|

Today’s varied Clear Digital Digest round-up includes:

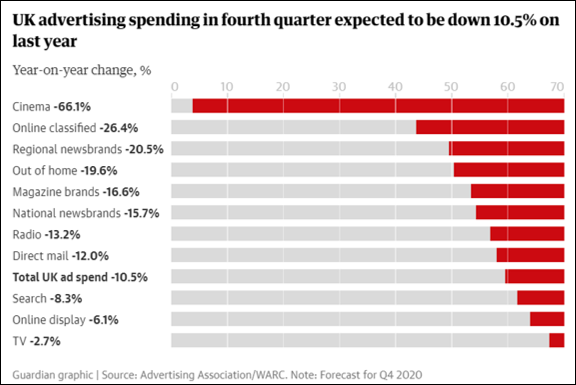

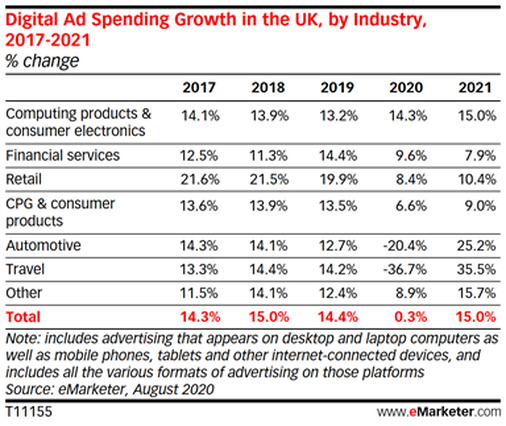

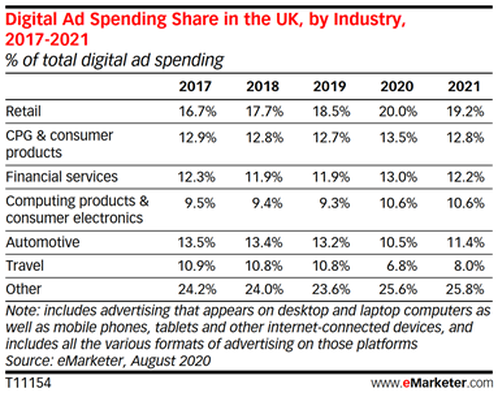

HERE COMES CHRISTMAS: BUT AD SPEND FORECAST TO BE £724M LESS THAN LAST YEAR With half term coming to a close this week and Christmas products all over the high street, November is typically when the large retail brand campaigns come to life, with large TV spend supported by a variety of other media. Of course 2020 is not a typical year, so there will certainly be all kinds of challenges creatively this year, as well as with regards to available budgets.

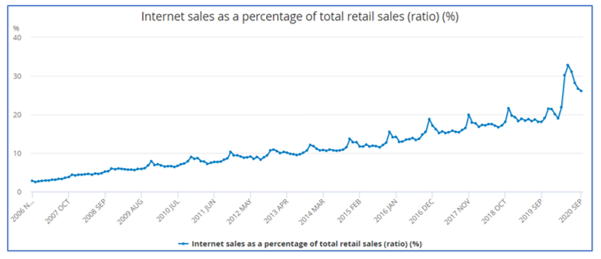

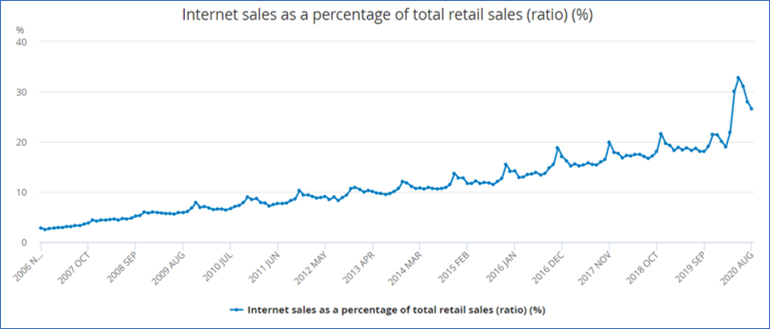

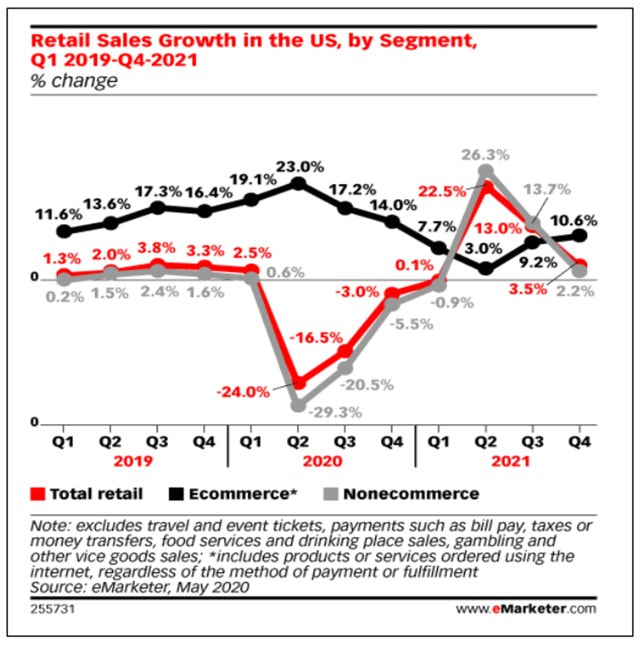

ECOMMERCE: SALES UPDATE - AND BLACK FRIDAY IS GETTING EARLIER EVERY YEAR Despite all this year’s uncertainty, one trend that can be confidently predicted for Christmas 2020 is that ecommerce sales will take a significant larger share of total retail sales, but how much larger exactly?

CHANNEL SHIFT: SHOPIFY, TIK TOK, ROYAL MAIL, AO, SKY, JOHN LEWIS Here are a few recent stories that caught my eye regarding channel purchasing shifts, including developments from AO and Sky which demonstrate how digital first brands continue to consider the ways that a physical presence can help them engage further with customers…

AND FINALLY… One brand that won’t be returning to the high street – despite a flurry of excitement earlier this week – is the old childhood favourite Woolworths.

0 Comments

Clear Digital Digest: subscription coffee, Amazon ads, retail sales update and cricket data18/9/2020 Today’s Clear Digital Digest looks at some recent stories regarding Pret A Manger and Amazon, reviews today’s new ONS retail data and learns how the data revolution is transforming the world of cricket.

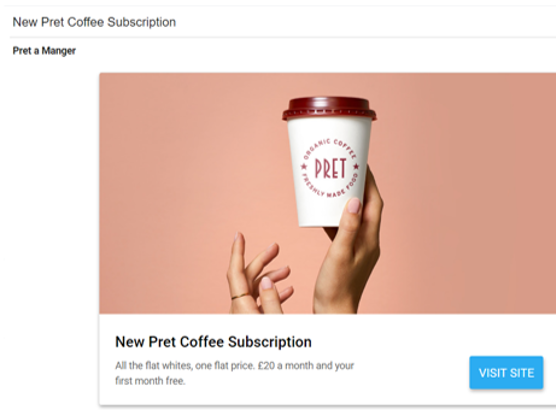

PRET A MANGER: ALL YOU CAN DRINK

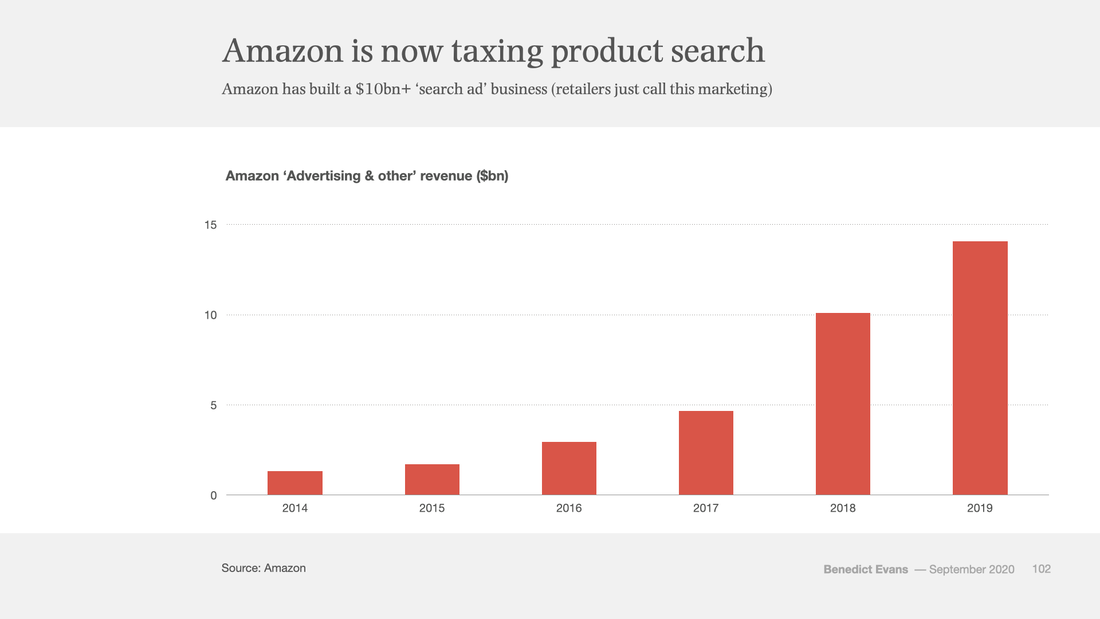

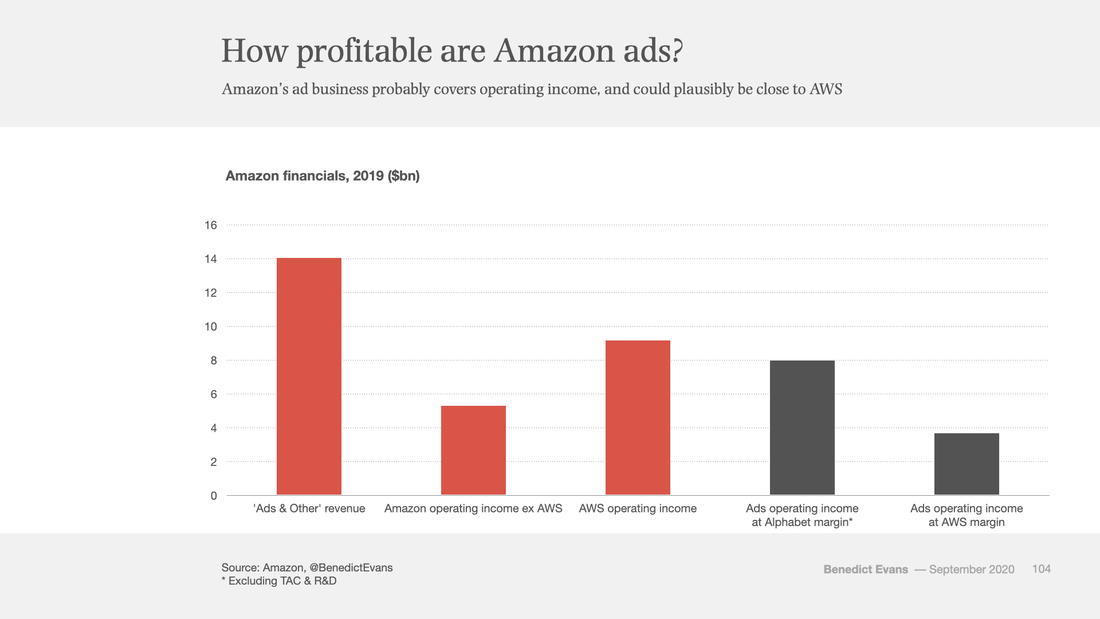

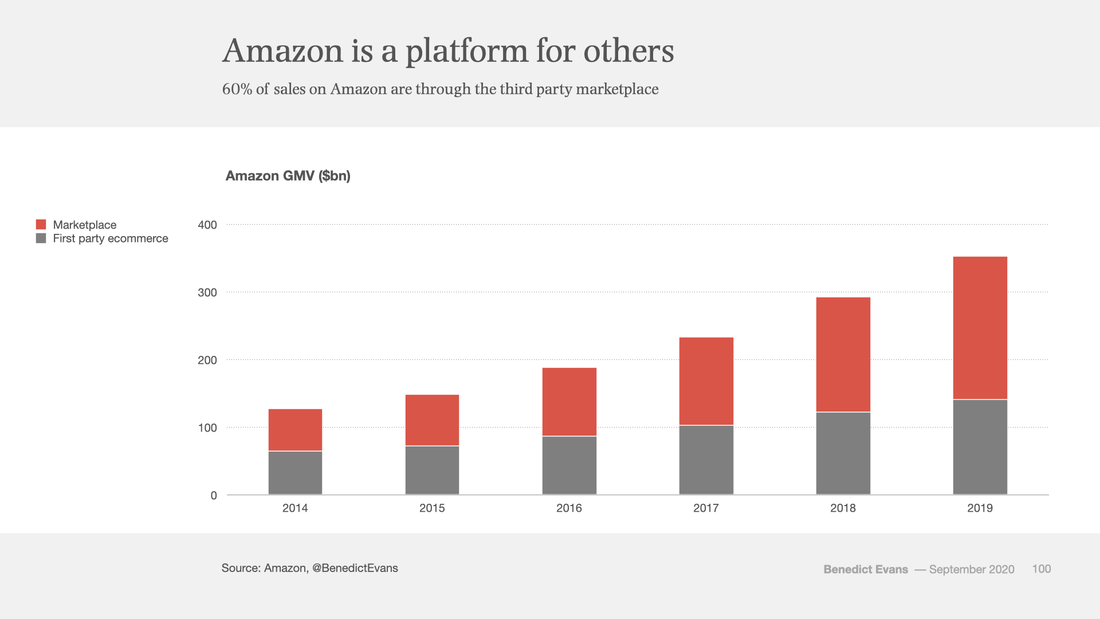

AMAZON’S PROFITABILITY: INCREASINGLY DRIVEN BY ITS ADVERTISING Well worth a read is this fascinating article about Amazon and its profitability, courtesy of Ben Evans.

RELEASED TODAY: ONS RETAIL SALES UPDATE FOR AUGUST The Office for National Statistics (ONS) have today released their latest retail sales figures for August. We reviewed July’s data in a Digital Digest last month, so here’s a quick update, one month on…

AND FINALLY... When my subscription copy dropped through my letterbox this week, I was surprised to see The Cricketer magazine (now in its centenary year) highlighting “The Data Decade” on its front page. With the relevant articles exploring how increasing use of digitised data has fundamentally changed recent cricket coverage and some future predictions on how this may evolve, it’s a timely reminder than even such a traditional pastime as cricket is experiencing unprecedented change with its own digital/data revolution.

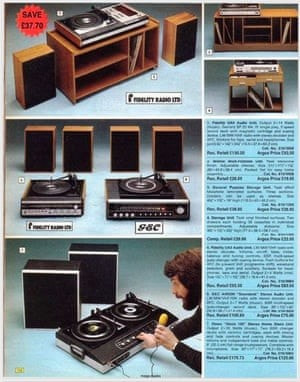

But this also demonstrates that there is still a place for more traditional media…yes I do still read some print magazines as well… Clear Digital Digest: Argos catalogue RIP, retail tie-ups, Q2 updates and soccer supervillains3/8/2020 Today’s Clear Digital Digest starts with a look back at the beloved Argos catalogue before looking forward to the growing impact of another Argos innovation in Click & Collect, as well as other retail partnerships. Then we turn our attentions Stateside to review Q2 updates from Amazon, Facebook and Google plus the latest digital innovation in sports watching… END OF AN ERA – GOODBYE ARGOS CATALOGUE So RIP the Argos catalogue – as one wag noted, much easier to say than to actually do. As was widely reported on Thursday, Argos have stopped producing their twice yearly catalogue, meaning that January’s Spring/Summer 2020 edition will be its final print version. Argos now say that online shopping offers “greater convenience” than flicking through a catalogue, part of the continuing wider shift to ecommerce sales. Having previously spent 8 years in various roles within Argos’ ecommerce operation, during which time the catalogue’s ubiquity (estimated to have been in approx. 75% of British homes at one time) certainly helped to mutually drive web sales, there’s definitely a sense of nostalgic regret to see the “laminated book of dreams” bid farewell. However, it appears that less and less were being printed, with 3.9m of the last edition down from a peak of over 10m a decade ago. And with each catalogue costing roughly £3 to produce back when I was working there, changing shopping habits will have made ceasing production an increasingly attractive option for the huge potential cost savings; something that has been frequently reviewed over the years. Nostalgia for kids being able to choose their favoured Christmas presents will be partly assuaged by the news that Argos plans to continue to print its Christmas Gift Guide, still generally a sturdy 300 pages or so, albeit well down on the 1800 page behemoth that was the main catalogue. Before then, for anyone after a quick nostalgic fix, the Guardian pulled together a selection of vintage covers and catalogue pages, count me in for 1976’s Home Stereo Disco Unit (item 7 below…) CLICK AND COLLECT/RETAIL PARTNERSHIPS Of course, there are other retail channels that Argos pioneered which remain highly relevant and continue to grow in popularity, none more so than Click & Collect. In line with all ecommerce sales, Click & Collect orders have been growing rapidly since the start of lockdown, with more and more brands partnering together for mutual benefit. Argos have offered a collection service for selected eBay customers since 2014, while the introduction of Argos collection points into many Sainsburys stores since being bought by the grocer in 2016 meant that Argos was able to continue offering C&C services throughout lockdown. Amazon entered into a similar partnership with Next last year with their Amazon Counter initiative, while John Lewis have recently announced plans to extend their C&C tie-up with the Co-op to over 500 stores. John Lewis have also just stated that they expect 60% of their sales to be online, up from 40% pre-Covid. In an update to all John Lewis partners, chair Sharon White said “We have two of the best loved and trusted brands in the UK, rated highly for our personal service and expert, impartial advice. Customers are, however, shopping in very different ways – younger people especially – with the pandemic accelerating the importance of digital. We expect John Lewis to be a 60% online retailer, from 40% pre-Covid-19, and Waitrose to rise above 20%, from 5%.” Such uncertain times do certainly seem to be leading to a much wider array of complementary brands working together, with another recent example seeing Sainsburys starting to provide a range of 3000 products to the garden centre retailer Dobbies. Q2 UPDATES: AMAZON, FACEBOOK, GOOGLE Three of the tech giants have provided their latest global Q2 updates in the last few days, with varying results. Of course, Q2 2020 is the first quarter since the world has been in lockdown, so one would certainly not expect standard trends from these updates.

AND FINALLY…

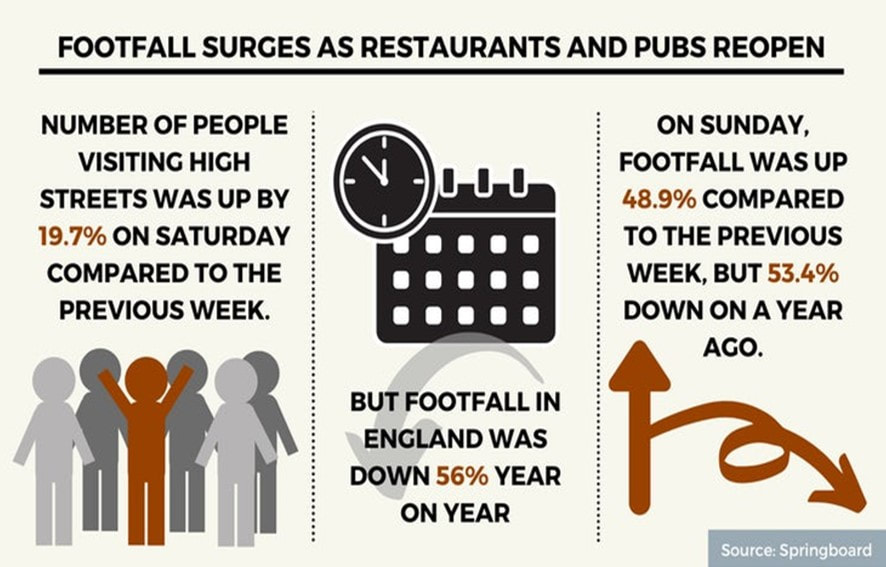

In a week when it was announced at the last minute that planned pilot sporting events were not allowed to admit limited spectators as originally planned, technology continues to serve up increasingly sinister options instead. After previously highlighting Japanese robotic baseball fans last month, MLS in the US have now seemingly opened applications for the world’s next supervillain… Today’s Clear Digital Digest looks at the early impact of the lockdown slightly easing last week, some updated ecommerce sales trends, Ofcom’s research regarding online usage habits and perceptions plus perhaps the scariest sports supporters seen for many a year. HAIRCUTS BEFORE HEINEKEN One of the biggest changes in the UK in the last week has obviously been the lockdown easing last Saturday (4th July) for both pubs and restaurants as well as for some other service retailers, most notably hairdressers.

ECOMMERCE SALES UPDATES

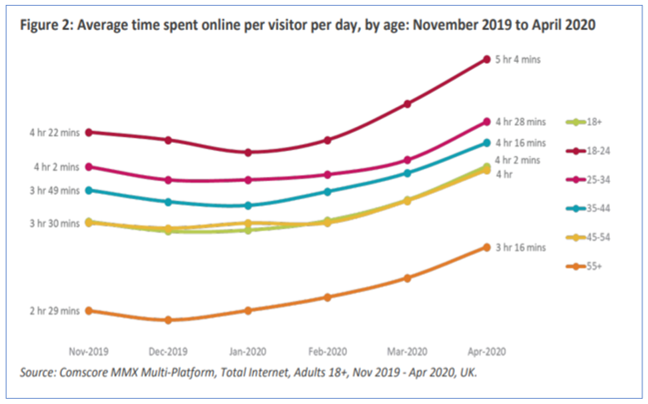

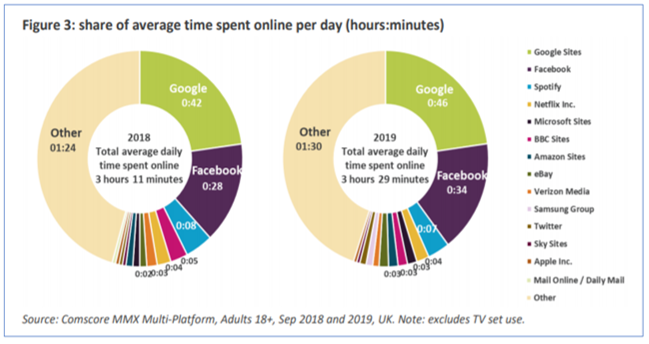

ONLINE NATION Ofcom last week released their latest report “Online Nation” that looks at what people are doing online as well as their attitudes to and experiences of using the internet.

AND FINALLY… In the week that cricket was the latest sport to return behind closed doors, its sporting cousin baseball showed off an imaginative replacement for supporters in the stadium. Japanese baseball team Fukuoka SoftBank Hawks unleashed 2 different types of robotic fans for their match against Rakuten Eagles on Tuesday, who arguably look scarier than Millwall fans from the 1980s…

Last Thursday (28th April 2016), I headed to Birmingham’s NEC for this year’s Internet Retailing Expo (IRX) to catch up with some old colleagues, attend a few conference sessions and generally take the temperature of the ecommerce sector. As one may expect, many of the big themes from the day were to some degree mobile centric and this blog pulls out what I considered to be 3 key overarching trends from the day:

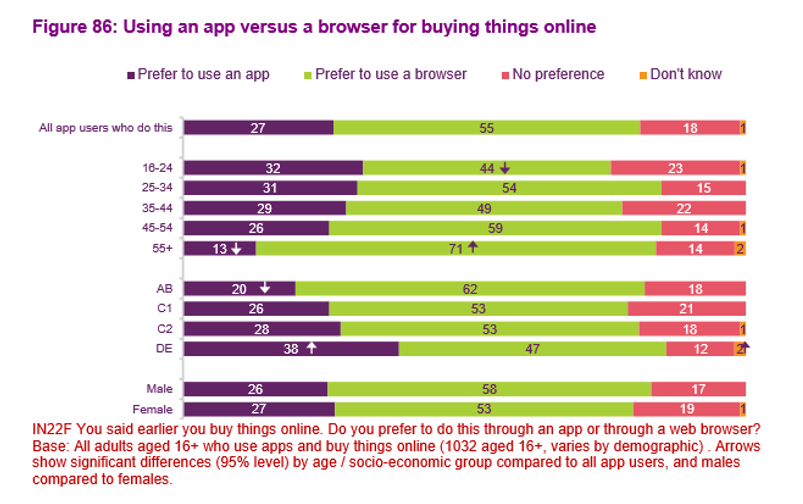

NB: This blog is also available as a PDF file, downloadablehere. RECENT OFCOM DATA HIGHLIGHTS HOW QUICKLY SMARTPHONES ARE GAINING ON LAPTOPS AS THE PREFERRED ONLINE SHOPPING CHANNEL An ever accelerating customer shift to smartphone usage means that now is a true time of change for selling via digital channels. This change does however mean that a lot of standard ecommerce best practice (honed ever more knowledgeably over the last 10-15 years based on desktop usage and behaviour) is now steadily becoming outdated for a majority of customer journeys. Before delving into some data and insights gleaned from IRX itself, it is worth pulling out a couple of pertinent points from Ofcom’s recently issued Adults Media Use and Attributes 2016 report. One specific section looking at online shopping really shows the pace of change, highlighting that last year, 24% of users said that the smartphone is the device they most use to shop online; a huge rise from 15% in 2014, with this growth all coming from a decline in laptop preference (falling to 37% from 50% the year before) albeit laptops still remain the most used device overall. This is not the case for all ages, with smartphones preferred by younger consumers, just edging out the laptop for those in the 16-24 and 25-34 brackets. So, this helps to provide some newly updated data for an ecommerce trend that is unlikely to surprise anyone. However, something that is perhaps not so well known is customers’ preference to transact on smartphone within browsers rather than via an app, a trend that is actually fairly consistent across most age groups. With mobile app strategy a source of much discussion for retailers, with many different viewpoints and strategies, this insight seems highly valuable.

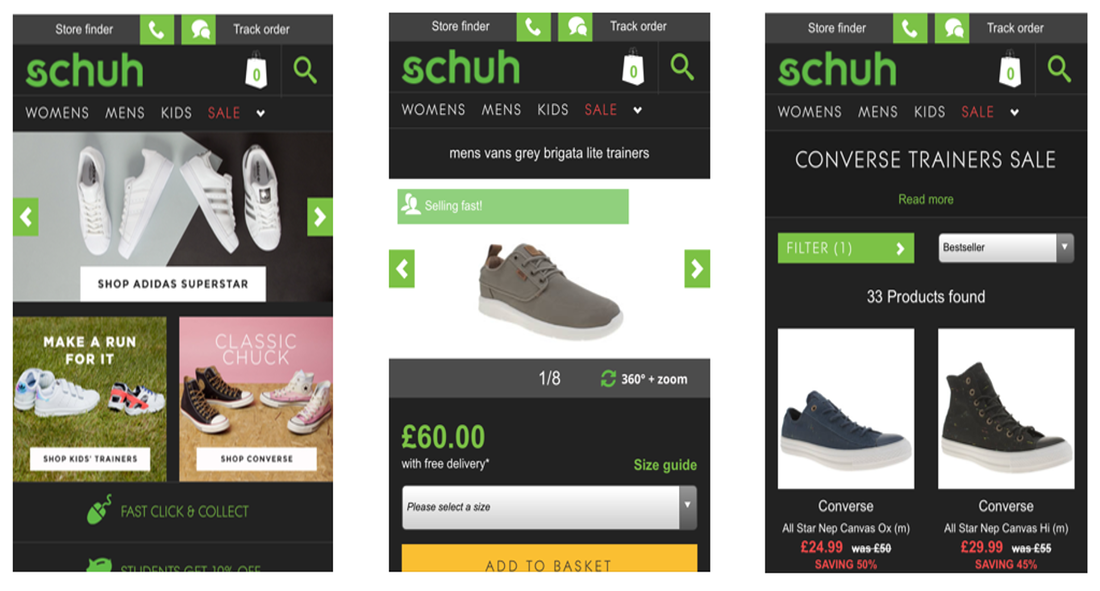

THE MOST VALUABLE IRX INSIGHTS WERE SMARTPHONE RELATED Moving on to look at IRX itself, Google’s Retail Industry Head Paul Goldstein delivered the Digital Sales & Marketing closing keynote address and as one would expect, this well attended session contained some helpful insights, principally centred on the mobile experience (and how to improve your PPC AdWords campaigns of course!). Outlining that 40% of online shoppers research on mobile but then convert on desktop/tablet may have been familiar news, but the fact that 50% of customers who conduct a local search on mobile (e.g. “buy a kettle near me”) end up in store within a day was certainly a useful statistic to demonstrate the different and unique nature of smartphone shopping. Paul’s presentation then looked into the need to “Be Personal, Be Actionable and Be Measured”; important points that I’ll return to when talking about my 3 key trends. Looking at some specific retailer examples, Schuh’s Deputy Head of Ecommerce Colin McMillan mentioned that from the 15-20% of Schuh’s overall sales that were transacted online, mobile was now accounting for nearly half its traffic (48%, compared to 30% for desktop and 22% for tablet) but a lower percentage of sales; 42% of revenue due to a reduced conversion rate of approximately 1.5% compared to the 2.5-3% seen on desktop/tablet. Some fairly common ecommerce benchmarks there, but what was intriguing was the fact that 89% of Schuh mobile shoppers only interact with Schuh digitally via mobile, so the oft voiced assumption that customers use mobile early in the buying process only to ultimately convert via desktop rather than mobile (due to factors such as ease of purchase/UX and security concerns) does not seem to apply here. Rather, Schuh has a sizeable proportion of customers for whom a smartphone is their sole ecommerce experience for the whole purchase funnel.

A likely lower than average age of Schuh shoppers would skew usage towards mobile to some degree, but this does also raise the question of why mobile conversion rate should be so much lower than for desktop if 9 out of 10 of mobile shoppers are exclusively using this as a digital channel. I believe that this seems to come down to 2 key factors: continuing difficulty with analysing all channels together (and understanding of the role each has to play) as well as ecommerce UX innovation proceeding at a slower pace than other mobile customer experiences, both of which I’ll explore more below. Before that though, it’s worth looking at the differences (and similarities) between desktop and mobile ecommerce, not least their different stages of maturity.

1. MOBILE COMMERCE IS STILL FAIRLY YOUNG, WITH ALL THE GROWING PAINS THAT IMPLIES

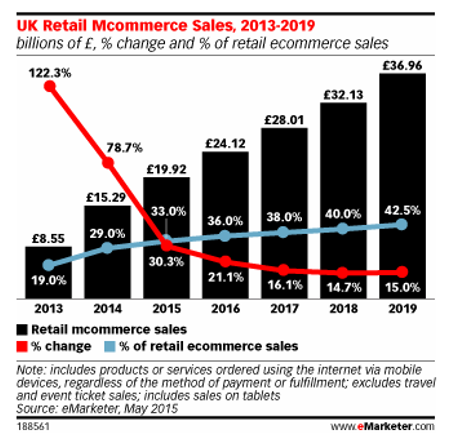

The art of designing, building and promoting standard desktop ecommerce sites is fairly well established now, with up to 20 years of practical experience, knowledge and research in this field. On the other hand, as more seasoned digital veterans will no doubt recall, despite being promised many times that the “year of mobile” was coming, it was really the iPhone’s launch in 2007 and ensuing smartphone penetration growth from the start of this decade that have led to the profound shift in consumer behaviour that has seen eMarketer forecast that UK m-commerce sales will grow nearly fourfold from £8.5bn in 2013 to a 2018 forecast of over £32bn.

So while desktop ecommerce may now have come of age and graduated, mobile commerce is about to start primary school, so it still has a lot to learn and also is likely to keep asking many hard to answer questions, for example:

Of course, the key point to remember here is that there is no “one size fits all” approach and needs will differ from company to company, even more than with desktop due to the smartphone’s nature. With recent Ofcom research highlighting that we would now miss the smartphone more than any other device – replacing the previous preferred TV and way ahead of the computer – this simply reflects that place that our mobile now takes in our life; as well as being a supremely powerful mini-computer (and of course phone!), it is also our camera, music player, GPS, torch, clock, stepometer, games console, calculator etc etc etc. Ecommerce operations will also notice this as customers use them in very distinct ways. Having heard from Schuh that mobile is their most important channel (with 48% of traffic and 42% of sales coming from smartphones), we learnt at IRX that this is very different for Eurostar, courtesy of their Head of Digital Neil Roberts. Desktop is by far their most important digital channel, accounting for 53% of research journeys and a huge 81% of purchase journeys; smartphones account for 34% of research and 9% of purchase, with tablets making up the remaining 13% of research and 10% of purchase journeys. This is likely due to various reasons – e.g. more considered and complex purchase, older demographic – but the fact that Eurostar’s mobile experience is not yet fully optimised, albeit moving to a responsive website very soon, is also surely a factor. One final IRX experience to highlight is that of MySupermarket, courtesy of UK MD Kim Ludlow. The fourth most visited supermarket site in the UK (behind only Tesco, Asda and Sainsburys), this online comparison website actually sees a majority of its customers using it to influence in-store purchases; 35% of its customers purchase online for home delivery while 65% research online and purchase offline. The mobile nature of smartphones therefore proves a strong fit with the MySupermarket experience, with 63% of shoppers using the website on their smartphone – an adoption much higher than their accompanying app which has a much lower transaction/usage rate, prompting Kim to question that if they had known how successful the site would be on mobile “would we have built it [the app]?” Therefore, Schuh, Eurostar and MySupermarket all have quite different mobile presences (e.g. app or not, responsive or not), something to be expected in this early phase as all companies start to grow up in this area. One thing to be aware of course is both the ever increasing demands that customers have, partly driven by innovation in other sectors, a theme I’ll cover shortly.

2. MEASURABILITY REMAINS A PROBLEM FOR RETAILERS, WITH SMARTPHONE GROWTH INCREASING THE COMPLEXITY HERE

Returning to Google’s IRX presentation, their 3rd main point was to “Be Measured” and this constant striving for better analytics and measurement to aid improved decisions was unsurprisingly a key theme from just about everything I heard and discussed at IRX. Of course, this quest for improved data and insights is also not new, but the continuing march of the smartphone is making this more complex to measure as well as changing many previously established dynamics. For example, Paul Goldstein from Google stated that 90% of consumers use multiple screens when buying online, but the established “last click wins” model is still highly prevalent and the main success metric for the majority of retailers, so many optimise to this. The old ROPO model (research online, purchase offline) has been with us a while but the complexity of measuring this accurately, and then being able to utilise this data in a meaningful way to optimise marketing activity, has long been the holy grail for retailers. Google stated that 59% of customers researched online before their last in store purchase: an impressive stat that is likely lost in standard day to day digital marketing programmes. With the importance of digital (and Google AdWords of course!) often under-reported, Google have been developing further ways to track both cross devices and in store purchases. It was reported that advertisers using Google's cross-device insights are measuring up to 16% more conversions as they benefit from a much wider picture than just tracking a customer on one laptop for example. Even bigger uplifts were mentioned when looking at digital influence on store purchases, with retailers using Google Store Visits data (to help tie up the online and physical) being able to measure 4 times more overall conversions that were started digitally, and a huge 10 times more when looking specifically at mobile. Unsurprisingly, it is not just Google amongst the internet’s giants that is looking to help retailers understand this influence (and ultimately shift even more media spend to digital channels). For example, Facebook last month announced a partnership with Tesco owned Dunnhumby to help FMCG brands understand the impact of Facebook campaigns in store at the supermarket. It’s probably safe to say that despite making progress around marketing attribution, the industry overall has still not solved the issue of how to fully measure and assess the importance of all customer touchpoints. With mobile growing in importance (but often further up the funnel and thus not measured via the common “last click wins” method), this will be key for retailers to understand and advertising providers to help them get there. Easier said than done of course, especially with the complexity of the marketing technology landscape as I blogged about in March.

3. IS ECOMMERCE UX INNOVATION BEING LEFT BEHIND BY OTHER SECTORS?

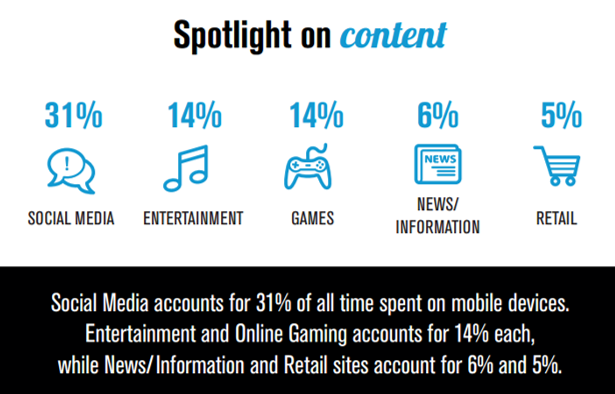

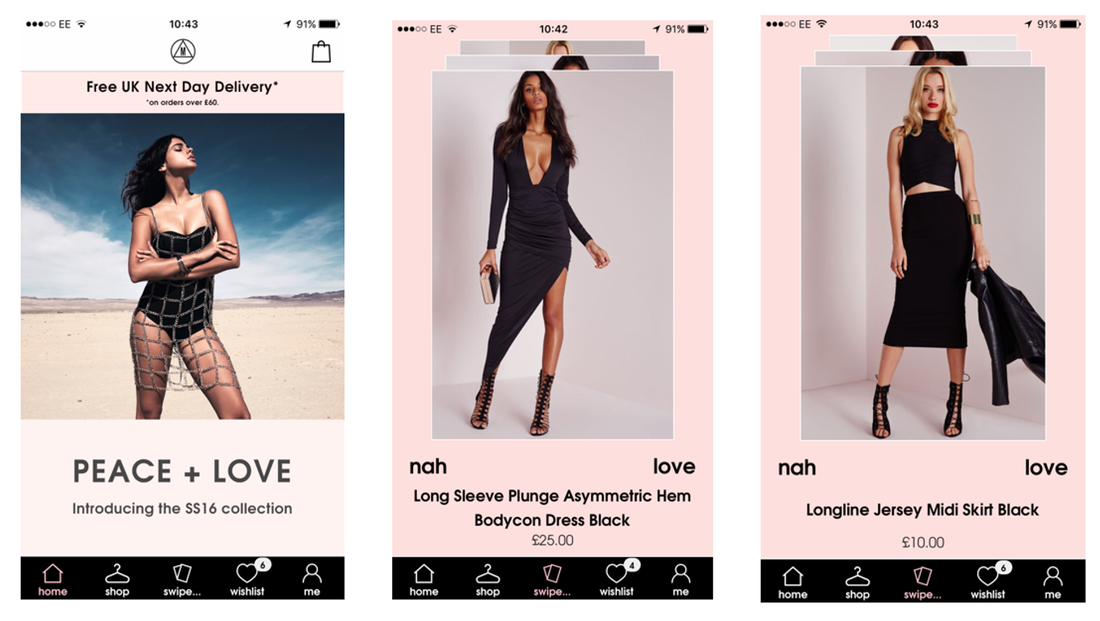

With all this complexity to consider (measurability, multiple channels) plus the aforementioned 20 years of history to fall back on, is it possible that ecommerce is being left behind in the UX stakes by new nimbler, truly mobile first experiences as varied as Instagram, Uber, messaging services such as WhatsApp/Facebook Messenger and even Tinder? With shopping only accounting for 5% of time spent on mobile, these new interfaces are becoming the smartphone norm for customers who may not see the difference between buying a pair of shoes or a lamp with ordering a taxi or even looking for love. As an example, Tinder’s hugely simple interface is starting to provide inspiration for some fashion brands, such as Missguided, whose mobile app includes a “swipe to hype” feature clearly modelled on Tinder’s swipe left/right functionality. This allows you to build your own wish list based on a constant flow of different clothing options, alongside more standard ecommerce features, albeit even these benefit from a design that feels akin to Instagram, seemingly a wise move for this brand’s young female demographic. Of course, this type of experience will not be suited to many retailers, but it does serve as a good example of challenging traditional UX hierarchy and looking wider than just competing ecommerce sites for inspiration. So, in conclusion, a really stimulating day at IRX with much food for thought. It feels like the world of internet retailing continues to move forward as ever, with a real aspiration to true omni-channel capabilities. The issue of measurement continues to be a challenge (and probably always will), but a challenge with real upsides for those able to streamline their data sets into actionable insights. However, the smartphone space will remain the biggest growth priority by far for most ecommerce operations. Here, it is the different opinions and challenges faced by many retailers, coupled with the need to keep abreast of wider mobile trends and innovations, which means that mobile strategy will no doubt continue to occupy the majority of forward thinking in the coming 12 months. |

Jim ClearLead blogger and founder of Clear Digital: talking about ecommerce, digital, marketing and media. Categories

All

Archives

December 2020

|