|

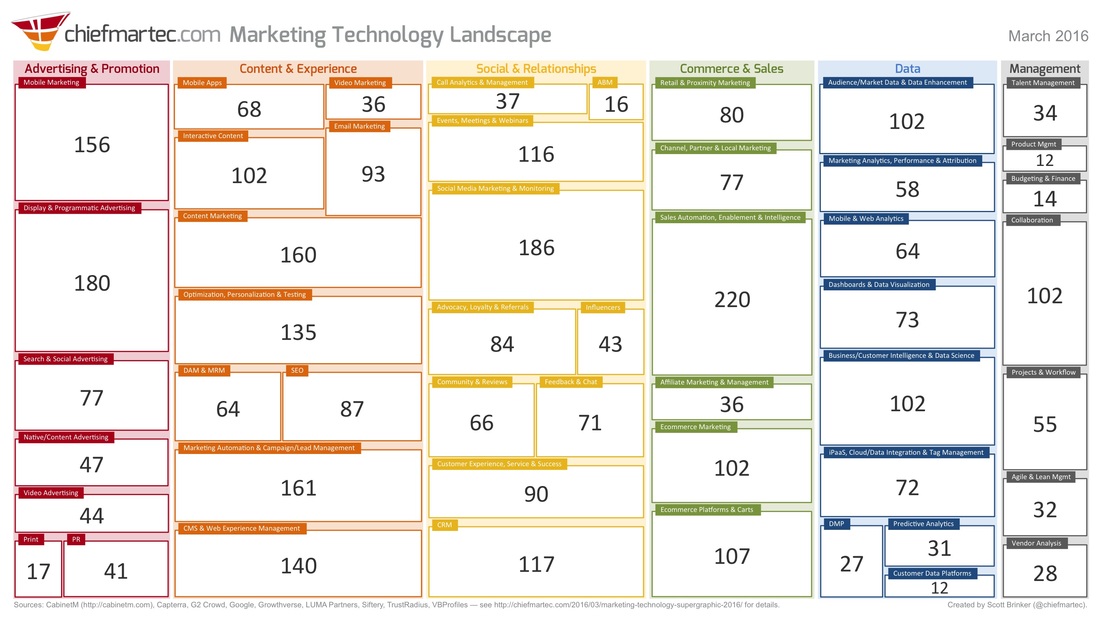

This week, Scott Brinker issued his updated Marketing Technology Landscape for 2016. Now an extremely helpful and anticipated annual review of this sector, it is perhaps no surprise that this year’s super graphic is bigger than ever – although a doubling of marketing technology solutions shown to 3874, from 2015’s 1876 (itself double the 947 featured in 2014) is maybe unexpected, and certainly not what I personally predicted in December when looking ahead to 2016. This blog looks at the key developments compared to last year’s landscape and pulls out my 3 main takeaways, including a look at Google’s newly announced Analytics 360 Suite. As Scott’s accompanying blog post makes clear, this continuingly large increase in solutions seems to have come about because rather than moving to a “one platform to rule them all model”, many organisations continue to use multiple platforms in their marketing technology stacks, with increasing ease of integration (including a category of products known as iPaaS = integration platforms as a service) meaning that the “all in one” solution is not as crucial to provide consistent data integration/customer experience etc as may have been believed before. NB – Of course, one other reason for the increase may of course be the ever growing industry interest in Scott’s landscape itself, with every tech solution no doubt making sure they are represented on there this year! One of the most interesting parts of the update is changes in how the multiple vendors are categorised, no simple job on such a huge chart. Here, I have to say that I really like the 6 categories that have been used for 2016, which are focused on 6 marketing technology capability clusters (with multiple categories then underneath):

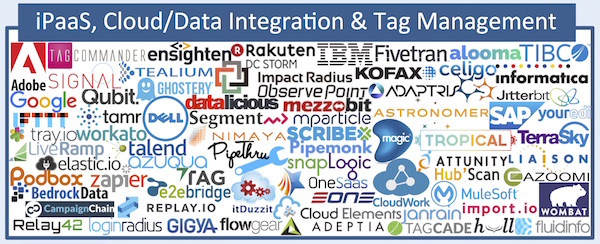

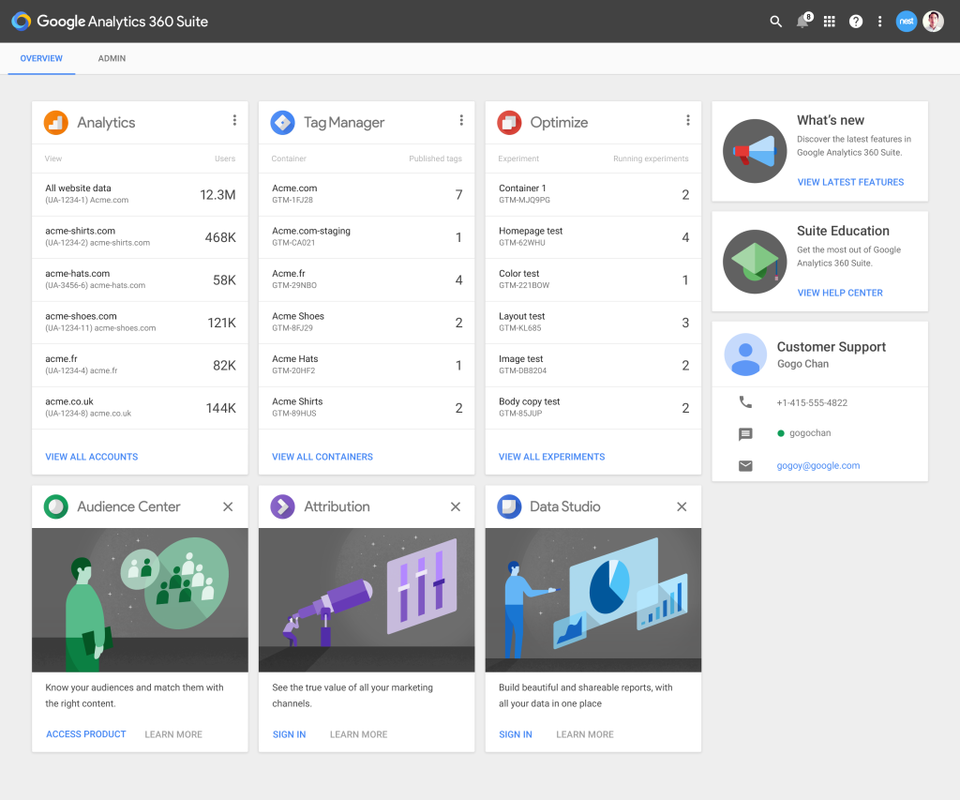

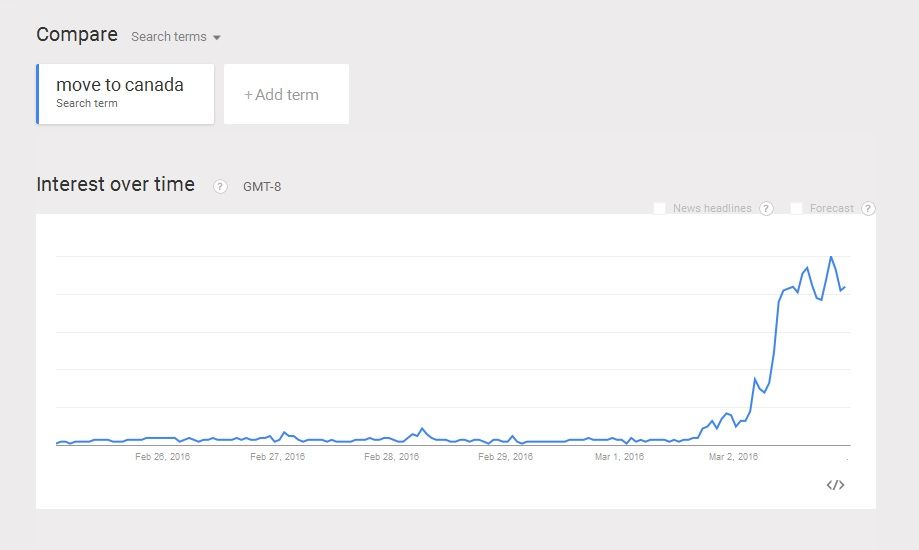

These new clusters appear more consistent with the final customer experience compared with last year’s model where marketing experience and operations solutions were “stacked” on top of infrastructure and platform systems at the bottom. This new set-up sees clusters 1-4 helping to replicate a typical customer funnel in logical order, with accompanying Data and Management enablers as numbers 5 and 6. Generally pulling out “paid” marketing as cluster 1, with “owned/earned” living in clusters 2, 3 and 4 is also a really helpful distinction from 2015. So what does all this mean? Here are my 3 key takeaways from this new Marketing Technology Landscape… 1. JOINING THE DOTS AND PLUG & PLAY SUPPORT ARE NOW THE NORM As alluded to above, I think it is significant that “Integration Platforms As A Service” (or iPaaS) has been pulled out as its own category, including data integration and tag management solutions. As our consumer lives via iOS, Android etc have become increasingly simple and user friendly, so marketers have been demanding a similar level of flexibility with business technologies. The huge 2016 landscape shows how big this potential system is overall. 2. BUT THE BIG BEASTS AREN’T GOING ANYWHERE However, of course base platforms do remain fundamentally important as core building blocks, with the significant recent news here being Google’s announcement last week of Google Analytics 360 Suite. With Google Analytics Premium at its core, this will consist of existing Google tag management and attribution products as well as other new applications. These include a new data visualisation tool Data Studio 360, Optimise 360 (on site testing and personalisation) and Audience Centre 360, a data management platform. An obvious challenger to the likes of Adobe’s Marketing Cloud and similar services from IBM, Salesforce etc – it will be interesting to see how this develops in the coming months. 3. THE NEW CLUSTERS SEEM CLOSER TO TYPICAL MARKETING PLANNING, THEREFORE MAKING IT EASIER TO ASSESS TECH REQUIREMENTS As I mentioned above, it is instructive that “paid” marketing channels are in a separate cluster to “owned/earned”, which I feel is particularly important for the hugely broad sphere of a discipline like content marketing, which now is well represented in cluster 1 (via “native/content advertising” and “video advertising”), cluster 2 (well, pretty much all of it as this cluster is “Content & Experience") plus cluster 3 (e.g. “Social Media Marketing”). In essence, what this does help to demonstrate is that for any successful campaign, ultimately to be serviced by cluster 4 “Commerce & Sales”, it is likely that a combination of channels from the first 3 clusters will be used. But of course, not all – and when developing any marketing tech stack, it is those priority calls about what to focus on when you can’t do everything that are always key. And finally, many thanks to Scott Brinker for producing this always helpful and thought provoking graphic. Although there is by necessity a lot packed in there, it is really useful as a “50,000 foot overview of the entire space”. There are various links to the original landscape through this blog, but you can also visit Scott’s website at www.chiefmartec.com

0 Comments

As well as increasingly showcasing traditional media stories and of course using its wealth of user generated content, Wired this week looked at the fact that Facebook are in talks with the NFL about buying the rights to stream American football games live. With sport increasingly important for traditional TV broadcasters as its live nature fuels “appointment to view” watching - and rights becoming more and more expensive – this development could have huge significance for the future of TV, and it’s a fair assumption that the likes of the Premier League will be watching this closely. Of course, Facebook is one of the old grandees of social media now, and the newly coming force – at least one much discussed – is Snapchat. However, Snapchat’s unique interface and younger user base can make it difficult to get to grips with for a newcomer, so Bloomberg’s look at “how Snapchat built a business” is an excellent review of the Snapchat phenomenon, including the increasingly visible mainstream rise of DJ Khaled, the “King of Snapchat, according to Emmanuel Seuge, senior vice president for content at Coca-Cola, one of Snapchat’s major advertisers. Snapchat is now at the stage where it needs to start monetising and it is looking to bring in $300-350m in revenue this year (up from $50m in 2015), as it bulks up its advertising solution. As a sense check on scale, $350m is still half of supposedly troubled Twitter’s revenue from just Q4 2015 of $710m, with Twitter’s overall 2015 revenue standing at $2.1bn.  Looking back at TV again, Vice Media this week announced a partnership with Sky to show its new channel Viceland upon its launch later this year, a meeting of traditional and newer content providers that would seem to make sense for both, with great distribution to 10m homes for Vice, while helping to capture and entertain a younger audience for Sky. Viceland launched originally in the US on 29th February with a slightly different model to most pay TV channels, with less standard advertising per hour but a greater emphasis on “a custom, native advertising approach”; which they plan to replicate in the UK, so it will be interesting to see how this pans out upon launch.

A happier sports brand tie up actually celebrated its 30th anniversary this week, namely the release of Run DMC’s magnificent “Raising Hell” album, which included the ground breaking “My Adidas” track, still probably the main reason I’ve always been an Adidas not a Nike man. According to The Quietus in their excellent retrospective, this led to a $1.6m deal with Adidas for Run DMC, not a bad endorsement if it’s still being talked about glowingly 30 years later. And finally – as explained by Adweek, this parody but real website from Canadian agency Zulu Alpha Kilo is well worth a look.

Moving onto the modern day, this week’s big ecommerce news was Amazon’s wholesale tie-up with Morrisons, enabling Amazon to expand on their Pantry offering with fresh and frozen produce, likely to be available to UK consumers within a few months. Looking back to Brent Cross, this continuing innovation makes one question what the shopping centre will look like in a further 40 years; Amazon itself is indeed already using Brent Cross as a pick-up point with one of its Lockers available there. As the viability of shopping centres and high streets themselves continues to need to encourage socialising and eating out opportunities more and more, above and beyond “traditional shopping”, some interesting innovation from McDonalds also caught my eye this week. Inspired by the continuing hype around Virtual Reality (which continued apace at last week’s World Mobile Congress) and Google’s cheap Cardboard option, McDonalds are today launching in Sweden an ingenious combination of VR with a Happy Meal box, named “Happy Goggles”.

|

Jim ClearLead blogger and founder of Clear Digital: talking about ecommerce, digital, marketing and media. Categories

All

Archives

December 2020

|