|

Today’s varied Clear Digital Digest round-up includes:

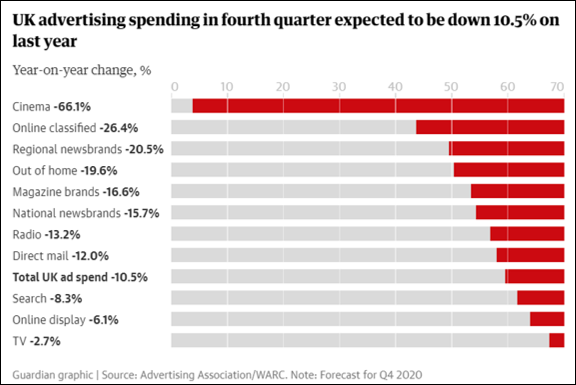

HERE COMES CHRISTMAS: BUT AD SPEND FORECAST TO BE £724M LESS THAN LAST YEAR With half term coming to a close this week and Christmas products all over the high street, November is typically when the large retail brand campaigns come to life, with large TV spend supported by a variety of other media. Of course 2020 is not a typical year, so there will certainly be all kinds of challenges creatively this year, as well as with regards to available budgets.

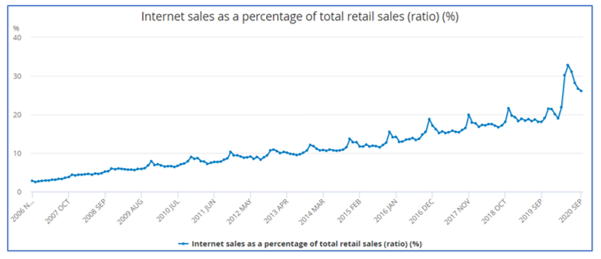

ECOMMERCE: SALES UPDATE - AND BLACK FRIDAY IS GETTING EARLIER EVERY YEAR Despite all this year’s uncertainty, one trend that can be confidently predicted for Christmas 2020 is that ecommerce sales will take a significant larger share of total retail sales, but how much larger exactly?

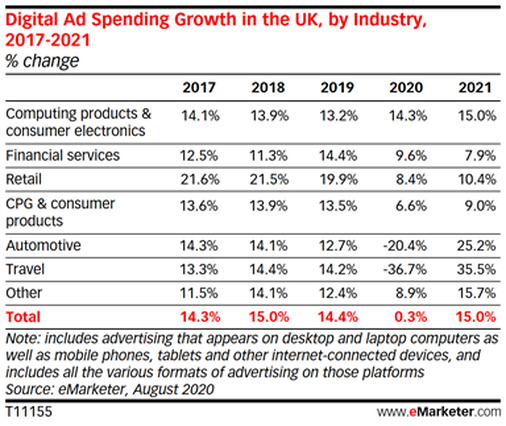

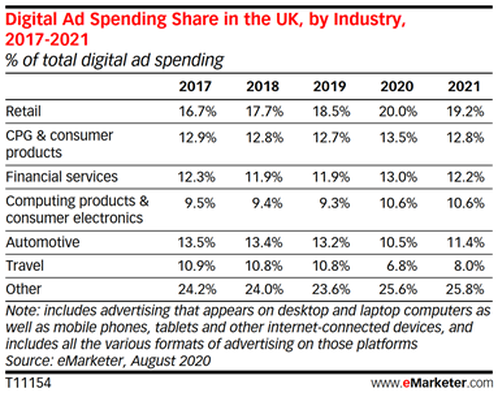

CHANNEL SHIFT: SHOPIFY, TIK TOK, ROYAL MAIL, AO, SKY, JOHN LEWIS Here are a few recent stories that caught my eye regarding channel purchasing shifts, including developments from AO and Sky which demonstrate how digital first brands continue to consider the ways that a physical presence can help them engage further with customers…

AND FINALLY… One brand that won’t be returning to the high street – despite a flurry of excitement earlier this week – is the old childhood favourite Woolworths.

0 Comments

Discogs is a digital brand with a difference – it’s thriving in the hugely competitive music sector, not by taking on streaming behemoths such as Spotify or Apple, but instead by catering to the niche but dedicated sector of music enthusiasts and record collectors that value the tactile and artistic value of the traditional LP or CD. From its origins as a community based purely around electronic music, Discogs has steadily evolved to encompass all genres. As well as serving as an IMDB meets Wikipedia resource for music fans, Discogs’ increasingly popular Marketplace allows collectors to buy and sell online, with nearly 15m records traded in 2019, up 34% on the year before. So far in 2020, usage of Discogs has rocketed still further, as we have all needed to focus on home-based leisure activities plus the temporary closures of all record stores. Having previously taken a detailed look at the “vinyl revival” in late 2015 when I focused on the “record shop renaissance” and how these establishments were diversifying in order to survive and thrive, I thought I’d take another look at the music sector, but this time with the specific focus on a recently growing niche digital specialist, i.e. Discogs. Therefore, this blog reviews the current music market as a whole, before delving deeper into the second hand vinyl market, a much under-researched area. Discogs’ offering is then examined, reviewing how Discogs’ recent success has been achieved as well as a typical Discogs customer journey.

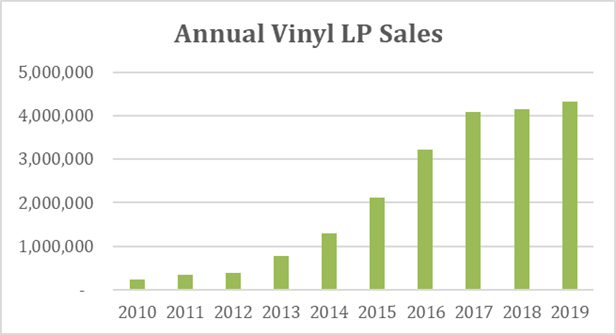

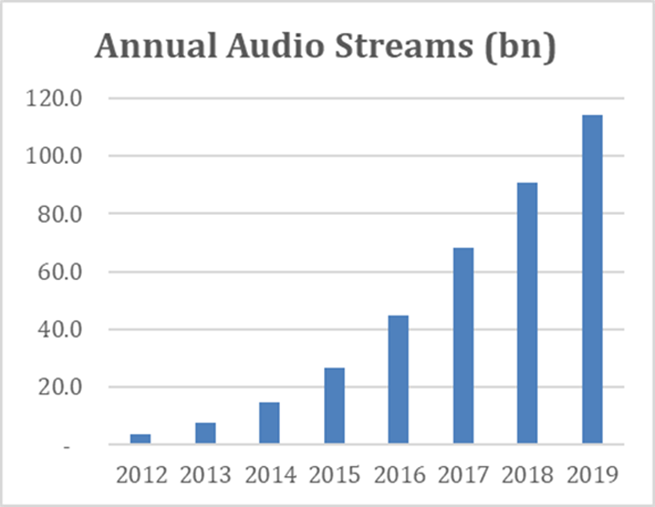

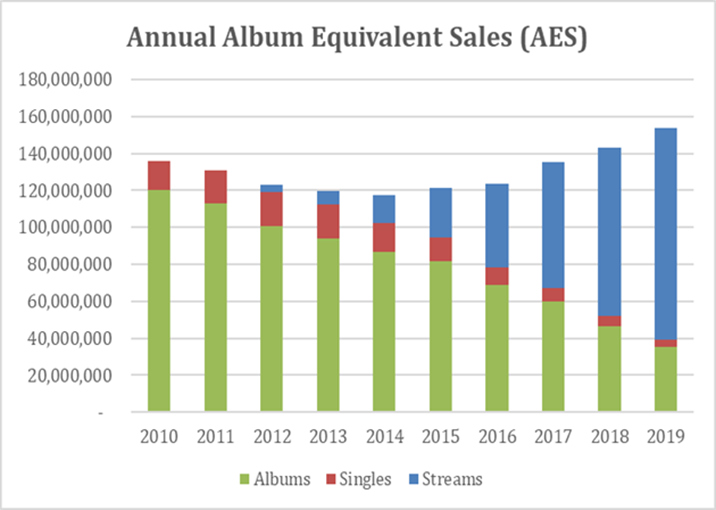

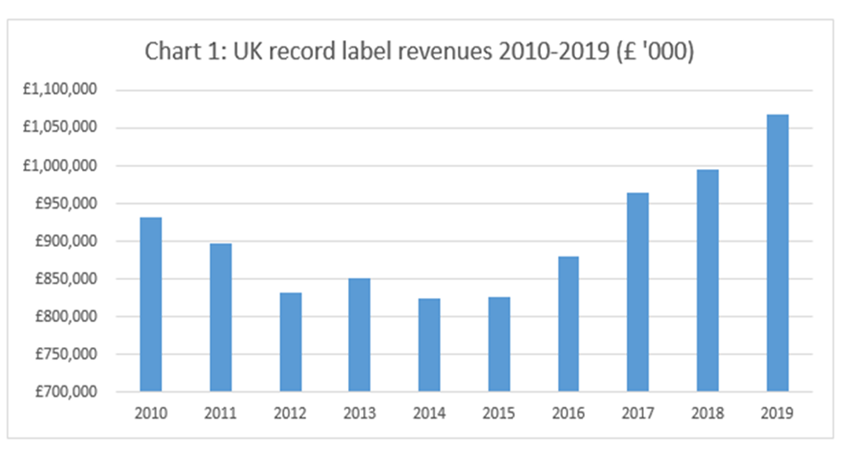

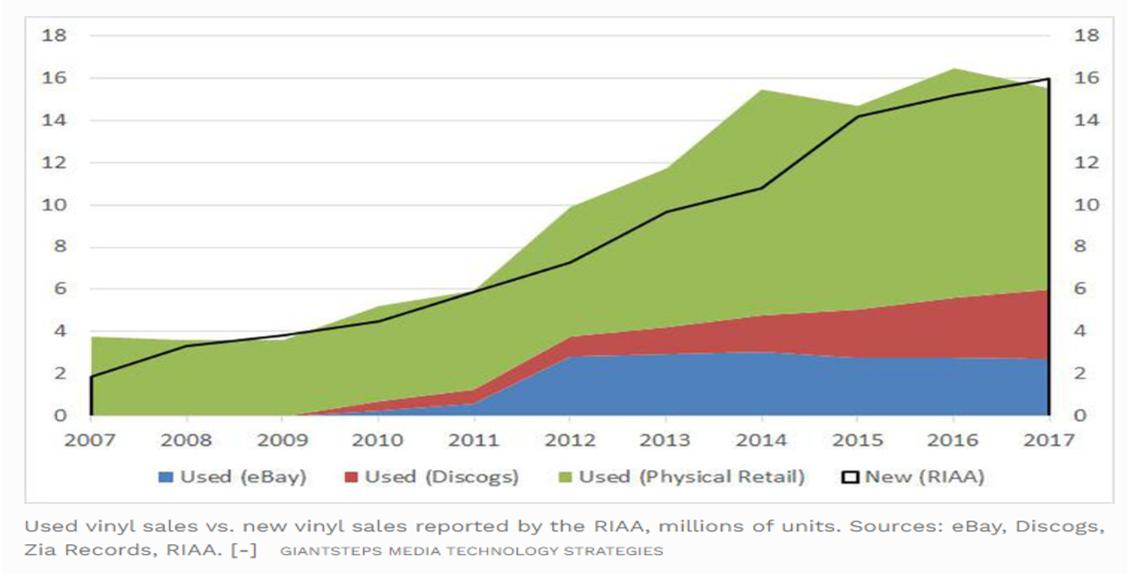

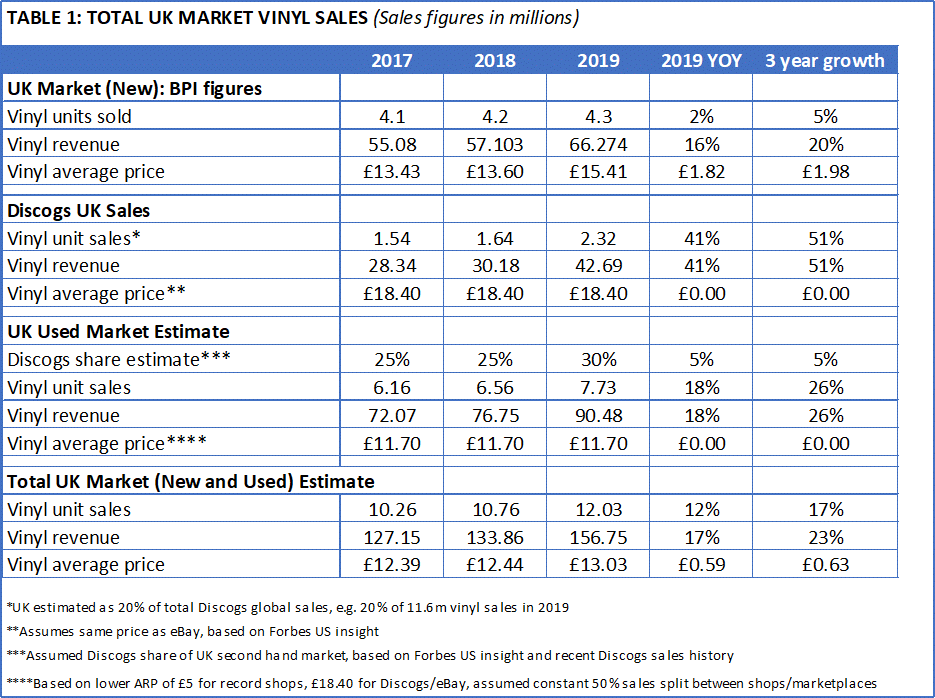

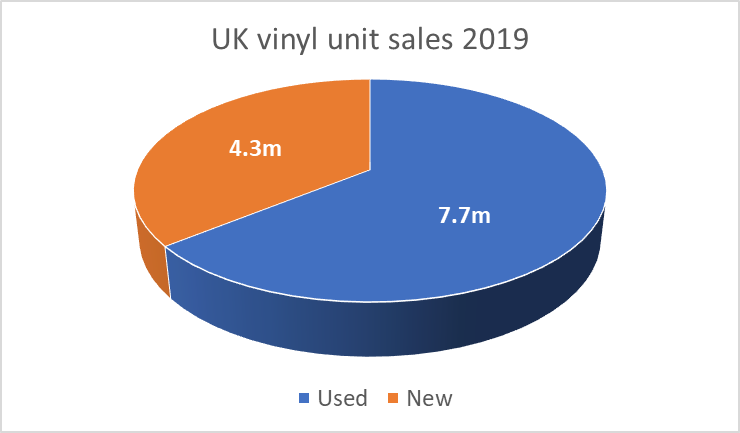

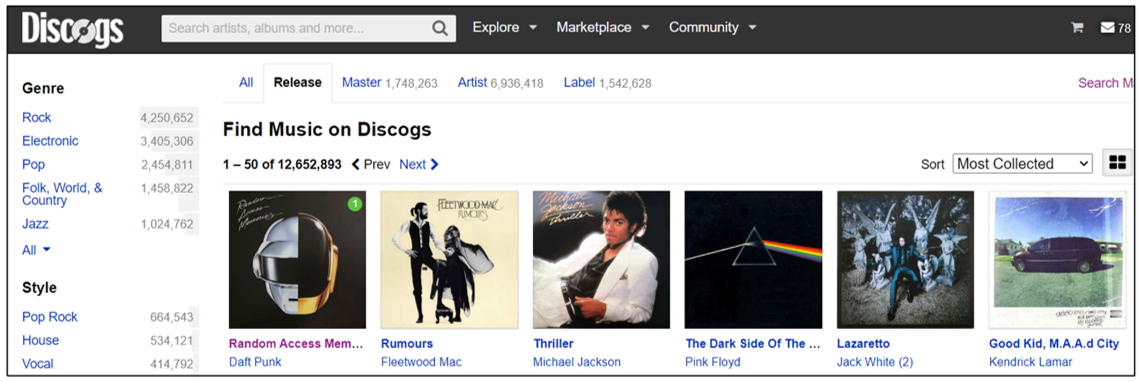

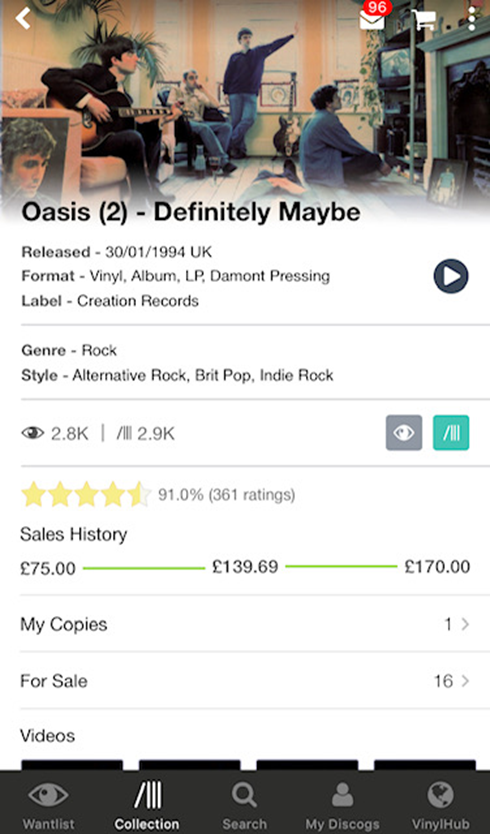

THE UK MUSIC MARKET When Clear Digital last reviewed the music market, we quoted BPI figures that vinyl sales were up 56% in the first half of 2015 and on track to hit 2m records sold for the year, which would be the highest figure since the early 1990s; although still a small fraction of the 80m routinely sold during the late 1970s. Vinyl sales did indeed exceed 2m in 2015, with sales of 2.1m and have continued to rise since then, more than doubling in the subsequent 5 years to reach 4.3m in 2019; albeit growth has slowed considerably during the last 3 years as the graph below demonstrates: The big news in the music industry over the last 5 years has of course been the rise of streaming services, spearheaded by Spotify with Apple Music, Amazon Music, Deezer et al. Streaming in the UK passed a significant milestone last year, with over 100bn tracks streamed for the first time, a total of 114bn, up 26% on 2018’s 91bn. The dominance of streaming this decade has seen the music industry create a new metric in order to compare distinct formats: the Album Equivalent Sale (AES). AES equates 100 streams as equivalent to purchasing one single “track” and 10 “tracks” as equivalent to an album, thus meaning that 1000 individual songs streamed is viewed as equivalent to one physical album purchased. As the graph above shows, 2019 was a strong year for music consumption, with 153.5m annual AES, +7.5% on the prior year and the highest of the decade. Streaming drove this increase, with 114.2m AES streams (+26% YOY), while 28m physical albums were sold (-23% YOY). These 28m include the 4.3m vinyl LPs (+4% YOY) mentioned earlier as well as 23.5m CDs, a format which continues to rapidly decline, with annual sales down 26.5% YOY. And having found a way to generate revenue from streaming services, record label revenues have also increased steeply in recent years, from a low of £825m in 2014 to £1.07bn in 2019, the highest such figure since £1.17bn was recorded in 2006. Streaming income of £629m accounted for 59% of total record label revenue in 2019 – with subscription revenue by far the most significant chunk generating £568m, with ad-supported streaming revenue contributing £25m and video streaming providing £35m. Physical sales of £216m made up just 20% of industry revenue, with CD sales of £142m down 20% YOY. However, vinyl revenue of £66m grew by 16% YOY, despite unit sales of 4.3m growing by just 4% YOY. CD revenue of £142m declined by 20%, meaning that while still the dominant traditional format, vinyl is taking an ever larger proportion of the amount spent on physical music. However, the total amount that consumers actually spend on physical records (and especially LPs) is grossly under-reported by industry bodies and most media as Bill Rosenblatt states in an excellent Forbes article: “Vinyl is bigger than we thought. Much bigger”. THE SECOND-HAND/USED VINYL MARKET Bill Rosenblatt mentions the vinyl revival of the last decade, but also highlights that “vinyl sales are actually much larger than what industry figures report, because they don't count used vinyl sales and they under-count new vinyl sales. Now, thanks to some new data, we know that the true size of the vinyl market is more than double those industry figures”. As revenue from second-hand records does not go to record labels or artists, the industry does not count them, prompting Ron Rich, SVP of Discogs Marketplace to say “Given the size of the overall market, I am always shocked that these numbers are ignored when reporting sales”. It is indeed challenging to obtain data on second-hand sales, but Forbes managed to secure sales figures from the two leading online players, namely eBay and Discogs, as well as work with a chain of independent record stores to calculate overall store sales. As the graph above demonstrates, second-hand unit sales in 2017 matched the 16m vinyl records reported by the RIAA, the US equivalent of the BPI. And this figure would increase further had Amazon (the third biggest player in online second-hand records) provided data for the used records comparison. Discogs’ recently published “State Of Discogs 2019” report states that Discogs sold 14.6m items globally in 2019, 34% on the prior year. Vinyl accounts for an ever growing lion’s share of Discogs’ sales, with vinyl sales of 11.6m units, +41% YOY. Breaking this down into the UK, we can estimate that Discogs sold 2.3m vinyl records in the UK last year, creating total sales revenue of £42.7m (with £3.4m commission for Discogs, at their 8% rate). In total, it is estimated that some 7.7m vinyl records were sold second-hand last year, 80% higher than the volume of new records quoted by BPI (4.3m). Further validation on volume is provided by eBay stating that they sold 4 vinyl records per minute in 2017, equating to 2.1m units in total and a 34% market share that year. These 7.7m records generated an estimated used revenue of £90.5m, well above the £66.3m spent on new vinyl. This leads to total vinyl sales revenue of £157m, of which only 42% is generated by the new music industry and directly reported on. This split reflects the US market as previously outlined by Bill Rosenblatt at Forbes: “thanks to some new data, we know that the true size of the vinyl market is more than double those industry figures”. Total physical new and used records (i.e. CDs plus vinyl) together generated sales of £302m in 2019, an extra £94m above the combined BPI reported figure of £208m, with £91m of this accounted for by second-hand vinyl. In 2019, 64% of vinyl records purchased were second-hand (7.7m, 58% of total spend) meaning that the widely reported figure of 4.3m vinyl LPs sold last year is severely under-stated; the true figure is more in the region of 12m. REVIEWING DISCOGS’ RECENT SUCCESS A potent mixture of Wikipedia, IMDB, eBay and Pokemon for music fans, Discogs was originally established in 2000 by Kevin Lewandoski purely to catalogue dance records but now describes itself as “the world's foremost Database, Marketplace, and Community for music”. From an initial 2200 users in its first year, Discogs now has over 7m active users and a database of over 12.6m releases listed. Originally focused purely on electronic records, Discogs gradually increased its remit, with rock releases becoming the dominant genre in 2016. Adding to the collection can be theurapetic and also addictive, but it was the launch of the Discogs marketplace in late 2005 that really planted the seed for Discogs’ future success. The cornerstone of Discogs is its Collection feature that allows users to easily create their own online record collection, from the 12.6m existing releases in the Discogs database. Users can opt to search via the Discogs website or app, which has a built-in barcode scanner, making this a much simpler process to locate your particular record (for those that have barcordes anyway!). Similar to Wikipedia, Discogs is reliant on its users to add new releases, as well as providing further information (e.g. extra pictures, song videos etc). 11.6M records were added to their collection in April 2020 by 306K users, well up on the more recent annual average of 7M per month due to lockdown. By way of comparison, the average submission in 2014 was just 2M per month. This collection spurt is also helped by the addictive/gamified nature of adding records, as you are able to get an updated total of how much your collection is worth based on recent sales in the Discogs Marketplace. Discogs will look at the most recent 10 sales of the relevant release and show its lowest, median and highest selling price. This then feeds up to your personal collection homepage with a min/med/max estimated value, thus encouraging the user to add as many records as possible to see this figure increase and increase… The Discogs Marketplace was launched in late 2005, due to user demand – as CEO Kevin Lewandoski has stated: “The users asked for it. There was already a "collection" and "want list" feature, and a lot of people asked for a "sell" list, just to have a list of things that they were selling…Amazon and eBay were around, but they weren't really what they are today.” There are over 50M records available globally on the Marketplace, with 9M from sellers in the UK. Sellers vary from individuals selling off unwanted/spare items from their collection to sole traders to established second-hand record shops. As outlined in the music industry section, the Discogs Marketplace has become an increasingly prominent player in the second-hand market, selling 14.5m records in 2019. Of these, 11.6m were vinyl, which increased sales by 41% on 2018. DISCOGS – CLOSING THOUGHTS Discogs has recently experienced strong growth, both commercially (with Marketplace sales +34% in 2019) and general usage, with 11.6m records added to users’ collections in the first month of lockdown, 65% above the usual monthly average of 7m. And despite the marketplace sector being dominated by Amazon and eBay, with 90% share between them (as the complementary “The UK Marketplace Sector – And The Role Of Community” Clear Digital research explores), Discogs managed to grow sales faster than either in 2019. 3 key dynamics helping to drive Discogs’ success are:

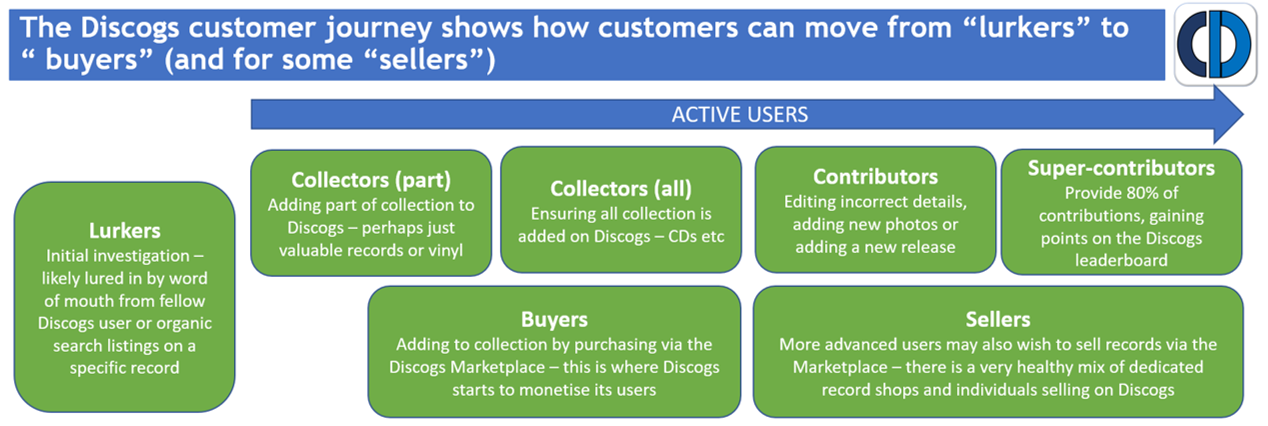

Breaking down the Discogs customer journey as shown below, we can see how customers move from “lurkers” to the more profitable “buyers”, and in some cases “sellers”, all underpinned by the strong Discogs community of half a million contributors, essential to the richness of its experience… Please note that this blog is a summary of the accompanying deeper dive on “Discogs: the digital success story of the vinyl revival” which is available to download here

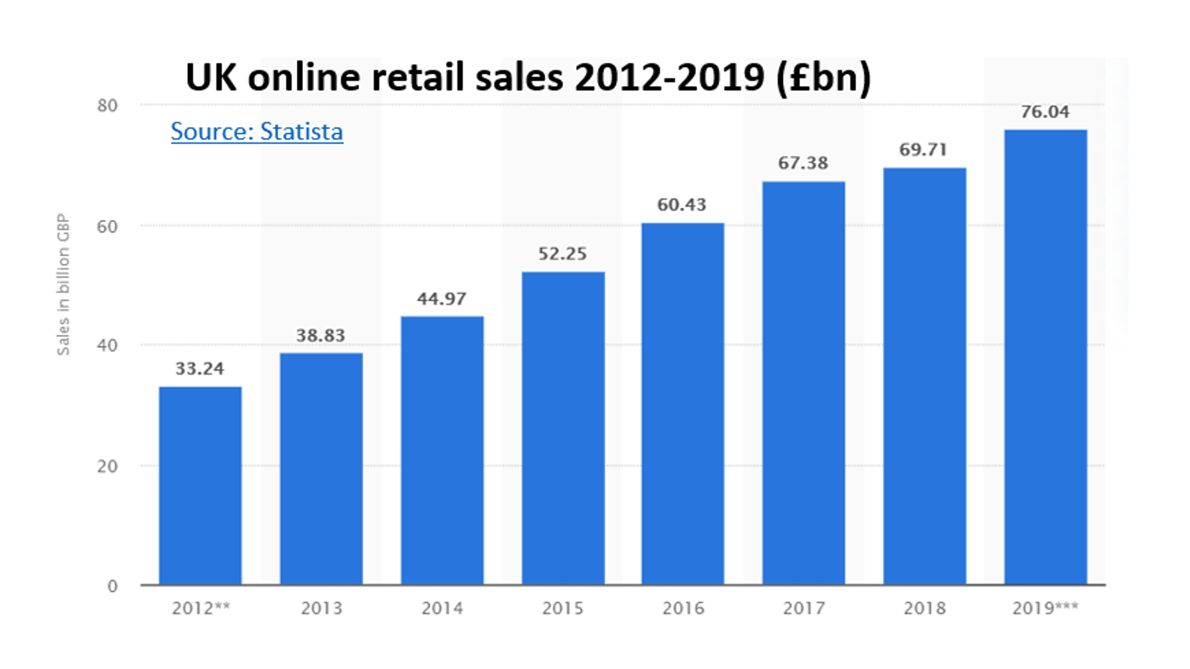

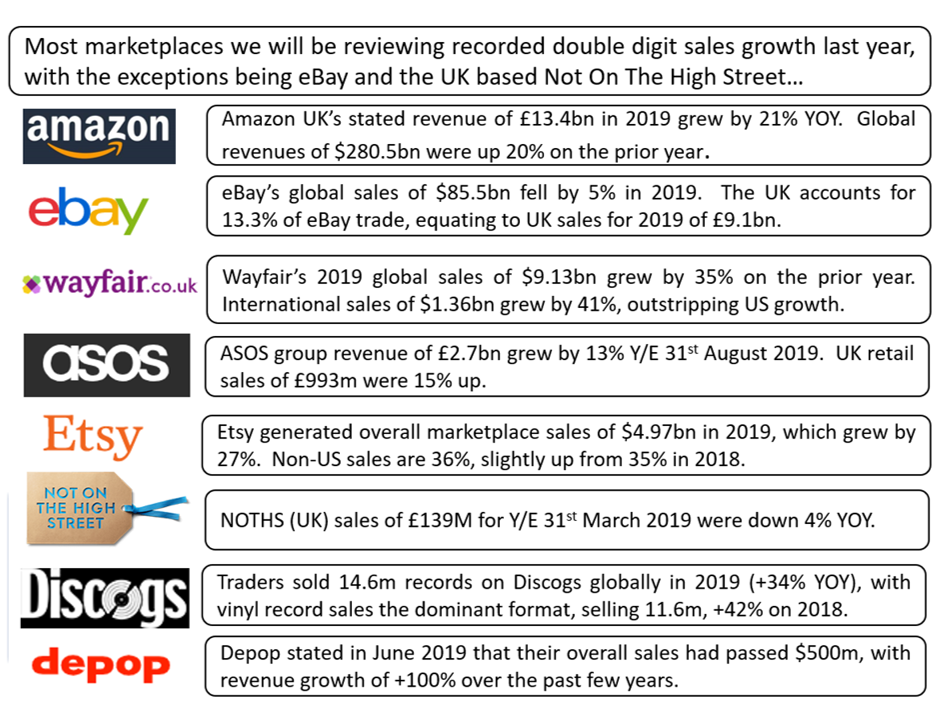

The UK marketplace sector is responsible for a significant slice of the UK ecommerce sector, with sales of £26.2bn in 2019 accounting for just over a third of the £76bn ecommerce market in 2019. And marketplace sales are forecast to grow by 50% over the next 5 years to reach £39.3bn by 2024*. 2020’s unfortunate events have seen marketplace sales on the rise – for both the giants Amazon and eBay as well as more niche players – as online shopping for home delivery has understandably rocketed in popularity. The enforced shutdown has seen many traders expanding online out of necessity and marketplaces offer a fast and practical route to market; for example ASOS Marketplace introduced twice as many independent boutiques in April as usual. Community-driven marketplaces as varied as Etsy, Depop and Discogs had already been experiencing substantial recent growth driven by an increasing appetite for unique and sustainable purchasing, and a desire to shop directly from independent traders and artists. This blog explores further the size and dynamics of the UK marketplace sector, delving beyond just Amazon and eBay (who do account for a huge 90% of sales), with a particular focus on community-driven marketplaces to examine the winners and what we can learn from them.

THE UK MARKETPLACE SECTOR Amazon and eBay dominate the UK marketplace sector of £26.2bn, with 90% of sales but the rest of the UK marketplace sector is worth a still significant £2.6bn. With total UK online retail sales for 2019 standing at £76bn, £1 in every £3 spent online is via a marketplace. The table below shows the top 15 marketplaces in the UK, ranked by monthly visits. This is a useful starting point to assess the UK marketplace, albeit it may under-represent the reach of m-commerce first platforms such as Depop, as app traffic is not recorded. The top 15 UK marketplaces can be split into 3 distinct sectors:

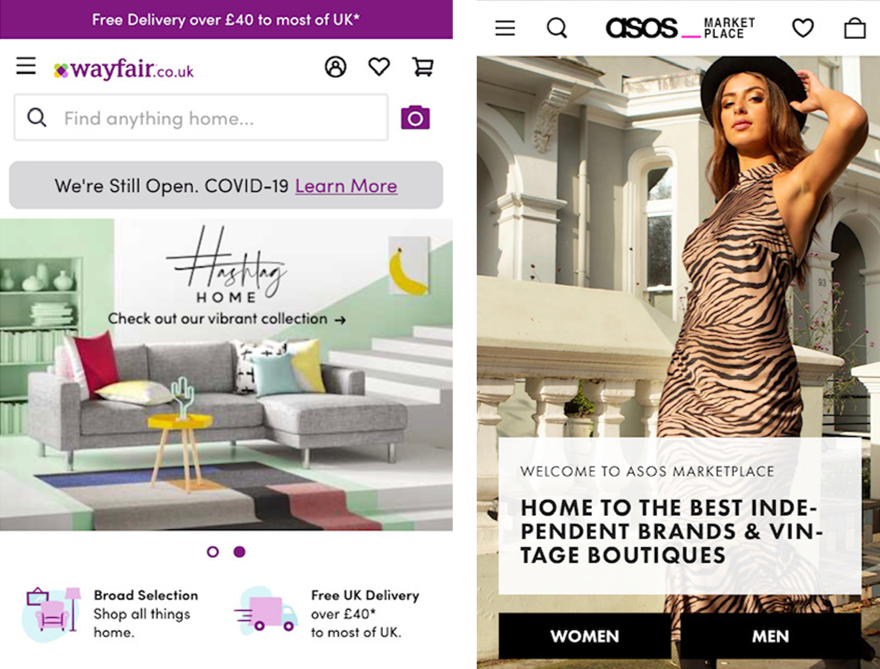

UK MARKETPLACE SIZE AND SHARE: DOMINATED BY AMAZON AND EBAY The research in the table below looks at the top 6 marketplaces by UK visits (plus Discogs, Bandcamp and Depop) and calculates the UK sales made through each marketplace, as well as the “take” or commission generated by each marketplace. As outlined earlier, Amazon and eBay dominate sales, with 90% of the £26.2bn UK marketplace sector. Established global players in Etsy and Wayfair are next in sales generated, with in excess of £250m each in 2019. The % of commission taken ranges from 8% for Discogs to 25% for Not On The High Street, with a median average of 12%. Wayfair does not disclose a take or commission rate in its annual reporting and will vary greatly based on merchant and product category. Please note that the table below is also featured on page 7 of the full "The UK marketplace sector - and the role of community" article, downloadable here. AMAZON AND EBAY Amazon’s UK revenue of £13.4bn soared by 23.2% in 2019. This figure includes all directly Amazon sold products (approx. 50% of its revenue) and commission paid by its third-party marketplace sellers but not the overall customer spend on these products, which is estimated at £14.5bn. See page 8 of the detailed article for more information on Amazon’s revenue breakdown. 7% of Amazon’s total revenue comes from Amazon Prime and it has now has 150m members worldwide, 15m in the UK. With Amazon’s convenience becoming ever more impressive – and many marketplace sellers piggybacking on the Fulfilled By Amazon (FBA) service to take advantage of this – Amazon is widening the gap in marketplace sales from the other giant of the sector, eBay. eBay’s growth has slowed in recent years, with global sales of $85.5bn actually declining by 5% YOY in 2019. The UK accounts for 13.3% of eBay’s global commission*, so this equates to $11.38bn or £9.1bn in sales. eBay’s sales do remain significant of course – 35% of all marketplace sales and 12% of all UK ecommerce sales. CATEGORY SPECIALISTS: WAYFAIR AND ASOS Wayfair and ASOS Marketplace’s category specialisms have led to recent continued growth; Wayfair’s 2019 global sales of $9.1bn grew by 35% year on year, while ASOS doubled its usual number of new sellers in April due to the Covid19 lockdown. Wayfair also offers logistics services to its retailers, helping smaller players with bulky furniture items in particular. It is this service specialism – and focus on “drop ship” items - that helps to differentiate Wayfair in the market and makes them a preferred partner for furniture/home product traders. The curated nature of ASOS’ marketplace, piggybacking off its huge ecommerce specialist fashion site and brand has helped it establish its own niche. However, the fashion sector moves notoriously quickly as can be seen by the emergence and continuing growth of new concepts such as Depop. COMMUNITY-DRIVEN MARKETPLACES Depop is a buzzy example of a new community-driven marketplace, with its social mobile app first approach very different to a traditional retail website. London based but with global reach, Depop has over 15m users, most under 26 and has sold over $500m of clothing on its platform since its launch. Depop is an example of a true “m-commerce first” brand – you are strongly advised to download the app to encounter the full experience, which is very reminiscent of Instagram. You are then encouraged to follow other users and see what they’re posting via your feed; a “new” way to shop online but using very familiar methods for Gen Z digital natives. And it is Gen Z sensibilities that are increasingly interested in the more sustainable options that Depop’s “pre-loved” marketplace offers – as Depop CEO Maria Raga states: “There are reports that show that in five years resale will be as big as fast fashion…We’re extending the life of the garment, which resonates.” Etsy and Not On The High Street (NOTHS) are both arts/gifts focused community marketplaces, but Etsy’s recent sales growth has been much more impressive, with $5bn global sales in 2019 growing by 27%. Etsy’s non-US sales are 36%, of which UK is estimated at 7.3% (based on website visits share), which would equate to $348m/£290m UK sales. When reporting first quarter results in early May, Etsy also stated that sales through its marketplace globally had grown by over 100% in April, with cloth face masks an understandably large seller, but all categories seeing significant uplifts. NOTHS’s sales transacted of £139M for Y/E 31st March 2019 were down 4% YOY, but NOTHS’s active customer base did increase, with 2.57m making at least one purchase, +3% YOY. Although previously seen by some as “the British Etsy”, NOTHS has not kept pace with recent Etsy sales and has looked to concentrate more heavily on its gifting credentials recently, with new tagline “the home of thoughtful gifts”. NOTHS’s recent lack of growth will likely not have been helped by its curated approach to introducing new sellers plus significantly higher commission compared to Etsy’s simpler on-boarding process and more advantageous rates. NOTHS will be hoping their new focus on gifts will arrest this decline. A potent mixture of Wikipedia, IMDB, eBay and Pokemon for music fans, Discogs was originally established in 2000 by Kevin Lewandoski purely to catalogue dance records but now describes itself as “the world's foremost Database, Marketplace, and Community for music”. Discogs Marketplace was launched in late 2005 after customer demand and has expanded since to become a key player in the used records market, selling 14.6m records in 2019, up 34% year on year. The complementary Clear Digital research “Discogs: The Digital Success Story Of The Vinyl Revival” explores Discogs and the wider music market in much more detail – click here to find out more. CLOSING THOUGHTS Convenience is always a key factor in any shopping decisions; “location, location, location” as the old retail adage explains. Competing with Amazon’s Prime shipping options is impractical for most, so generalist marketplace traders have used this to their advantage, which has been to eBay’s detriment with their recent declining sales. However, convenience is not purely related to fast, flexible delivery; as we have seen, other marketplaces’ success has included convenient browsing and purchasing options… Instead, marketplaces as diverse as Etsy, Wayfair, Depop and Discogs have harnessed a sense of community and different online shopping experiences to build successful niche experiences serving a variety of dedicated, engaged customers with quirky/unique product selections, a strong sense of usefulness and fun, all underpinned by strong trust and ethical credentials, increasingly important for younger consumers in particular... Product Selection: Specialising in product sectors that are not as suited to Amazon’s model, for example vintage merchandise (Depop, Discogs), bulky items (Wayfair) or artisan hand-crafted products (Etsy), has seen these niche marketplaces thrive in recent times – and with the warm feeling engendered by supporting smaller/local businesses. Usefulness/Fun: Creating a sense of usefulness or fun in the online shopping experience, especially when looking to non-retail digital presences, is also proving successful – whether that’s using Discogs’ IMDB/Wikipedia type music resources, or gaining inspiration from Depop’s Instagram style User Experience and community. Trust: When purchasing from any marketplace, the slightly faceless aspect of the ultimate seller can be disconcerting, which is again why reliability factors such as user reviews and strong trust in both the marketplace brand and overall community are highly important for both initial and repeat purchases. Ethics/Sustainability: The trend for ethical trading and purchasing sustainable products continues to be a growing concern, especially for younger consumers – Depop have stated that “there are reports that show that in 5 years resale will be as big as fast fashion”, while the built to last wares of Etsy products and second hand records from Discogs also fit comfortably into being ethical, sustainable purchases from like-minded traders. This blog is a summary of the accompanying deeper dive on “The UK marketplace sector – and the role of community” which is available to download here

Last Thursday (28th April 2016), I headed to Birmingham’s NEC for this year’s Internet Retailing Expo (IRX) to catch up with some old colleagues, attend a few conference sessions and generally take the temperature of the ecommerce sector. As one may expect, many of the big themes from the day were to some degree mobile centric and this blog pulls out what I considered to be 3 key overarching trends from the day:

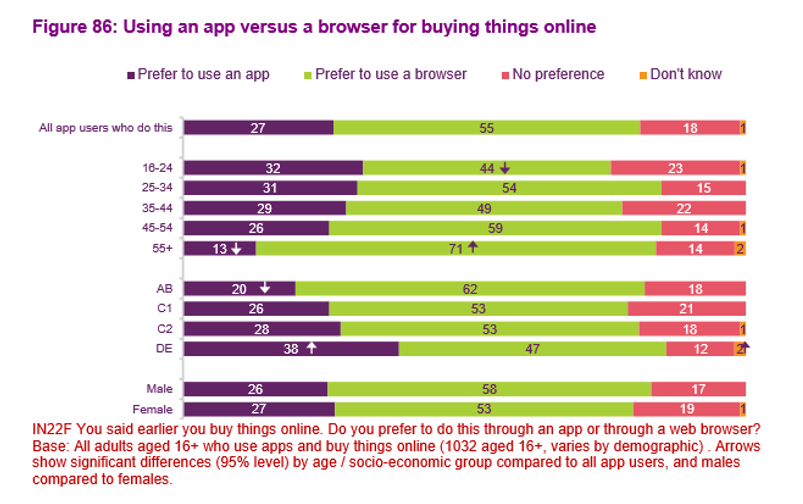

NB: This blog is also available as a PDF file, downloadablehere. RECENT OFCOM DATA HIGHLIGHTS HOW QUICKLY SMARTPHONES ARE GAINING ON LAPTOPS AS THE PREFERRED ONLINE SHOPPING CHANNEL An ever accelerating customer shift to smartphone usage means that now is a true time of change for selling via digital channels. This change does however mean that a lot of standard ecommerce best practice (honed ever more knowledgeably over the last 10-15 years based on desktop usage and behaviour) is now steadily becoming outdated for a majority of customer journeys. Before delving into some data and insights gleaned from IRX itself, it is worth pulling out a couple of pertinent points from Ofcom’s recently issued Adults Media Use and Attributes 2016 report. One specific section looking at online shopping really shows the pace of change, highlighting that last year, 24% of users said that the smartphone is the device they most use to shop online; a huge rise from 15% in 2014, with this growth all coming from a decline in laptop preference (falling to 37% from 50% the year before) albeit laptops still remain the most used device overall. This is not the case for all ages, with smartphones preferred by younger consumers, just edging out the laptop for those in the 16-24 and 25-34 brackets. So, this helps to provide some newly updated data for an ecommerce trend that is unlikely to surprise anyone. However, something that is perhaps not so well known is customers’ preference to transact on smartphone within browsers rather than via an app, a trend that is actually fairly consistent across most age groups. With mobile app strategy a source of much discussion for retailers, with many different viewpoints and strategies, this insight seems highly valuable.

THE MOST VALUABLE IRX INSIGHTS WERE SMARTPHONE RELATED Moving on to look at IRX itself, Google’s Retail Industry Head Paul Goldstein delivered the Digital Sales & Marketing closing keynote address and as one would expect, this well attended session contained some helpful insights, principally centred on the mobile experience (and how to improve your PPC AdWords campaigns of course!). Outlining that 40% of online shoppers research on mobile but then convert on desktop/tablet may have been familiar news, but the fact that 50% of customers who conduct a local search on mobile (e.g. “buy a kettle near me”) end up in store within a day was certainly a useful statistic to demonstrate the different and unique nature of smartphone shopping. Paul’s presentation then looked into the need to “Be Personal, Be Actionable and Be Measured”; important points that I’ll return to when talking about my 3 key trends. Looking at some specific retailer examples, Schuh’s Deputy Head of Ecommerce Colin McMillan mentioned that from the 15-20% of Schuh’s overall sales that were transacted online, mobile was now accounting for nearly half its traffic (48%, compared to 30% for desktop and 22% for tablet) but a lower percentage of sales; 42% of revenue due to a reduced conversion rate of approximately 1.5% compared to the 2.5-3% seen on desktop/tablet. Some fairly common ecommerce benchmarks there, but what was intriguing was the fact that 89% of Schuh mobile shoppers only interact with Schuh digitally via mobile, so the oft voiced assumption that customers use mobile early in the buying process only to ultimately convert via desktop rather than mobile (due to factors such as ease of purchase/UX and security concerns) does not seem to apply here. Rather, Schuh has a sizeable proportion of customers for whom a smartphone is their sole ecommerce experience for the whole purchase funnel.

A likely lower than average age of Schuh shoppers would skew usage towards mobile to some degree, but this does also raise the question of why mobile conversion rate should be so much lower than for desktop if 9 out of 10 of mobile shoppers are exclusively using this as a digital channel. I believe that this seems to come down to 2 key factors: continuing difficulty with analysing all channels together (and understanding of the role each has to play) as well as ecommerce UX innovation proceeding at a slower pace than other mobile customer experiences, both of which I’ll explore more below. Before that though, it’s worth looking at the differences (and similarities) between desktop and mobile ecommerce, not least their different stages of maturity.

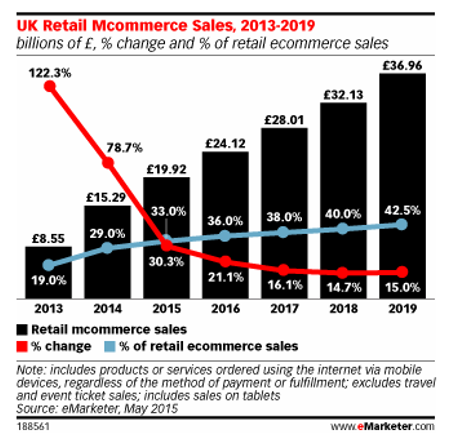

1. MOBILE COMMERCE IS STILL FAIRLY YOUNG, WITH ALL THE GROWING PAINS THAT IMPLIES

The art of designing, building and promoting standard desktop ecommerce sites is fairly well established now, with up to 20 years of practical experience, knowledge and research in this field. On the other hand, as more seasoned digital veterans will no doubt recall, despite being promised many times that the “year of mobile” was coming, it was really the iPhone’s launch in 2007 and ensuing smartphone penetration growth from the start of this decade that have led to the profound shift in consumer behaviour that has seen eMarketer forecast that UK m-commerce sales will grow nearly fourfold from £8.5bn in 2013 to a 2018 forecast of over £32bn.

So while desktop ecommerce may now have come of age and graduated, mobile commerce is about to start primary school, so it still has a lot to learn and also is likely to keep asking many hard to answer questions, for example:

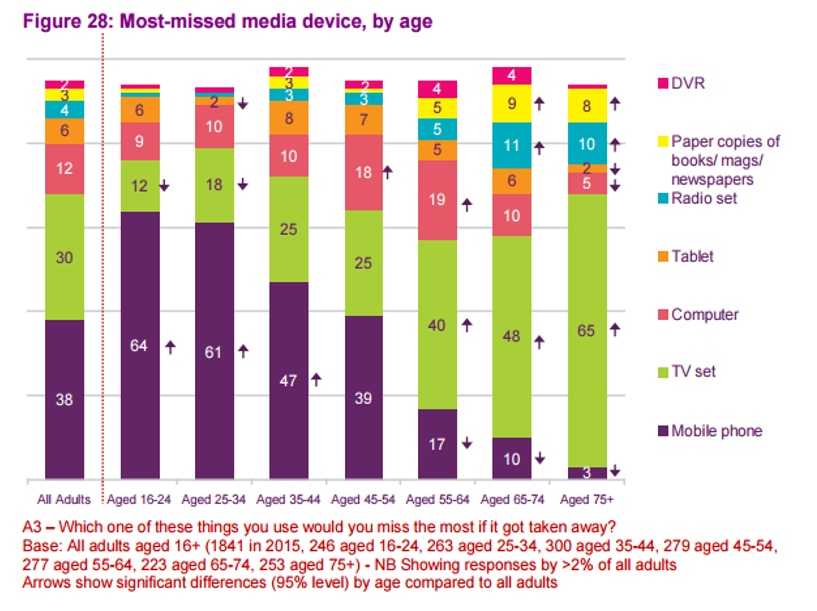

Of course, the key point to remember here is that there is no “one size fits all” approach and needs will differ from company to company, even more than with desktop due to the smartphone’s nature. With recent Ofcom research highlighting that we would now miss the smartphone more than any other device – replacing the previous preferred TV and way ahead of the computer – this simply reflects that place that our mobile now takes in our life; as well as being a supremely powerful mini-computer (and of course phone!), it is also our camera, music player, GPS, torch, clock, stepometer, games console, calculator etc etc etc. Ecommerce operations will also notice this as customers use them in very distinct ways. Having heard from Schuh that mobile is their most important channel (with 48% of traffic and 42% of sales coming from smartphones), we learnt at IRX that this is very different for Eurostar, courtesy of their Head of Digital Neil Roberts. Desktop is by far their most important digital channel, accounting for 53% of research journeys and a huge 81% of purchase journeys; smartphones account for 34% of research and 9% of purchase, with tablets making up the remaining 13% of research and 10% of purchase journeys. This is likely due to various reasons – e.g. more considered and complex purchase, older demographic – but the fact that Eurostar’s mobile experience is not yet fully optimised, albeit moving to a responsive website very soon, is also surely a factor. One final IRX experience to highlight is that of MySupermarket, courtesy of UK MD Kim Ludlow. The fourth most visited supermarket site in the UK (behind only Tesco, Asda and Sainsburys), this online comparison website actually sees a majority of its customers using it to influence in-store purchases; 35% of its customers purchase online for home delivery while 65% research online and purchase offline. The mobile nature of smartphones therefore proves a strong fit with the MySupermarket experience, with 63% of shoppers using the website on their smartphone – an adoption much higher than their accompanying app which has a much lower transaction/usage rate, prompting Kim to question that if they had known how successful the site would be on mobile “would we have built it [the app]?” Therefore, Schuh, Eurostar and MySupermarket all have quite different mobile presences (e.g. app or not, responsive or not), something to be expected in this early phase as all companies start to grow up in this area. One thing to be aware of course is both the ever increasing demands that customers have, partly driven by innovation in other sectors, a theme I’ll cover shortly.

2. MEASURABILITY REMAINS A PROBLEM FOR RETAILERS, WITH SMARTPHONE GROWTH INCREASING THE COMPLEXITY HERE

Returning to Google’s IRX presentation, their 3rd main point was to “Be Measured” and this constant striving for better analytics and measurement to aid improved decisions was unsurprisingly a key theme from just about everything I heard and discussed at IRX. Of course, this quest for improved data and insights is also not new, but the continuing march of the smartphone is making this more complex to measure as well as changing many previously established dynamics. For example, Paul Goldstein from Google stated that 90% of consumers use multiple screens when buying online, but the established “last click wins” model is still highly prevalent and the main success metric for the majority of retailers, so many optimise to this. The old ROPO model (research online, purchase offline) has been with us a while but the complexity of measuring this accurately, and then being able to utilise this data in a meaningful way to optimise marketing activity, has long been the holy grail for retailers. Google stated that 59% of customers researched online before their last in store purchase: an impressive stat that is likely lost in standard day to day digital marketing programmes. With the importance of digital (and Google AdWords of course!) often under-reported, Google have been developing further ways to track both cross devices and in store purchases. It was reported that advertisers using Google's cross-device insights are measuring up to 16% more conversions as they benefit from a much wider picture than just tracking a customer on one laptop for example. Even bigger uplifts were mentioned when looking at digital influence on store purchases, with retailers using Google Store Visits data (to help tie up the online and physical) being able to measure 4 times more overall conversions that were started digitally, and a huge 10 times more when looking specifically at mobile. Unsurprisingly, it is not just Google amongst the internet’s giants that is looking to help retailers understand this influence (and ultimately shift even more media spend to digital channels). For example, Facebook last month announced a partnership with Tesco owned Dunnhumby to help FMCG brands understand the impact of Facebook campaigns in store at the supermarket. It’s probably safe to say that despite making progress around marketing attribution, the industry overall has still not solved the issue of how to fully measure and assess the importance of all customer touchpoints. With mobile growing in importance (but often further up the funnel and thus not measured via the common “last click wins” method), this will be key for retailers to understand and advertising providers to help them get there. Easier said than done of course, especially with the complexity of the marketing technology landscape as I blogged about in March.

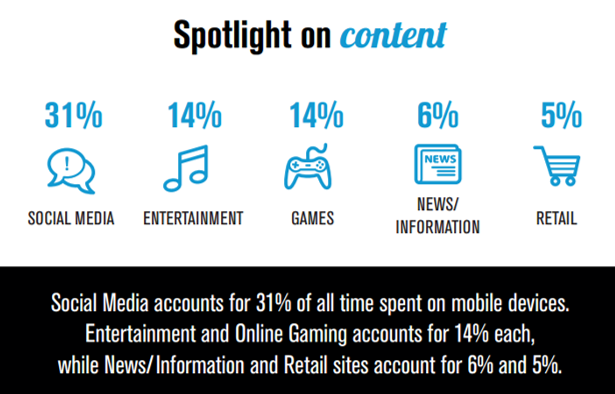

3. IS ECOMMERCE UX INNOVATION BEING LEFT BEHIND BY OTHER SECTORS?

With all this complexity to consider (measurability, multiple channels) plus the aforementioned 20 years of history to fall back on, is it possible that ecommerce is being left behind in the UX stakes by new nimbler, truly mobile first experiences as varied as Instagram, Uber, messaging services such as WhatsApp/Facebook Messenger and even Tinder? With shopping only accounting for 5% of time spent on mobile, these new interfaces are becoming the smartphone norm for customers who may not see the difference between buying a pair of shoes or a lamp with ordering a taxi or even looking for love. As an example, Tinder’s hugely simple interface is starting to provide inspiration for some fashion brands, such as Missguided, whose mobile app includes a “swipe to hype” feature clearly modelled on Tinder’s swipe left/right functionality. This allows you to build your own wish list based on a constant flow of different clothing options, alongside more standard ecommerce features, albeit even these benefit from a design that feels akin to Instagram, seemingly a wise move for this brand’s young female demographic. Of course, this type of experience will not be suited to many retailers, but it does serve as a good example of challenging traditional UX hierarchy and looking wider than just competing ecommerce sites for inspiration. So, in conclusion, a really stimulating day at IRX with much food for thought. It feels like the world of internet retailing continues to move forward as ever, with a real aspiration to true omni-channel capabilities. The issue of measurement continues to be a challenge (and probably always will), but a challenge with real upsides for those able to streamline their data sets into actionable insights. However, the smartphone space will remain the biggest growth priority by far for most ecommerce operations. Here, it is the different opinions and challenges faced by many retailers, coupled with the need to keep abreast of wider mobile trends and innovations, which means that mobile strategy will no doubt continue to occupy the majority of forward thinking in the coming 12 months. This week saw Ofcom release their always useful and insightful annual UK media review: Adults Media Use and Attributes 2016. At over 200 pages, there is a huge wealth of detail to take in at once, but this report can prove an invaluable one stop shop over the year for many must have stats. A good place to start is the report overview which pulls out 4 major trends, with the ever moving shift to smartphone usage unsurprisingly to the fore:

I spent yesterday at the Internet Retailing Expo and these trends around shifting device usage were resonating loud and clear from some of my discussions there plus presentations attended; I’ll be blogging more thoughts on this next week. Returning to the Ofcom report, I’d recommend a couple of other interesting summaries:

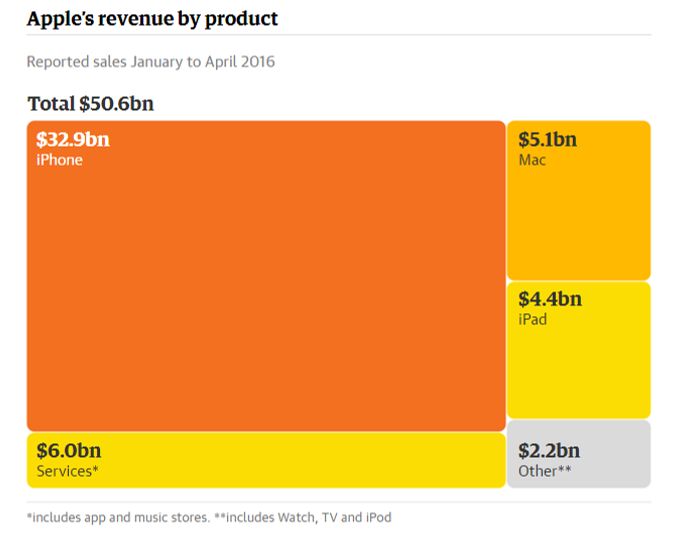

Some diverging results statements from the internet’s big beasts this week. Although widely trailed before, it was still strangely odd to see Apple report its first fall in sales since 2003 on Tuesday, with sales of quarterly sales of $50.6bn down from $58bn in the same quarter last year. This was primarily due to a slowdown in iPhone sales (which account for 65% of Apple’s revenue) to 51.2m in the quarter from 61.2m the year before. This of course led to a wealth of think pieces on what Apple needs to do to turn this decline around (spoiler alert: it is unlikely to be the Apple Watch), while I did enjoy this “brief guide to everything that’s annoying about Apple” – my personal favourites being numbers 5 and 11. Meanwhile, Amazon has just posted its fourth straight profitable quarter in a row, and the largest quarterly profit in its history, prompting Wired to exclaim “Whoa, Amazon Isn’t Just Making Money. It’s Making More Than Ever”. Amazon’s Q1 net profit stood at $513m with global revenue of $29.1bn, up 28% on last year and beating analysts’ expectations, leading to a share price increase of over 12%. It’s worth stating here that Amazon spent years incurring losses as it built its huge empire (including its increasingly important AWS cloud computing arm which saw revenue up 64% YOY to $2.6bn), but has now posted ever growing profit growth for the 4 quarters of the last year; a development sure to please investors but also demonstrating that Amazon seems to be entering its next phase of maturity.

|

Jim ClearLead blogger and founder of Clear Digital: talking about ecommerce, digital, marketing and media. Categories

All

Archives

December 2020

|

||||||||||||||||||||||||||