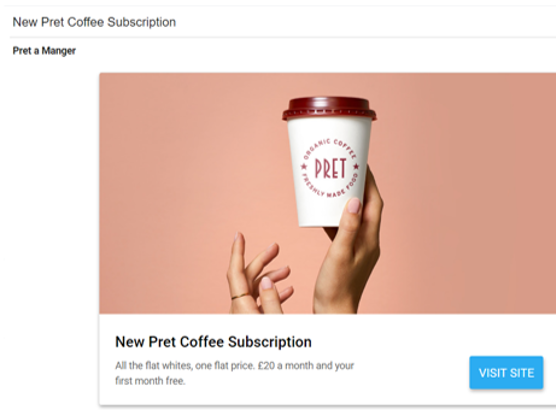

Please note that this blog is a summary of the accompanying deeper dive on "The growth of Direct To Consumer, Shopify – and developing multiple channels", which is available to download here. Clear Digital Digest: subscription coffee, Amazon ads, retail sales update and cricket data18/9/2020 Today’s Clear Digital Digest looks at some recent stories regarding Pret A Manger and Amazon, reviews today’s new ONS retail data and learns how the data revolution is transforming the world of cricket.

PRET A MANGER: ALL YOU CAN DRINK

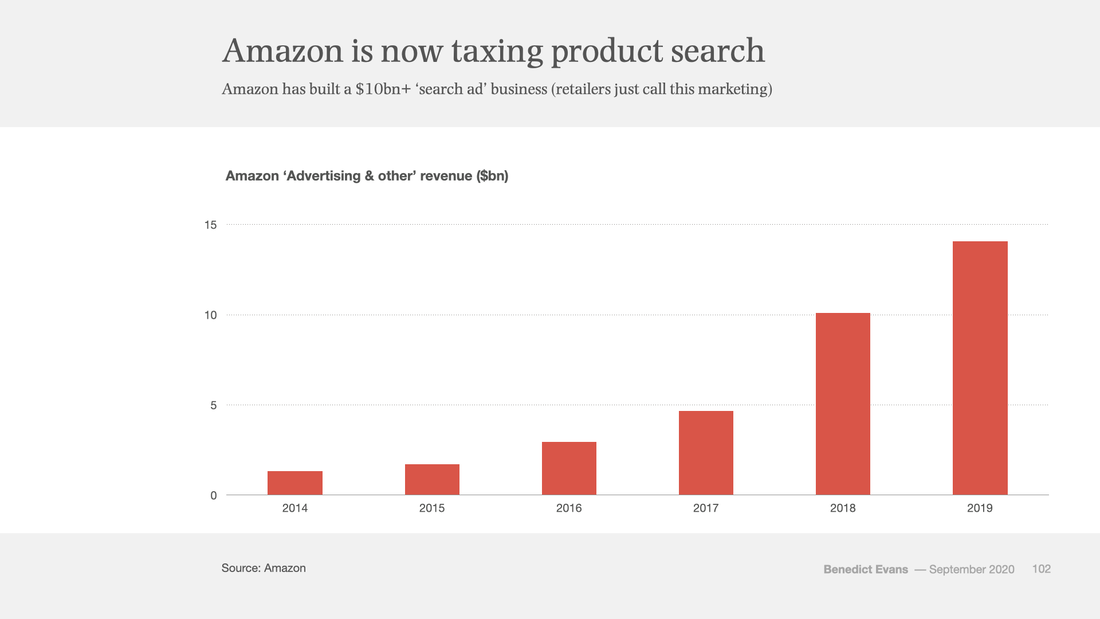

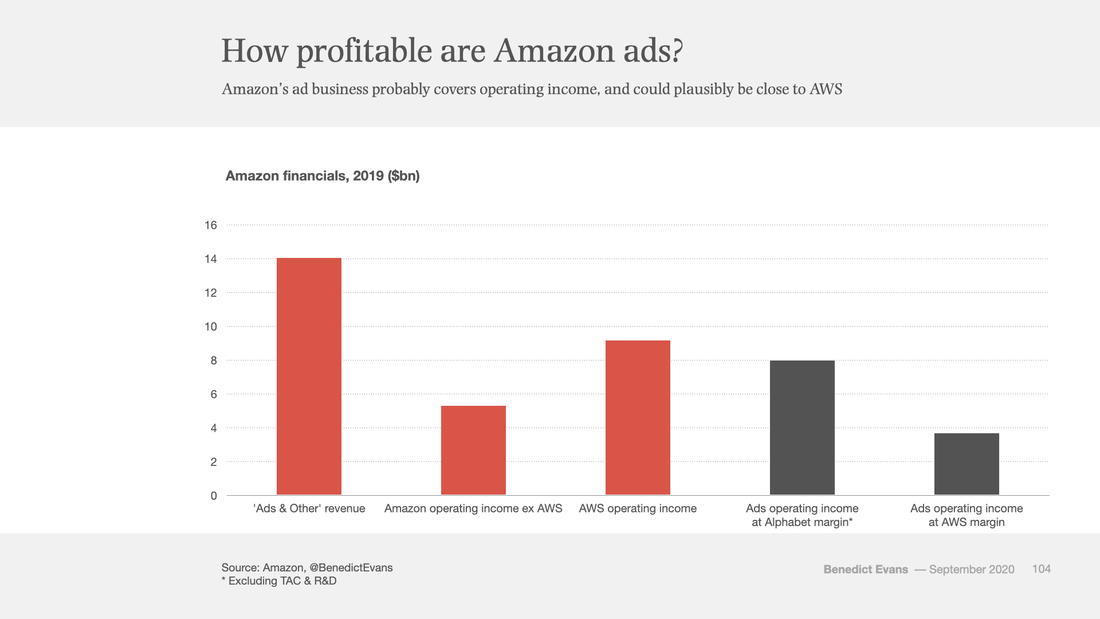

AMAZON’S PROFITABILITY: INCREASINGLY DRIVEN BY ITS ADVERTISING Well worth a read is this fascinating article about Amazon and its profitability, courtesy of Ben Evans.

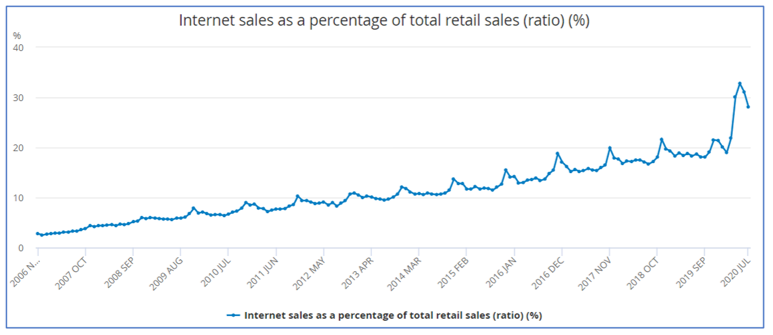

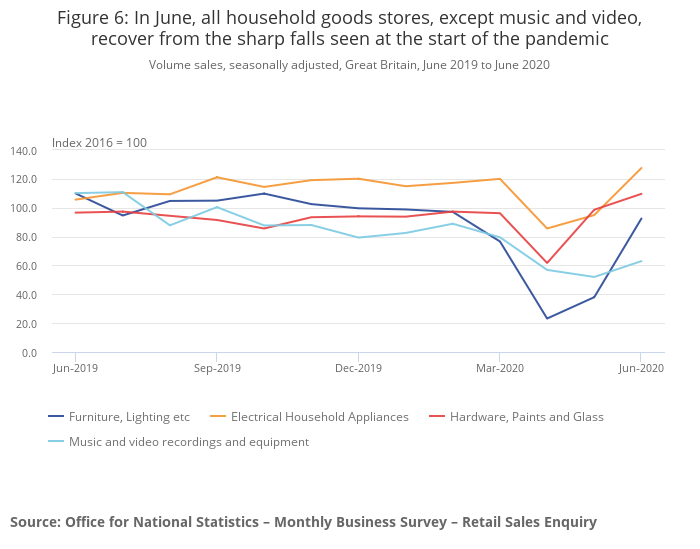

RELEASED TODAY: ONS RETAIL SALES UPDATE FOR AUGUST The Office for National Statistics (ONS) have today released their latest retail sales figures for August. We reviewed July’s data in a Digital Digest last month, so here’s a quick update, one month on…

AND FINALLY... When my subscription copy dropped through my letterbox this week, I was surprised to see The Cricketer magazine (now in its centenary year) highlighting “The Data Decade” on its front page. With the relevant articles exploring how increasing use of digitised data has fundamentally changed recent cricket coverage and some future predictions on how this may evolve, it’s a timely reminder than even such a traditional pastime as cricket is experiencing unprecedented change with its own digital/data revolution.

But this also demonstrates that there is still a place for more traditional media…yes I do still read some print magazines as well… It’s now been 5 months since we entered lockdown and then slowly started to re-emerge as restrictions began to ease, bit by bit. It would be trite to say the world has changed in a way previously unrecognisable to all of us; of course it has and constantly so. In fact the pace of change makes it increasingly difficult to keep up, especially with a seemingly never-ending deluge of data and information and data being provided. Looking at these awful events from an ecommerce perspective, I’ve highlighted 5 key trends from these last 5 months to help understand the seismic shifts we’ve been experiencing with regards to how customers have been shopping during this unique period:

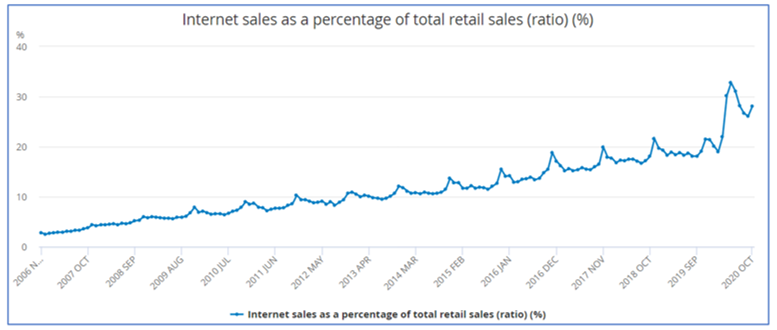

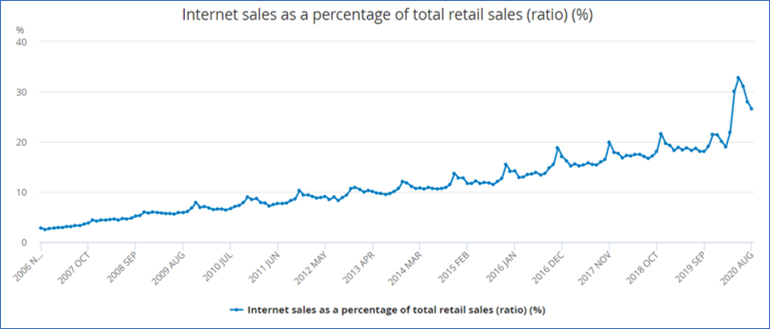

This Clear Digital Digest takes a look at each of these trends in turn, as well as providing some retro gaming light relief at the end… 1. ONLINE SALES HAVE ACCOUNTED FOR AS MUCH AS A THIRD OF TOTAL RETAIL SALES DURING LOCKDOWN This insightful chart from the Office for National Statistics (ONS) shows the huge growth in ecommerce sales during lockdown, with internet sales peaking at 32.8% of all retail sales in May.

2. ECOMMERCE DROVE £658M OF ADDITIONAL GROCERY SALES JUST LAST MONTH

According to Nielsen’s head of retailer and business insight Mike Watkins:

3. SUCH DYNAMIC ECOMMERE GROWTH IS SPEEDING UP SECTOR INNOVATION This step change in customer behaviour is seeing a never faster pace of innovation within the market, with recent developments including:

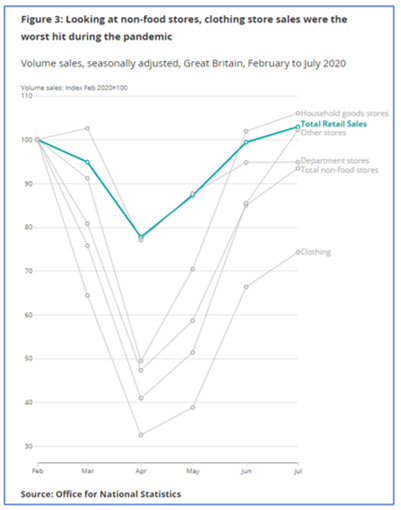

4. SPENDING IS VERY SQUEEZED IN OTHER SECTORS, ESPECIALLY CLOTHING AND MID-MARKET BRANDS

5. AS WELL AS ECOMMERCE INNOVATION, OTHER NEW CHANNELS ARE BEING INTRODUCED, SUCH AS PRODUCT RENTAL

AND FINALLY… As an 80s kid that loved arcade gaming and a 90s student who used part of his student loan to buy a Sega Mega Drive, before then becoming involved professionally as a PS2/Xbox buyer in the 00s, I really enjoyed watching the new Netflix video games history docuseries “High Score” - well the first two episodes I have thus far encountered anyway… Hi and welcome to the first Clear Digital Digest for a while, as the Clear Digital blog returns. More about that here but as before, these summaries will select a range of recent interesting, insightful and sometimes quirky ecommerce, marketing and media stories and break them down into handily digestible form. Today we’re looking at some new research on the world’s largest brands, the increasingly polarised nature of the UK retail market plus a novel way to socially distance ahead of lockdown restrictions further easing this weekend… AMAZON REMAINS THE WORLD’S MOST VALUABLE BRAND, BUT FACEBOOK FALLS

Methodology: Kantar’s BrandZ valuation process takes the financial value created by a brand in US dollars and multiplies it by brand contribution, to calculate its Brand Value: the worth in dollars that each individual brand is tangibly worth.

RETAIL’S CONTINUING DIVIDE It’s been another unfortunately contrasting week of winners and losers in the retail space.

AND FINALLY…

As Clear Digital returns this week, I’ve just published two deeper dives as well, both examining the marketplace sector. This is an area that has actually benefitted to some degree from the present turmoil, with recent stories including Etsy doubling its sales in April and music marketplace Discogs seeing usage levels increase by 65%.

And finally, with (some) pubs set to reopen this weekend – and mixed views as to what this will bring – I did like this novel solution from across the Channel that I discovered on Twitter this week… |

Jim ClearLead blogger and founder of Clear Digital: talking about ecommerce, digital, marketing and media. Categories

All

Archives

December 2020

|

||||||||||||