|

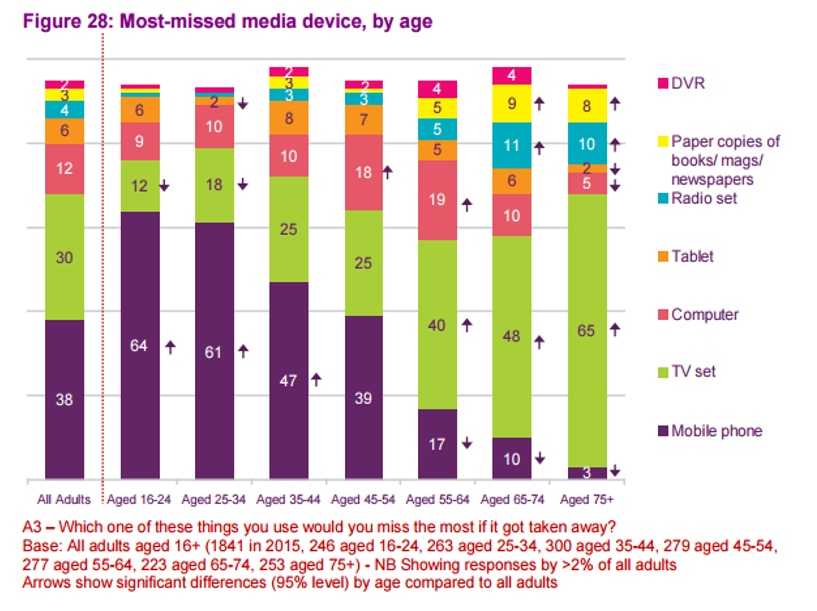

This week saw Ofcom release their always useful and insightful annual UK media review: Adults Media Use and Attributes 2016. At over 200 pages, there is a huge wealth of detail to take in at once, but this report can prove an invaluable one stop shop over the year for many must have stats. A good place to start is the report overview which pulls out 4 major trends, with the ever moving shift to smartphone usage unsurprisingly to the fore:

I spent yesterday at the Internet Retailing Expo and these trends around shifting device usage were resonating loud and clear from some of my discussions there plus presentations attended; I’ll be blogging more thoughts on this next week. Returning to the Ofcom report, I’d recommend a couple of other interesting summaries:

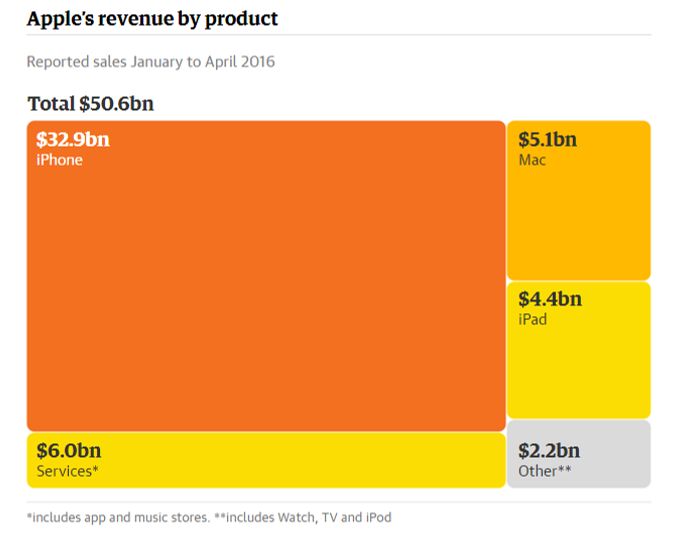

Some diverging results statements from the internet’s big beasts this week. Although widely trailed before, it was still strangely odd to see Apple report its first fall in sales since 2003 on Tuesday, with sales of quarterly sales of $50.6bn down from $58bn in the same quarter last year. This was primarily due to a slowdown in iPhone sales (which account for 65% of Apple’s revenue) to 51.2m in the quarter from 61.2m the year before. This of course led to a wealth of think pieces on what Apple needs to do to turn this decline around (spoiler alert: it is unlikely to be the Apple Watch), while I did enjoy this “brief guide to everything that’s annoying about Apple” – my personal favourites being numbers 5 and 11. Meanwhile, Amazon has just posted its fourth straight profitable quarter in a row, and the largest quarterly profit in its history, prompting Wired to exclaim “Whoa, Amazon Isn’t Just Making Money. It’s Making More Than Ever”. Amazon’s Q1 net profit stood at $513m with global revenue of $29.1bn, up 28% on last year and beating analysts’ expectations, leading to a share price increase of over 12%. It’s worth stating here that Amazon spent years incurring losses as it built its huge empire (including its increasingly important AWS cloud computing arm which saw revenue up 64% YOY to $2.6bn), but has now posted ever growing profit growth for the 4 quarters of the last year; a development sure to please investors but also demonstrating that Amazon seems to be entering its next phase of maturity.

2 Comments

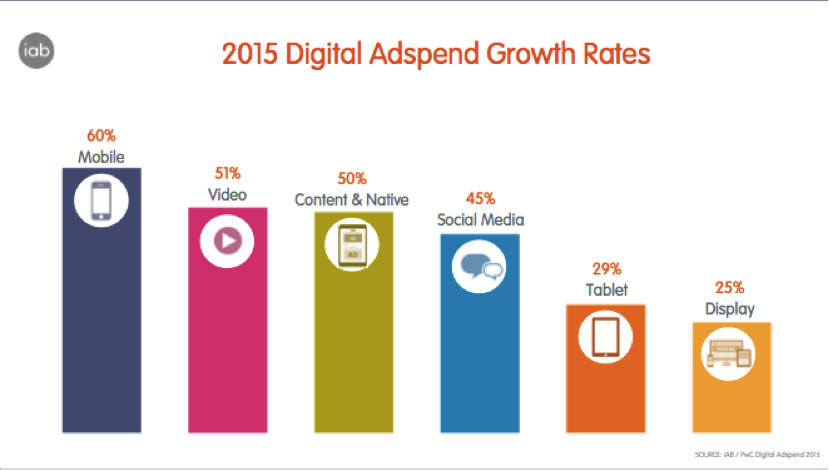

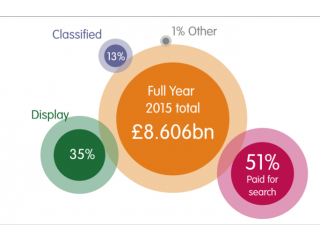

Firstly, some recent stats that caught my eye. The IAB have released their latest annual figures on digital adspend with 2015 revenue of £8.6bn, up by 16.4% YOY. With digital spend always growing year on year as it takes an ever increasing slice of the marketing budget, this is not in itself surprising; what is of note however is the fact that this is the fastest such growth seen for 7 years. This has been driven in the main by mobile spend, which was responsible for 78% of this growth, with mobile now worth £2.6bn (up 60% YOY), accounting for 30% of all digital spend.

Even larger mobile growth was seen in the ecommerce sector, courtesy of the latest IMRG Capgemini eRetail Sales Index. Monthly figures for March recently released show overall online sales growing by 11%, within which smartphone transactions grew by a huge 101%. This meant that Q1 ecommerce sales increased by 15% YOY, nearly double the annual growth rate seen in Q1 2015. Larger mobile screen sizes coupled with much improved mobile shopping experiences from a variety of retailers are no doubt hoping to drive this upturn.

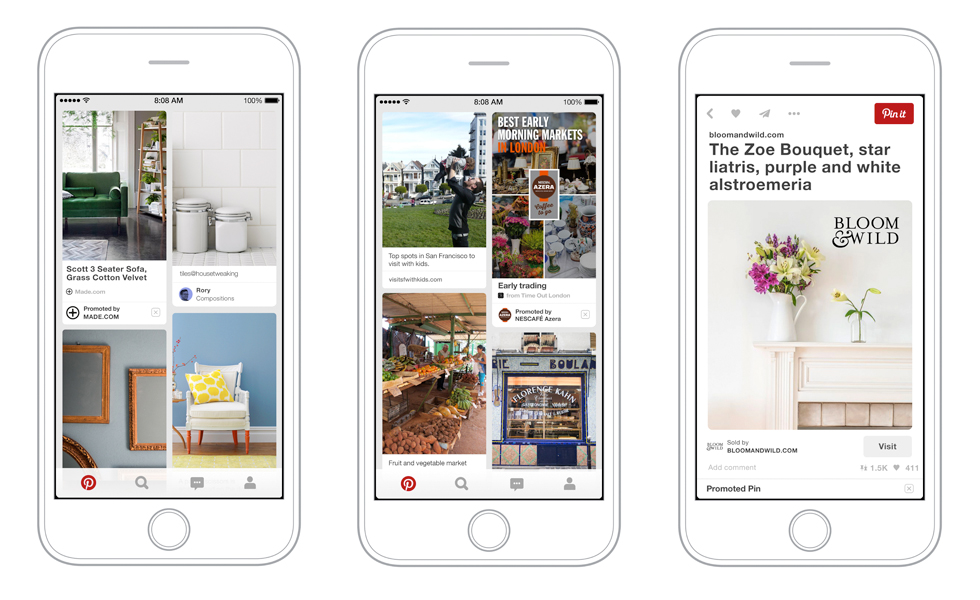

After launching in the US last year, Pinterest introduced its Promoted Pins ad solution in the UK this week, with brands such as John Lewis, Made.com and B&Q involved from day one. Pinterest’s visual nature makes it well suited to product categories such as furniture, where it should help retailers at the top of the purchase funnel, something that Hannah Pipel from Made.com highlighted thus: “I think potentially the planning stage is a really interesting one especially for home decor and higher ticket price items”. Of course, this will then entail efficient tracking and analysis to understand the value of Pinterest in the consideration phase, as it’s much less likely to gain the still often most visible last click. Having been around a fair while in the ever changing social media world, it is in fact perhaps surprising that it is only now that Pinterest are seeking to actively monetise their user base via advertising. With that in mind, Facebook’s announcement this week of a partnership with Tesco owned Dunnhumby to give greater visibility to FMCG brands on the effectiveness of their Facebook campaigns also shows that the job on proving digital marketing success is still far from done. According to The Drum this is in response to the fact that top FMCG brands “were being forced to put more budget than they might like to TV advertising, rather than digital, because the buyers at supermarkets – the people who decide if a product will go on shelves – believe that mass marketing is still the only way to shift stock at scale”. Therefore, this reality check helps to demonstrate the ongoing need for digital to still prove its worth compared to more established media, an education process that ecommerce teams still generally need to make a priority. Some unexpected news in the intersection between social media and sport this week too, with Twitter swiping the rights to live stream NFL Thursday night games worldwide. As previously reported, there had been a fair amount of speculation about this, with Facebook widely considered to be the front runner to help further boost its Facebook Live offering. Instead, Twitter will be benefitting from the live rights which will also help visibility and user growth for Periscope, its live streaming service which will be central to this.

|

Jim ClearLead blogger and founder of Clear Digital: talking about ecommerce, digital, marketing and media. Categories

All

Archives

December 2020

|