|

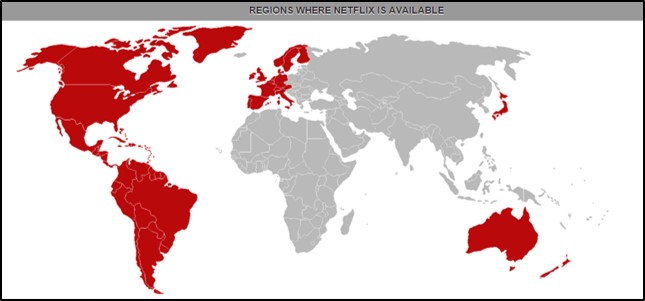

INTRODUCING THE MOST UNDER-RATED TV SHOW OF 2015: CLUB DE CUERVOS As Christmas is nearly here, along with those strange few days between Christmas and New Year - or “Twixtmas” as some now call it - which often prove a perfect time to sit back and binge on TV and box sets, I thought I’d highlight a much neglected gem (in the UK at least) that also happens to be Netflix’s first foreign language original programming: Club De Cuervos. It’s also interesting to look at what this means for how Netflix is likely to grow as it expands its global reach. Launching all 13 episodes at once in August 2015 in the usual Netflix way, Club De Cuervos is a 13 part comedy-drama set in the fictional Mexican town of Nuevo Toledo. Starting with the death of the family patriarch and local industrialist who has built his football club (the “Cuervos”) up from scratch to compete in Mexico’s top division, the show then focuses on a power struggle to assume control of the club between his son and daughter. This is backed up by a range of great supporting characters – players, staff, fans etc – and accompanying sub-plots, appearing to also satirise a range of Mexican attributes along the way (although I have to be honest that I’m speculating here), providing the immersive experience of a unique, self-contained world that we’re now accustomed to from series created by the likes of HBO, AMC and Netflix itself of course. Now, two strong alarm bells may be ringing here based on my description above. Firstly, the use of the term “comedy-drama” (or even worse “dramedy” but I didn’t use that slightly clumsy portmanteau). Usually, I find that “comedy-drama” programmes are often neither, but that’s definitely not the case with Club De Cuervos, which boasts lots of genuinely hilarious scenes plus a strong narrative with many twists and turns which don’t feel bolted on; a problem that many sitcoms trying to be “dramatic” can suffer from. Together with the otherness of being set in Mexico, this gives Club De Cuervos a hugely unique feel and makes it incredibly watchable - so a warning here: if you like this show, you are probably going to binge watch all 13 episodes in 3 or 4 sittings based on my and a few others’ experiences. Alarm bell number two would be the subject of the show: football. Despite being a huge football fan, I acknowledge that previous TV dramas with football as a background have been of fairly low standard, such as ITV’s Footballers’ Wives and Sky’s Dream Team. That said, I’ll always stick up for Jossy’s Giants and Murphy’s Mob and not just for their great theme tunes, although of course watching football programmes as a kid is very different (and make no mistake, Club De Cuervos is not suitable for children). It’s therefore worth stating that football is just a backdrop for the action here, in the same way that an interest in docker politics or Baltimore’s education system is not required to find The Wire a masterpiece. That said, a passion for football will help with a viewer’s enjoyment, especially with the introduction in the series of an intriguing character clearly intended as a hybrid of Cristiano Ronaldo and Zlatan Ibrahimovic.  Intriguingly, Club De Cuervos’ creative team is a Mexican/American mix, with the American Jay Dyer (an industry veteran of shows such as Californication) acting as showrunner in tandem with Mexican show creators Gaz Alazraki and Michael Lam. Gaz Alazraki is the writer/director of Nosotros los Nobles, the highest domestic grossing ever Mexican film, but wanted to tap into the American experience of making high quality cable programming. As Jay Dyer explains: “Alazraki and Lam wanted to hire an American writer, and specifically a writer who had an American cable sensibility. Over the last 10 years in American TV, there’s been an explosion of great cable shows, but there’s been no real equivalent explosion in Mexico”. It’s also interesting that Netflix have used the global game of football as a way into new markets while also appealing to established territories. So, when Netflix launched in Spain in October, Club De Cuervos was prominent in its promotion, as their sole original programme purely in the Spanish language, while the reaction in Mexico itself has been generally positive, also helped by its authentic local feel. As show creator Alazraki says: "We are enjoying the success of 'Club de Cuervos,' we are the first company in the world that hires Mexicans at an international level ... and we're really happy”. It is notoriously difficult to get hold of viewing figures and other indicators from Netflix but Club De Cuervos certainly seems to have proved popular since its launch in August; it was confirmed in October that a second series has been commissioned to screen in 2016, while negotiations are also already underway for four more series in total. According to Hollywood Reporter: “Club de Cuervos has helped the streaming service establish itself in new markets — particularly Mexico. Further working in Club's favour is that 25 percent of the show's viewers are U.S. subscribers. Sources say the streaming service has also upped the show's production budgets as it looks to capitalize on [lead actor Luis Gerardo] Mendez's popularity as arguably Mexico's biggest box office draw”. So, it appears that Club De Cuervos is being watched in Netflix’s core market of the US, likely helped by the fact that one American in six is now hispanic. However, 25% of viewers being American is a much lower share than would usually be expected; of Netflix’s 65m subscribers worldwide, 40m are in the US, so a show could typically expect around 60% of viewers from the US. As an aside, the UK is apparently Netflix’s next most popular market, with an estimated 4.5m subscribers (approx. 7% of total). Using the internationally popular game of football as an important theme for a way in has therefore probably proved invaluable for Netflix’s streaming service penetrating further into South America and Europe especially, backed up of course by a very enjoyable show itself. Although not likely to be of as much interest to many American viewers, Club De Cuervos may ultimately prove more relatable and popular in many other countries than the Washington machinations of Netflix’s original flagship show House Of Cards. Anyway, in what has been another great year for TV series, Club De Cuervos would definitely sit in my personal top 10, if not top 5. OK, it’s no Better Call Saul, Fargo or Peep Show but Club De Cuervos is certainly a whole lot more fun than series two of True Detective for example (or so I imagine, having given up on that fairly early on). With a second series planned for 2016 and Netflix having announced more “local” shows coming soon as it doubles its production of original series in 2016, this is a hugely welcome development for TV binge watchers interested in stories from outside the US. It will also be fascinating to see if this wider international scope is followed by competitors such as Amazon Prime; one suspects it will be. With all this in mind, I feel it’s a great shame that Club De Cuervos seems to have been noticeably absent from any “TV best of 2015” lists in the UK, be that across all channels/formats or even Netflix round ups. Therefore, why not rectify this by relaxing with the Club De Cuervos in Nuevo Toledo to escape from the cold wasteland of the UK between Christmas and New Year? I'd also love to hear any thoughts about the show or other favourites from 2015...

3 Comments

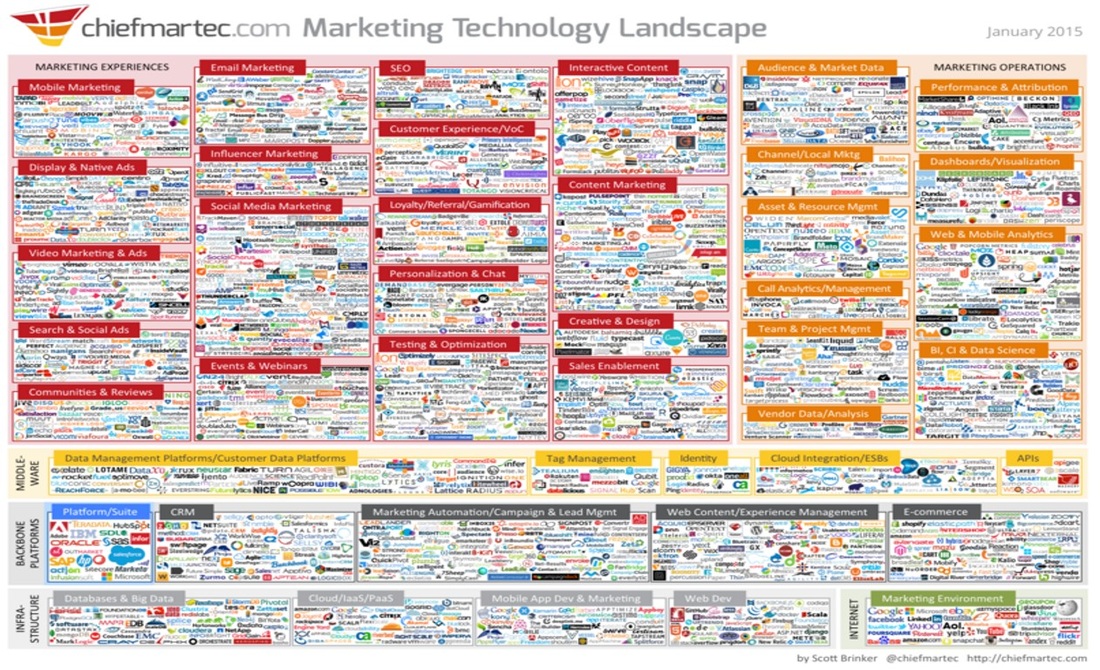

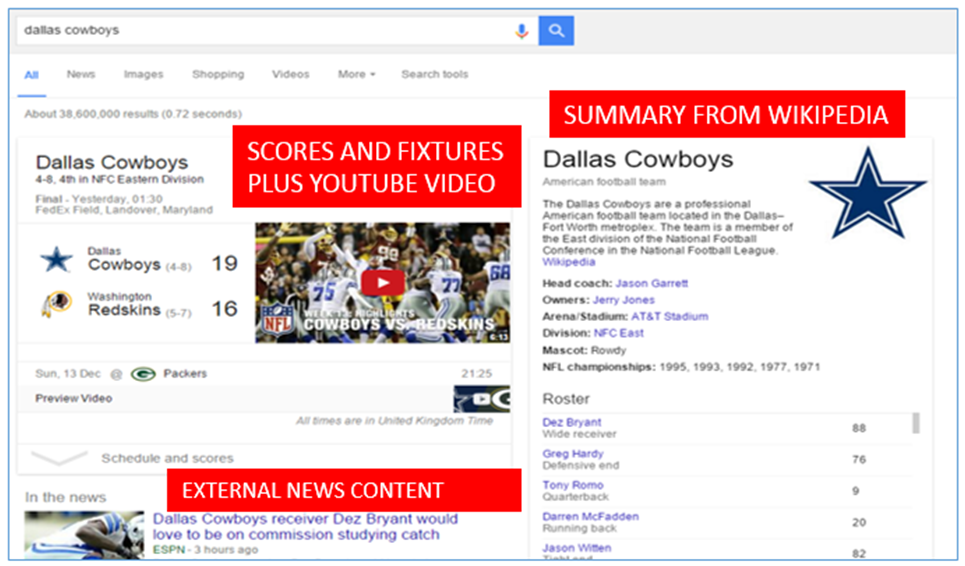

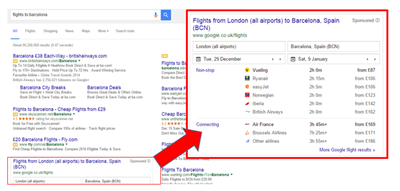

So, as the festive period approaches, it is now the custom to both look back at the last year as well as forward to what the next year holds. I’ve personally decided to look forward to next year (with a nod to 2015 too) and outline 6 interesting trends that I think we’ll see during 2016 in the worlds of digital, marketing, ecommerce and media. By no means comprehensive (that would take a list of 16, if not 216), but hopefully an interesting list nonetheless. I’d also love to hear what you think too via comments below or on Twitter… 1. DIGITAL MARKETING TECHNOLOGY WILL CONTINUE TO CONSOLIDATE Next month is likely to see the latest update of Scott Brinker’s always helpful Marketing Technology Landscape; principally helpful to form an indicative view of how just how many different providers and channels/categories are out there due to its sheer scale. Typically updated annually, January 2015’s update featured a huge 1876 companies, double the 947 featured in January 2014. However, despite this growth in marketing tech providers, there is also an increasing rise in usage of the enterprise suites (“all in one/many in one” solutions from Adobe, IBM, Salesforce etc) as many businesses are understandably adopting a less is more approach and trying to simplify their marketing tech stack as far as they can, especially in pursuit of the nirvana of the ultimate multi-channel single customer view. Adobe for one expect this to continue into 2016, recently forecasting revenues from its digital marketing cloud to grow by 20% next year. IMPLICATION/PREDICTION: With a fair bit of merger and acquisition activity in the sector, I would expect 2016’s Marketing Technology Landscape “Supergraphic” to feature perhaps a similar number of companies; I’ll certainly be very surprised if the number doubles again from last year! More interest will come from the categorisation used and any key changes there year on year. In any case, I fully expect to see consolidation continue on both fronts; with the enterprise suites continuing to grow by acquisition/new product development and businesses themselves striving to use a smaller amount of powerful tools to help with simplicity and also greater data integration. In essence, the desire is obviously there to spend more time not worrying about the tools themselves and their implementation, but to focus instead on maximising what these tools can do now and for future development; easy to say, often harder to do! 2. GOOGLE CONTINUES TO DEVELOP ITS ECOMMERCE AND MEDIA AMBITIONS Any digital list looking forward to the New Year of course has to have an opinion on Google (and in particular search innovation) so here is mine. As ever, Google have of course rolled out a plethora of developments during 2015, with the news that Google are now indexing in-app content amongst the most interesting along with the usual ongoing algorithm updates, including April’s change to encourage mobile friendly websites. However, the area I’m going to highlight is the increasing amount of real estate and utility on Google’s main search page itself. Google’s Knowledge Graph continues to provide an increasing amount of information (and so take up an ever larger part of the SERP) helped no doubt by the recent RankBrain update, thus reducing the need to visit other websites; as an example, have a look at the search results below, returned for the “Dallas Cowboys” NFL team. All the likely most popular information from this general search term is freely available within this one Google page: latest result, upcoming fixtures, even video highlights from the last match (via YouTube of course). Additionally, Wikipedia content here is providing a summary of other key information/history etc directly on the SERP, which is actually leading to declining traffic to Wikipedia itself.  IMPLICATION/PREDICTION: Looking into the ecommerce space, Google Shopping changes and the increasing prevalence of PLAs over the past couple of years have very much encroached onto the main SERP and other new developments such as the recent launch of Google Compare for products like mortgages will see this continuing to spread to most if not all key ecommerce sectors. For example, how long will it be before the “Google flight results” section of this search for “flights to Barcelona” rises to the top and above the 3 standard PPC ads? The way that Google Shopping has hugely reduced the popularity of price comparison sites like Kelkoo and Pricerunner means that all ecommerce businesses obviously need to be aware of changes to the Google “shop window”. Google are certainly keen to own more and more of the customer experience where they can up to the point of distribution (for now!). This means that the need to provide a strong and unique customer experience remains ever more important, as I also expanded on in this recent blog. 3. COULD MOBILE (AND THE “BUY BUTTON”) DRIVE THE SECOND COMING OF SOCIAL/F-COMMERCE? “F-Commerce” (ie: "Facebook Commerce"). Now there is a phrase to drive dread into my heart. Rewind 5 or more years and with Facebook’s huge user growth at the time coupled with its then “new kid in town” status, there was a stampede from retailers (and tech providers too) to see if/how Facebook itself could drive sales directly. Most typically, this was by offering a cut down version of an ecommerce site within Facebook itself, which I always thought was a bit like setting up a market stall in a busy pub despite having a great store 3 doors down. Anyway, as a launch partner around that time for the short lived Facebook Deals initiative, I have to say pretty much everyone in ecommerce was jumping on the social/Facebook bandwagon. Therefore, it is fair to say that I have a certain amount of cynicism about selling on social networks (albeit a big fan of “social commerce” in the form of customer reviews etc but that’s for another day). However, perhaps this was just at the “peak of inflated expectations” on Gartner’s Hype Cycle and maybe we are now moving into the “slope of enlightenment” where there may actually be a way to drive sales via Facebook and other social channels, with Pinterest in particular also coming to mind. I say this not just because of the ongoing introduction of the “buy button” to Facebook, Twitter etc, but also because of the continuing shift to mobile usage too (and with its accompanying heavier social media usage, especially via apps). Indeed, this logic seems to be behind Facebook’s recent announcement “Connecting People to Brands and Products on Mobile” and purchasing directly from your news feed rather than being heading elsewhere may prove attractive – at least for some customers and some brands. IMPLICATION/PREDICTION: This will be an interesting one to watch. As Facebook in particular starts to resemble more and more the portals of “Web 1.0” (see my point 5 below too) with it moving beyond simply sharing photos and gossip with friends and developing further into a one stop shop for areas such as news and discovery, it would be foolish to neglect the increasing time that your customers may be spending there, especially on mobile. However, for retailers, their different dynamics such as product, price etc will all need careful consideration – buying an impulse buy of some music or a small gift from your news feed, compared to a more considered purchase such as a TV or laptop, will of course be fundamentally different. The opportunity may actually be greater for smaller retailers with minimal mobile/app presence, as Facebook may offer a more streamlined payment procedure too, which can often be a challenge to get right on mobile. Watch this space then. 4. NATIVE ADVERTISING WILL CONTINUE TO GROW IN LINE WITH ITS SIBLING, CONTENT MARKETING

IMPLICATION/PREDICTION: Although this extreme Pepsi example may be a bit too sickly for many UK brands, the blurring between branded and non-branded content will continue to blur as publishers and media owners continue to diversify their revenue streams out of necessity. The ongoing difficulty to maximise advertising effectiveness both digitally, due to factors like the rise in ad blocking, and also with TV, due to increasing usage of streaming services like Amazon Prime as well as more watching via PVRs such as Sky+, means that brands are equally keen to make use of these new opportunities. Indeed, household names such as Stella Artois and Samsung are already taking advantage of product placement in Netflix original programming such as House of Cards. 5. ARE FACEBOOK AND OTHER “FRENEMIES” SPEARHEADING THE RETURN OF THE PORTAL? Remember the “early days” of the Internet (I’m talking mid to late 90s here)? For the mainstream, there could often seem to be only about 20 websites, most of which were large one stop shop portals: the likes of Yahoo, AOL and MSN, all with multiple news/sports/entertainment etc channels, as well as a range of “Partner” shopping channels featuring a selection of most large retailers. Then, Google’s search revolution at the start of the millennium and the rise of the open web led to a decline in popularity of these “walled gardens”. However, could we be seeing a return to the portal in the guise of Facebook in particular? Actually, could it be argued that we are already there? The Huffington Post’s new CEO Jared Grusd thinks so, recently commenting: “Companies like Facebook and Snapchat are saying: ‘We have already attracted one billion people in the world to our platform. Rather than refer them back to your site, we actually want to keep them…So post-social is, in many respects, coming full circle to where we began in the old days when people would go to AOL and Yahoo and you would just consume all your content on their portals.” IMPLICATION/PREDICTION: As outlined above in points 2 and 3, the big beasts of the internet are keen to increasingly own more and more of both consumers’ quest for information (a threat to media and content companies) and more of the purchase cycle, which ecommerce companies need to carefully consider. Often referred to as “frenemies”, a core presence on Google, Facebook etc is of course essential to pretty much any business due to their scale, but the need to add something additional to your customer’s experience of your brand therefore becomes ever more important. Here, examples such as The Guardian’s membership scheme and accompanying live events plus Hamleys’ plans to create even more excitement and entertainment in-store help to demonstrate ways forward to compete. 6. THE “AGE OF THE CUSTOMER” AND INCREASING COMPETITOR THREATS MEANS A NEED FOR EVER GREATER CUSTOMER OBSESSION

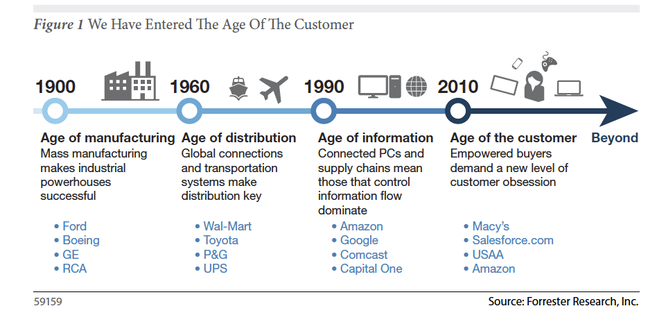

Perhaps not just new for 2016, but the ever increasing demands of the customer, helped by social media’s democratisation of information flow, mean that the need to provide a much better experience for your customers than ever before is paramount. I expanded on these developments (defined as the “age of the customer” by Forrester) at the end of this recent blog. Also, as we’ve seen above, the competitor set is ever widening – be that content distributors increasingly becoming content providers too, or large digital hubs wanting to own more of the ecommerce journey. In addition, the likes of Uber and Airbnb saw the much used term of “digital disruption” bandied about in 2015, a term that is unlikely to go away in 2016, as start-ups will continue to look for innovative business models as well as gaps to exploit in established markets. IMPLICATION/PREDICTION: This particular prediction is really pulling together a lot of the earlier forecasts so tough to summarise in a paragraph. That said, understanding and validating your customer needs and wants, keeping close to market and competitor trends, along with embracing and implementing the right levels of change (technology, product development, new channels etc) all remain key to a successful year in 2016. Oh yes and a couple of final predictions to finish off with: Ipswich Town to be promoted via the play-offs and Leicester City to win the Premier League. Well, one can dream… What do you think too? Would love to know any thoughts or comments, either below or via Twitter @clrdigital

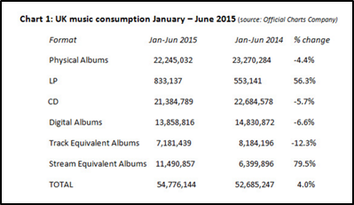

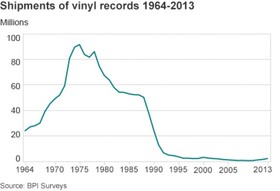

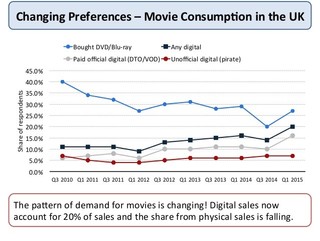

MAGICAL MYSTERY TOUR Visiting Brighton’s main independent record store Resident the other week with a locally based friend to pick up our tickets for that day’s Mutations music festival, it appeared to me that Resident had grown considerably in size from my last visit there, perhaps two or three years before. This doesn’t fit with an often widely held perception that independent specialist shops are generally all dying out if not already extinct, record shops slain by the three headed beast of Amazon, streaming and downloading. And yet, here was Resident seemingly in rude health and having managed to expand next door too. So, how has this come about – and are there any wider lessons for other sectors to learn too? Firstly, let me declare an old standing personal interest here. Going back a fair while, my Marketing degree dissertation (that oft forgotten document after the pain involved in creating it) was actually entitled “Selling music in the 1990s; the niche of the independent retailer”. Written in early 1996, with hindsight this was not exactly the timeliest piece of research, appearing just after Amazon started selling books online, but still before they moved into music or the UK come to that. The UK music market was then at a peak of success helped by the continuing CD boom plus still reaping the best of Britpop times; this was after the commercial high of Oasis’ “(What’s The Story) Morning Glory?” but before the comedown that was “Be Here Now”. I mention this trip down memory lane to help set some historical context for the independent record store sector. The continuing closures in high street stores in general since the most recent recession has been extensively documented over the past few years and independent record stores certainly suffered from the turn of the new millennium onwards, with online sales from the likes of Amazon, Play.com and CDWOW (anyone remember them?) plus illegal streaming by Napster etc hurting the sector even before the advent of iTunes and legal streaming sites such as Spotify meant the range of new competitors was becoming ever more fierce. And yet, about 5 years ago, something changed. The closures started to decline and new independent stores started to open; to the extent that according to the Record Store Day website in April 2015: “The rate of independent record shop openings is on the rise as more than 40 new shops have opened in UK high streets in the last 5 years. The most dramatic increase came in 2014, with more than 50% of openings occurring in the last 12 months alone.”  Vinyl sales were hugely up in the first 6 months of 2015, albeit from a low base Vinyl sales were hugely up in the first 6 months of 2015, albeit from a low base THE VINYL REVIVAL – MYTH OR REALITY? Here’s where the record store story gets more interesting too. Record stores sell records, right? And the excellently promoted Record Store Day itself that has taken place each April in the UK since 2008 since its creation in the USA the year before has definitely helped with this, despite the increasing backlash that this originally “independently spirited” event is being taken over by the major labels and mainstream acts, not helped by releases this year such as a limited picture disc of Belinda Carlisle’s global number one “Heaven Is A Place On Earth”. And it seems that barely a week goes by without more news about the much trumpeted “vinyl revival”; the latest example being Tesco’s announcement that they will be selling a small range of vinyl LPs (or “trendy gifting options” for Christmas), which follows on from HMV’s previous news that all their stores will now stock vinyl for the first time since the 1990s. However, please excuse this vinyl lover the odd note of cynicism as although LP sales are indeed currently showing great sales growth, this is from a very low base following years of decline until the recent slight up-turn. BPI figures show that vinyl sales were indeed up 56% in the first 6 months of 2015, strong growth indeed in a generally declining market, (streaming aside), with annual sales potentially reaching 2m units for the first time since the Official Charts Company started monitoring sales in 1994.  Vinyl LPs still have a way to go reach the +80m sales of the late 70s. Source: BBC Vinyl LPs still have a way to go reach the +80m sales of the late 70s. Source: BBC Going further back in time however shows that this is still massively down from the approx 20m sold in 1990, let alone the 80m or more sold each year in the late 1970s. This has led to the situation where although the strongest growing format by far, vinyl still accounts for less than 3% of the UK recorded music market. OK, so pessimism over. Although not the saviour of the music industry as some more hyperbolic articles and press releases may hint at, there is definitely something happening with regards to the vinyl revival. As we have seen, sales are undoubtedly rising significantly, the number of retailers stocking LPs is increasing (both online and high street) and the term even has its own Wikipedia page, while the BBC last year defined eight tribes of vinyl collector, a great debate piece but far from a definitive list by my reckoning. However, this BBC “tribes” list is instructive in helping to segment out those who have kept vinyl alive through the last 10-15 years (typically fans of dance or more obscure indie music and DJs) from the newer, younger vinyl buyers who like the “authenticity” and heritage of the format, a trend we are seeing across many areas, from the ever growing thirst for craft beer to continuing hunger for “artisan breads” and their like. In this respect, Tesco selling their limited 20 vinyl LPs is similar to them stocking BrewDog ales and not just John Smiths. The intersection between fashion and vinyl is probably best represented by Urban Outfitters who have been stocking LPs for a fair while now, to the extent that there was quite a bit of noise last year about their claim to be the world’s largest vinyl stockist (in summary, on the high street: yes, overall: no) As an aside, this particular blog summarised the contrasting views around this news very entertainingly (and I did personally enjoy the mixed thoughts about what this meant for a personal favourite album of mine, Slint’s “Spiderland”). In any case, the increasing number of “millennials” enjoying vinyl and other retro music media is an interesting trend that is helping to keep this much treasured format alive.  RECORD SHOP RENAISSANCE But a small (albeit fast growing) market in vinyl records is not the sole or even main reason for the growth in record shops – and this despite the outlook for the high street as a whole continuing to darken, with a recent PwC report showing that 437 more shops closed than opened over the past year. PwC also stated that “The sustainable new businesses occupying our high streets are often leisure or services based - more about enjoying the experience than browsing or buying a product” as well as highlighting the coffee shop sector as an area that continues to grow, both factors that have a key role to play in the record shop renaissance. Perhaps the best known and biggest record store success story of the last 5 years is the indie stalwart Rough Trade which opened a new, second London store just off Brick Lane in 2007 (to add to its historic original Ladbroke Grove location) and since then have expanded into the USA with a store opening in 2013 in Brooklyn’s hipster enclave Williamsburg, followed by the maybe less obvious location of Nottingham last year (albeit a city perhaps still in mourning for losing its own legendary record store Selectadisc back in 2009). When visiting Rough Trade East in Brick Lane, as well an extensive vinyl collection across all genres including a dedicated dance music desk, plus the more obvious CDs, music books etc, it is the extra services offered such as a stage that regularly hosts live performances and an in-store coffee shop that helps Rough Trade to differentiate itself, encouraging the sense of community that Rough Trade Store Director Stephen Godfroy says is essential to thrive: "Hold listening parties, serve coffee, give people the 'third place' they can hang out in when they're not at work or at home." Plus, of course, the much higher margins on selling coffee and muffins than music will also help with overall profitability too. While East London and Brooklyn are perhaps uniquely placed location wise to cater for this music obsessed market, this trend is not just confined to wherever heavily bearded chai latte drinkers may lurk. More recent openings such as Watford’s LP Café, Newcastle’s Long Play Café and Bradford’s Record Café, which boasts the very enticing promise of “Vinyl, Ale, Ham”, show that this combination of knowing your customers intimately and offering a unique, pleasurable experience appears to be working. In tandem with the tangible instant gratification of picking up a desirable physical artefact (and LPs are of course not as simple to deliver as other music formats due to their sheer heft so are also the least suited to online purchasing), it appears that a small but committed market segment of dedicated music fans are once again being served well. Rough Trade’s Stephen Godfroy summarises this interestingly: "The act of purchasing is just 1% of a much larger experience. We want to defy expectation, so on each visit there's something different to see and appreciate – as a destination store, you can't be predictable."  Source: Matt Bentley (slide 19) Source: Matt Bentley (slide 19) THAT’S ENTERTAINMENT We can also see this quest for the experience and physical artefacts in other media too. Amazon’s launch of an actual bookstore in Seattle last month gained a huge amount of attention (perhaps too much, to the extent that some dismissed it as mainly a PR stunt) while traditional books themselves continue to prove surprisingly resilient despite the high customer penetration of Kindles and iPads. A just returning to profit Waterstones have removed Kindles from the majority of their stores to make room for more actual books, with improvements to their in-store experience apparently directly improving their commercial performance. How we consume films also provides an illuminating example. UK cinema box office is on course for another record breaking year, helped of course by popular releases such as Spectre and the new Star Wars: The Force Awakens (did you know there was a new Star Wars film out this month?!), while the DVD/Blu-ray market is in long-term decline, due to the ongoing rise of video on demand services led by Netflix and Amazon Prime. Watching digital discs at home just can’t compete with the experience of a “night at the flicks” or the convenience/choice (and value) that streaming services offer; and so DVD/Blu-ray continues its march into unpopularity like its cousin the CD. Oddly, its physical nature could ultimately see DVD/Blu-ray follow a late climb back as a niche concern, for example for film buffs who just must have the first 4 Alien films in an Alien Head Boxset.  MORE THAN THIS… So, having looked at the world of record shops (and associated ways of consuming music, books etc), are there any lessons that can be learned for the wider world of retail and ecommerce? In particular, what has helped these sectors that were seen as terminally dying to stop years of decline and return to some robust sales growth? I’ve pulled out 3 main points that I think seem pertinent to many other sectors too. 1. We are now in the “age of the customer” Forrester have consistently referred to the fact that we are now living in the “age of the customer” (following 3 previous “ages” as shown in the accompanying image). Their assertion is that the advent of new more democratic technologies (especially the rise of social media) have fundamentally changed the flow of information and content provision from the few to the many, meaning that a “new level of customer obsession” is fundamental to overall business success. In line with this, Forrester recently outlined 10 critical success factors; the need to “personalise the customer experience” with “connecting culture to business success”, together with “operating at the speed of disruptors” all seem very in line with what successful record stores are currently doing, with their strong customer focus and need to constantly evolve (e.g by moving into food and drink too). 2. The “age of the customer” is not just about new technology From an industry standpoint, “customer experience” (and its ecommerce offshoot term “user experience”) can mean many different things to many people but of course real customers (that is to say actual individual people) don’t care about this, they just want the “best” way for them to purchase their desired product(s). However, a customer’s personal “best way” will vary hugely; as we’ve seen, buying a new album from Rough Trade on vinyl is of course very different to buying a CD from Tesco or downloading via iTunes. This has led to the continuing quest for personalisation, usually seen through the lens of how technology can help to drive this, and ultimately a “one to one” conversation with the customer, although I agree wholeheartedly with Michelle Moorehead when she says: “Customers' expectations around personalization will continue to grow in 2016, but most companies still won’t be ready to truly deliver one-to-one experiences. That’s OK: Customers don’t necessarily need perfect personalization; they just want their needs to be met in a way that delights them.” New technology advances can undoubtedly help deliver personalisation (and more) but it’s always important not to get too carried away here. At a recent Guardian roundtable discussing retail technology, this view was echoed thus: “Some were concerned about the scope for installing hi-tech gadgets for their own sake. “Technology is not your source of innovation,” said Runar Reistrup, chief executive of Depop, a marketplace mobile app for independent retailers. “Your source of innovation is the changing needs of customers. You need to innovate on value. Technology can help you find that value and scale it.” This view was shared by John Vary, innovation manager at John Lewis. “It’s got to the point now where we can do pretty much whatever we like with technology,” he said. “The question is: how can we humanise it to the point where our customers, no matter what their demographic, can actually engage in a way that is beneficial?” This is not to play down the importance of innovation but rather to state the need to innovate on top of the core basics as well, not to just do what may seem simpler to execute or simply more exciting and “cutting edge”. Improving in-store, online or overall brand experience should not be just technically led – investing in new technology without the accompanying resources and personal expertise to work with and manage it (ie actual people) is arguably worse, and with customers being ever more demanding, the need for good, knowledgeable customer facing staff and a strong company culture is arguably higher than ever as this will become an increasing differentiator between the successes and the failures. 3. The world moves fast, you need to as well With customers ever more demanding and their tastes shifting based on a range of factors, successful businesses obviously need to anticipate and react to these as quickly as they can – with threats not just coming from the usual competitors as the disruptive likes of Uber, Airbnb, Spotify etc (the list goes on…) have shown. Once dominant brands such as Kodak and Encyclopedia Britannica (last printed version in 2012) also know this only too well. Diversifying into other related areas like coffee shops has worked for record shops but of course a deep understanding of your customer is critical to success here to understand which products/services would seem of added benefit and which would be a distraction. This actually helps me to go full circle – from revisiting my degree dissertation I mentioned earlier, I saw that my main conclusions around specialist independents’ future success (albeit framed through the lens of niche marketing theory) back then were:

Nearly 20 years on, it was therefore refreshing (and surprising!) to see that these conclusions still hold true today in a fundamentally different market sector, and retailing world. So, it seems fair to say that an increasing amount for authenticity, better “customer experience” plus changing trends have helped well run, flexible record shops to survive and thrive. Replicating this passion and thirst for meeting and exceeding customer demands, using both technology and the more human personal touch, while being ahead of the curve in external related trends should therefore be of benefit to just about all organisations; whether looking to stay at number one or make an impact with a new entry.  WELCOME TO CLEAR DIGITAL Hi and welcome to the Clear Digital blog, my freshly minted space to talk, discuss, review and speculate about the worlds of digital marketing, ecommerce and media. Now that’s a fairly well populated field of course, with a wealth of great information, blogs and publications already out there. Therefore, I’ll be focusing on a few key areas based on my personal main areas of interest plus my past experience of over 10 years working in and living the digital space, during which time my experiences have included heading up a large multi-channel retailer’s digital marketing team, evangelising and educating about new digital channels for a global health and insurance brand and most recently running a company transitioning from being a traditional retailer into a pure ecommerce brand. This means you can expect to see the following sorts of themes covered (well, this is the plan for now at least!):

I’ll also be curating regular digests of recent great articles, videos, blogs and other content from around the web. Why not follow our new Twitter feed @clrdigital too to ensure you’re up to date with all our latest updates, plus other great news from around the industry, as well as letting us know what you think. Of course, I’d love to hear comments and thoughts below too...

So far so good, but what else? Well, one observation is that a lot of great insight out there can get lost through a haze of PR puff plus the perceived need to be first with latest opinions on everything all the time, a trend creeping into all media. Clear Digital plans to provide a more considered, curated read following a “less is more” approach (think a considered Sunday supplement rather than Mail Online), but not to say that there won’t be timely thoughts on key fast moving trends. One more point to make is that I’ll be looking at everything from the perspective of a practitioner who’s been there and done it – whether that’s launching new channels, setting out next year’s budgets and strategy, developing new functionality, websites or apps, building internal teams, selecting new partners, planning Christmas trading or just getting ready for a weekend’s hectic selling. “So what and what does this mean?” is the mantra to try to ensure everything we discuss is clear and to the point, along with the need to always always think customer first, not technology first, which can be so tempting with so many new and shiny exciting “toys” to play with. Finally, I will also be mixing up the purer ecommerce/marketing articles with more around my passions and interest for the changing world of media and how people consume it. My interest in this dates all the way back to my University days where my Marketing degree dissertation was entitled “Selling music in the 1990's: the niche of the independent retailer” – and I’ll be alluding this to in my first main blog post which I’m also publishing today: “The Record Shop Renaissance: Customers, Coffee and Changing Trends” (For a related good read, I can also heartily recommend this Pitchfork article on “What your music format says about you”).  CLEAR DIGITAL CONSULTING Related to this is the opportunity to also directly help with making things happen and give additional unbiased views, advice and support. To this end, I can also often help on a freelance and consulting basis, helping to utilise my past experience but also a wider network of contacts out there, specialising in a wide range of ecommerce and digital marketing disciplines. You can find out more by visiting my Consulting section, and I’d love to hear from you and catch up over a coffee for a quick chat to see if there’s anything we can help you with or even just share and exchange some thoughts. GET IN TOUCH So, that’s all for this for intro blog, but I would love to hear any thoughts on this or “The Record Shop Renaissance” so please get in touch via the usual channels, whether that’s comments below, on Twitter via @clrdigital, email [email protected] or connect on LinkedIn. |

Jim ClearLead blogger and founder of Clear Digital: talking about ecommerce, digital, marketing and media. Categories

All

Archives

December 2020

|

||||||||||||||