|

Discogs is a digital brand with a difference – it’s thriving in the hugely competitive music sector, not by taking on streaming behemoths such as Spotify or Apple, but instead by catering to the niche but dedicated sector of music enthusiasts and record collectors that value the tactile and artistic value of the traditional LP or CD. From its origins as a community based purely around electronic music, Discogs has steadily evolved to encompass all genres. As well as serving as an IMDB meets Wikipedia resource for music fans, Discogs’ increasingly popular Marketplace allows collectors to buy and sell online, with nearly 15m records traded in 2019, up 34% on the year before. So far in 2020, usage of Discogs has rocketed still further, as we have all needed to focus on home-based leisure activities plus the temporary closures of all record stores. Having previously taken a detailed look at the “vinyl revival” in late 2015 when I focused on the “record shop renaissance” and how these establishments were diversifying in order to survive and thrive, I thought I’d take another look at the music sector, but this time with the specific focus on a recently growing niche digital specialist, i.e. Discogs. Therefore, this blog reviews the current music market as a whole, before delving deeper into the second hand vinyl market, a much under-researched area. Discogs’ offering is then examined, reviewing how Discogs’ recent success has been achieved as well as a typical Discogs customer journey.

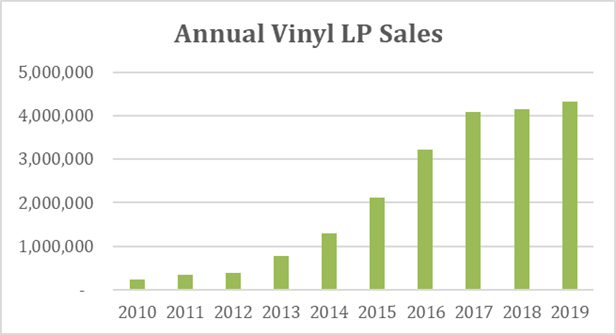

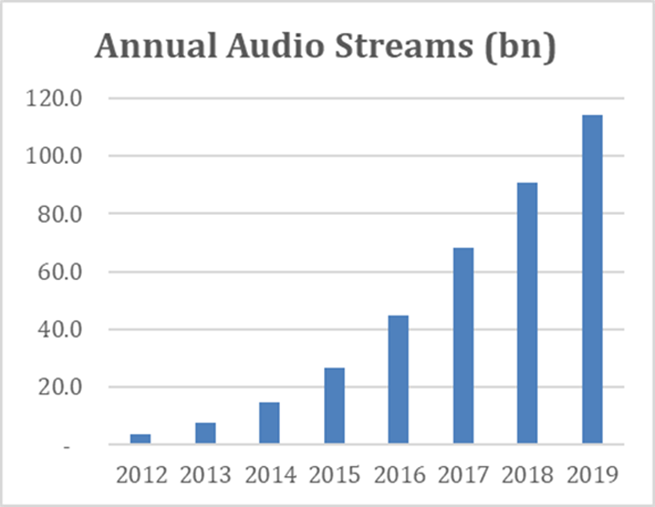

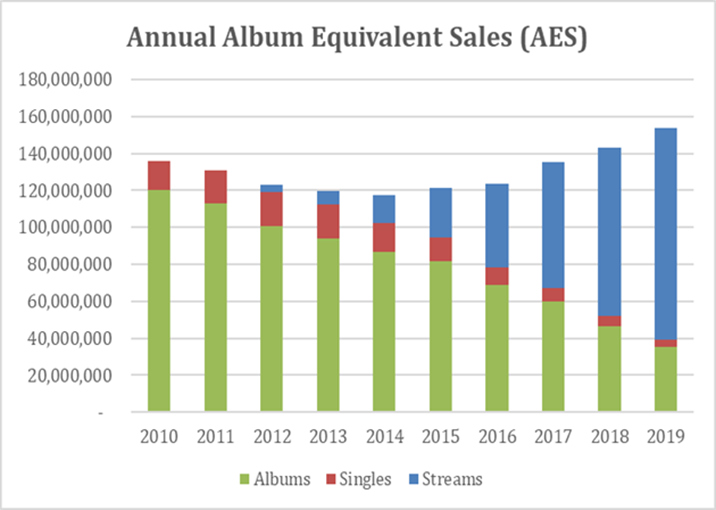

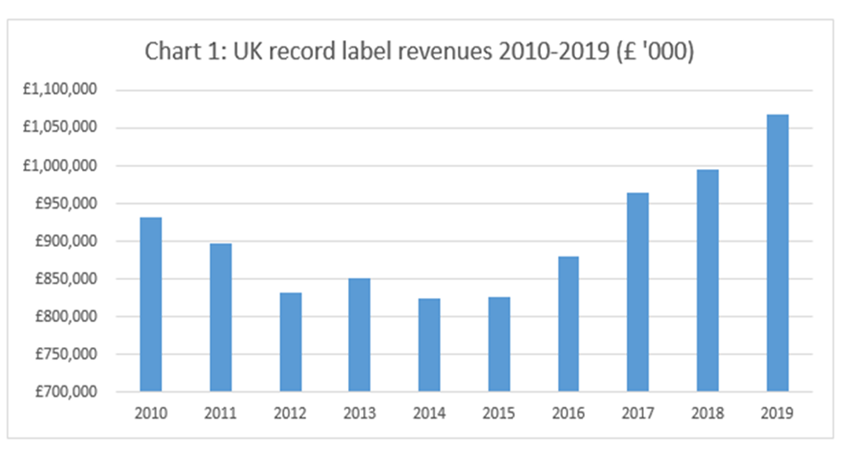

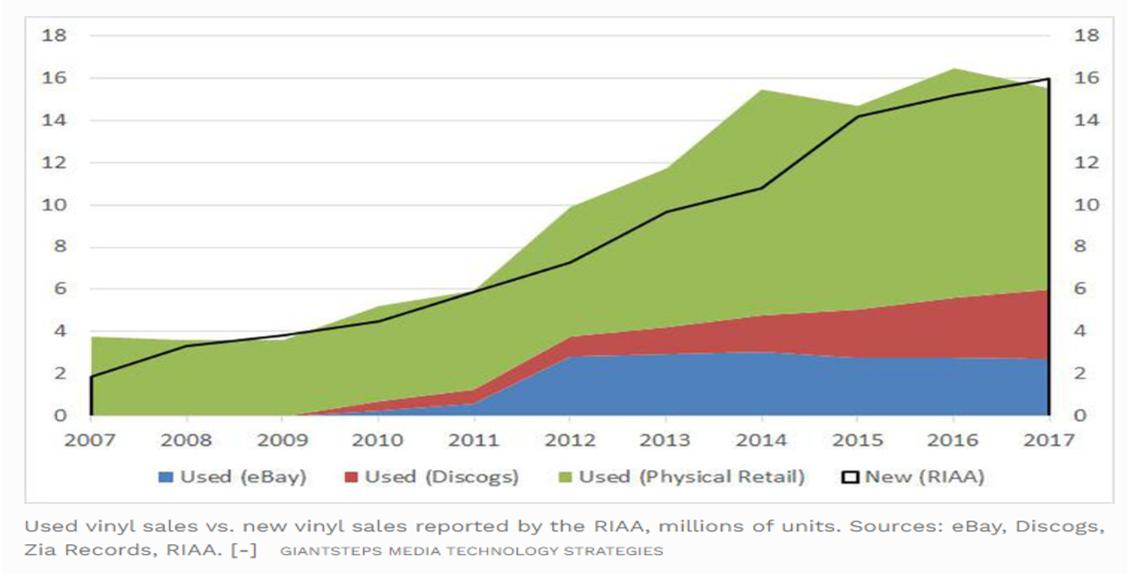

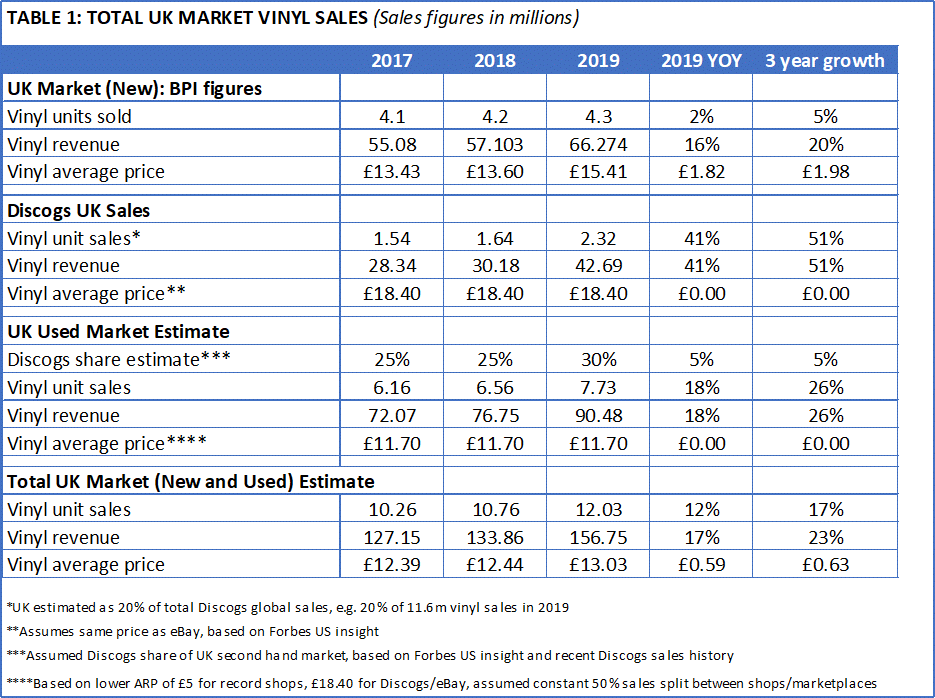

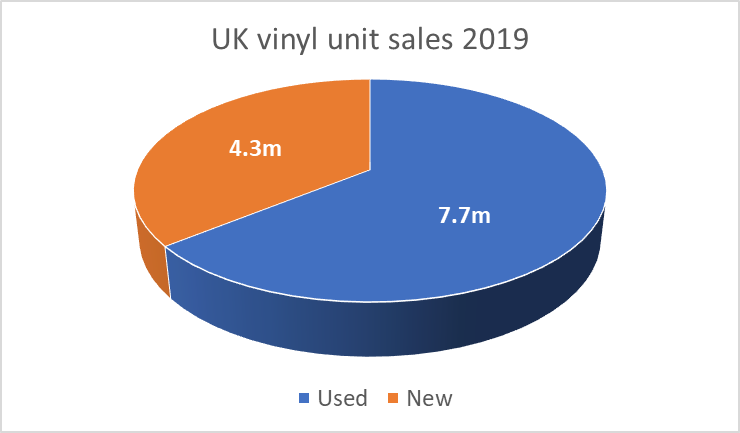

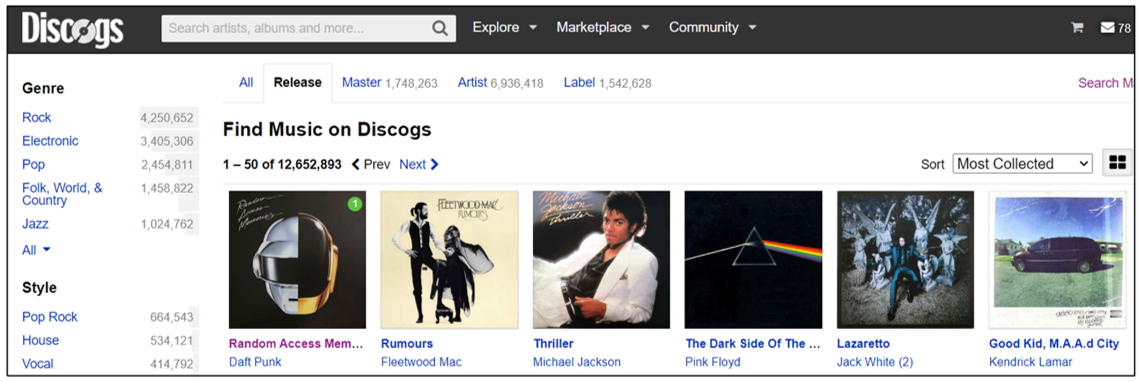

THE UK MUSIC MARKET When Clear Digital last reviewed the music market, we quoted BPI figures that vinyl sales were up 56% in the first half of 2015 and on track to hit 2m records sold for the year, which would be the highest figure since the early 1990s; although still a small fraction of the 80m routinely sold during the late 1970s. Vinyl sales did indeed exceed 2m in 2015, with sales of 2.1m and have continued to rise since then, more than doubling in the subsequent 5 years to reach 4.3m in 2019; albeit growth has slowed considerably during the last 3 years as the graph below demonstrates: The big news in the music industry over the last 5 years has of course been the rise of streaming services, spearheaded by Spotify with Apple Music, Amazon Music, Deezer et al. Streaming in the UK passed a significant milestone last year, with over 100bn tracks streamed for the first time, a total of 114bn, up 26% on 2018’s 91bn. The dominance of streaming this decade has seen the music industry create a new metric in order to compare distinct formats: the Album Equivalent Sale (AES). AES equates 100 streams as equivalent to purchasing one single “track” and 10 “tracks” as equivalent to an album, thus meaning that 1000 individual songs streamed is viewed as equivalent to one physical album purchased. As the graph above shows, 2019 was a strong year for music consumption, with 153.5m annual AES, +7.5% on the prior year and the highest of the decade. Streaming drove this increase, with 114.2m AES streams (+26% YOY), while 28m physical albums were sold (-23% YOY). These 28m include the 4.3m vinyl LPs (+4% YOY) mentioned earlier as well as 23.5m CDs, a format which continues to rapidly decline, with annual sales down 26.5% YOY. And having found a way to generate revenue from streaming services, record label revenues have also increased steeply in recent years, from a low of £825m in 2014 to £1.07bn in 2019, the highest such figure since £1.17bn was recorded in 2006. Streaming income of £629m accounted for 59% of total record label revenue in 2019 – with subscription revenue by far the most significant chunk generating £568m, with ad-supported streaming revenue contributing £25m and video streaming providing £35m. Physical sales of £216m made up just 20% of industry revenue, with CD sales of £142m down 20% YOY. However, vinyl revenue of £66m grew by 16% YOY, despite unit sales of 4.3m growing by just 4% YOY. CD revenue of £142m declined by 20%, meaning that while still the dominant traditional format, vinyl is taking an ever larger proportion of the amount spent on physical music. However, the total amount that consumers actually spend on physical records (and especially LPs) is grossly under-reported by industry bodies and most media as Bill Rosenblatt states in an excellent Forbes article: “Vinyl is bigger than we thought. Much bigger”. THE SECOND-HAND/USED VINYL MARKET Bill Rosenblatt mentions the vinyl revival of the last decade, but also highlights that “vinyl sales are actually much larger than what industry figures report, because they don't count used vinyl sales and they under-count new vinyl sales. Now, thanks to some new data, we know that the true size of the vinyl market is more than double those industry figures”. As revenue from second-hand records does not go to record labels or artists, the industry does not count them, prompting Ron Rich, SVP of Discogs Marketplace to say “Given the size of the overall market, I am always shocked that these numbers are ignored when reporting sales”. It is indeed challenging to obtain data on second-hand sales, but Forbes managed to secure sales figures from the two leading online players, namely eBay and Discogs, as well as work with a chain of independent record stores to calculate overall store sales. As the graph above demonstrates, second-hand unit sales in 2017 matched the 16m vinyl records reported by the RIAA, the US equivalent of the BPI. And this figure would increase further had Amazon (the third biggest player in online second-hand records) provided data for the used records comparison. Discogs’ recently published “State Of Discogs 2019” report states that Discogs sold 14.6m items globally in 2019, 34% on the prior year. Vinyl accounts for an ever growing lion’s share of Discogs’ sales, with vinyl sales of 11.6m units, +41% YOY. Breaking this down into the UK, we can estimate that Discogs sold 2.3m vinyl records in the UK last year, creating total sales revenue of £42.7m (with £3.4m commission for Discogs, at their 8% rate). In total, it is estimated that some 7.7m vinyl records were sold second-hand last year, 80% higher than the volume of new records quoted by BPI (4.3m). Further validation on volume is provided by eBay stating that they sold 4 vinyl records per minute in 2017, equating to 2.1m units in total and a 34% market share that year. These 7.7m records generated an estimated used revenue of £90.5m, well above the £66.3m spent on new vinyl. This leads to total vinyl sales revenue of £157m, of which only 42% is generated by the new music industry and directly reported on. This split reflects the US market as previously outlined by Bill Rosenblatt at Forbes: “thanks to some new data, we know that the true size of the vinyl market is more than double those industry figures”. Total physical new and used records (i.e. CDs plus vinyl) together generated sales of £302m in 2019, an extra £94m above the combined BPI reported figure of £208m, with £91m of this accounted for by second-hand vinyl. In 2019, 64% of vinyl records purchased were second-hand (7.7m, 58% of total spend) meaning that the widely reported figure of 4.3m vinyl LPs sold last year is severely under-stated; the true figure is more in the region of 12m. REVIEWING DISCOGS’ RECENT SUCCESS A potent mixture of Wikipedia, IMDB, eBay and Pokemon for music fans, Discogs was originally established in 2000 by Kevin Lewandoski purely to catalogue dance records but now describes itself as “the world's foremost Database, Marketplace, and Community for music”. From an initial 2200 users in its first year, Discogs now has over 7m active users and a database of over 12.6m releases listed. Originally focused purely on electronic records, Discogs gradually increased its remit, with rock releases becoming the dominant genre in 2016. Adding to the collection can be theurapetic and also addictive, but it was the launch of the Discogs marketplace in late 2005 that really planted the seed for Discogs’ future success. The cornerstone of Discogs is its Collection feature that allows users to easily create their own online record collection, from the 12.6m existing releases in the Discogs database. Users can opt to search via the Discogs website or app, which has a built-in barcode scanner, making this a much simpler process to locate your particular record (for those that have barcordes anyway!). Similar to Wikipedia, Discogs is reliant on its users to add new releases, as well as providing further information (e.g. extra pictures, song videos etc). 11.6M records were added to their collection in April 2020 by 306K users, well up on the more recent annual average of 7M per month due to lockdown. By way of comparison, the average submission in 2014 was just 2M per month. This collection spurt is also helped by the addictive/gamified nature of adding records, as you are able to get an updated total of how much your collection is worth based on recent sales in the Discogs Marketplace. Discogs will look at the most recent 10 sales of the relevant release and show its lowest, median and highest selling price. This then feeds up to your personal collection homepage with a min/med/max estimated value, thus encouraging the user to add as many records as possible to see this figure increase and increase… The Discogs Marketplace was launched in late 2005, due to user demand – as CEO Kevin Lewandoski has stated: “The users asked for it. There was already a "collection" and "want list" feature, and a lot of people asked for a "sell" list, just to have a list of things that they were selling…Amazon and eBay were around, but they weren't really what they are today.” There are over 50M records available globally on the Marketplace, with 9M from sellers in the UK. Sellers vary from individuals selling off unwanted/spare items from their collection to sole traders to established second-hand record shops. As outlined in the music industry section, the Discogs Marketplace has become an increasingly prominent player in the second-hand market, selling 14.5m records in 2019. Of these, 11.6m were vinyl, which increased sales by 41% on 2018. DISCOGS – CLOSING THOUGHTS Discogs has recently experienced strong growth, both commercially (with Marketplace sales +34% in 2019) and general usage, with 11.6m records added to users’ collections in the first month of lockdown, 65% above the usual monthly average of 7m. And despite the marketplace sector being dominated by Amazon and eBay, with 90% share between them (as the complementary “The UK Marketplace Sector – And The Role Of Community” Clear Digital research explores), Discogs managed to grow sales faster than either in 2019. 3 key dynamics helping to drive Discogs’ success are:

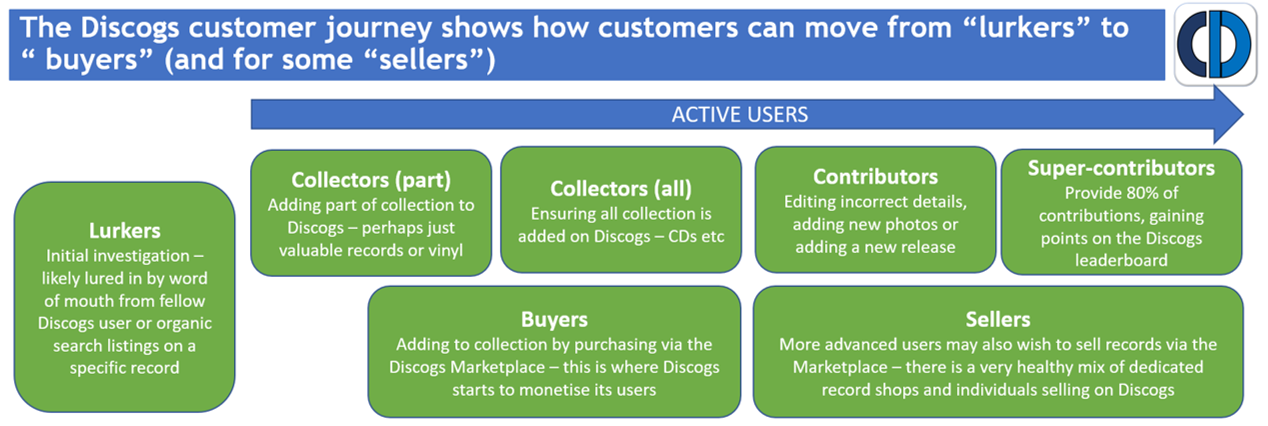

Breaking down the Discogs customer journey as shown below, we can see how customers move from “lurkers” to the more profitable “buyers”, and in some cases “sellers”, all underpinned by the strong Discogs community of half a million contributors, essential to the richness of its experience… Please note that this blog is a summary of the accompanying deeper dive on “Discogs: the digital success story of the vinyl revival” which is available to download here

0 Comments

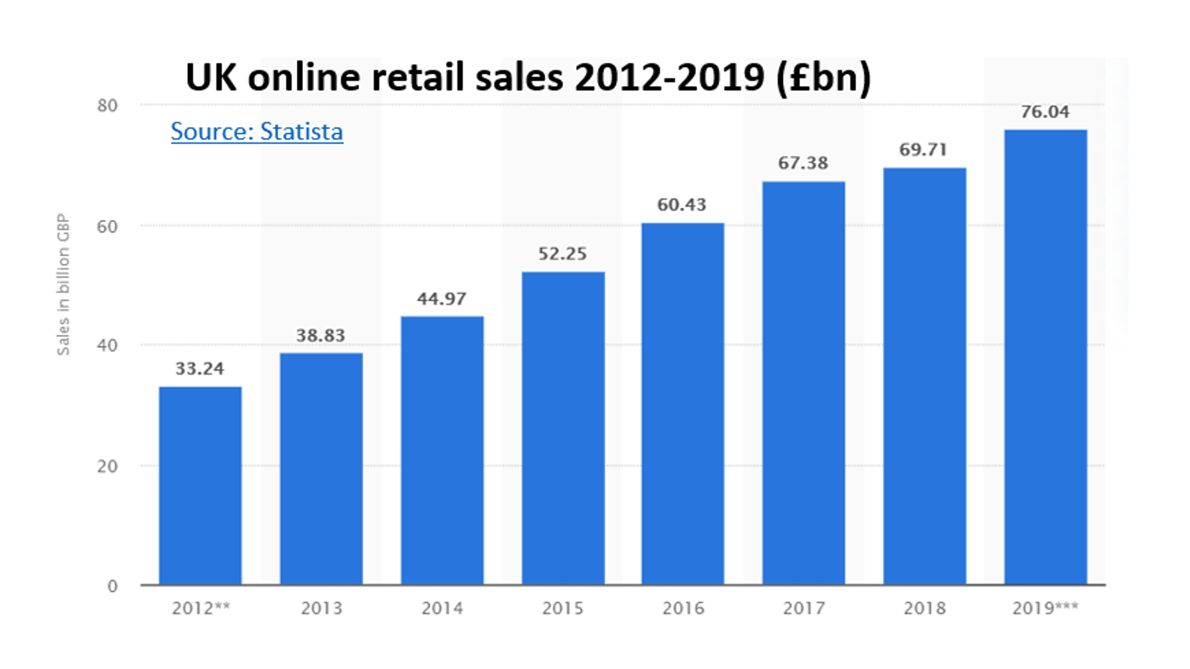

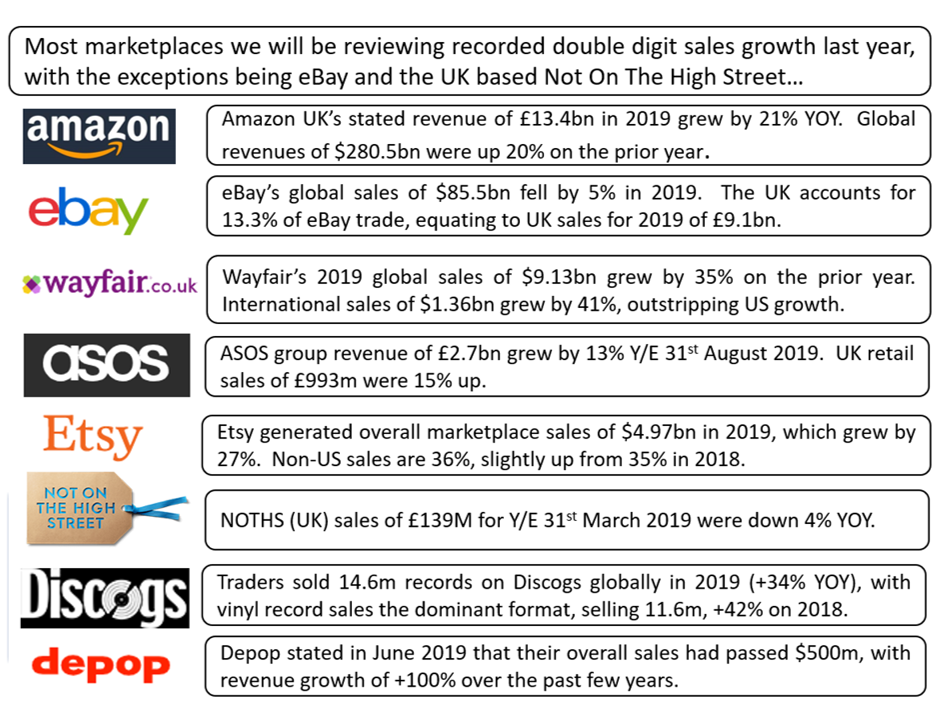

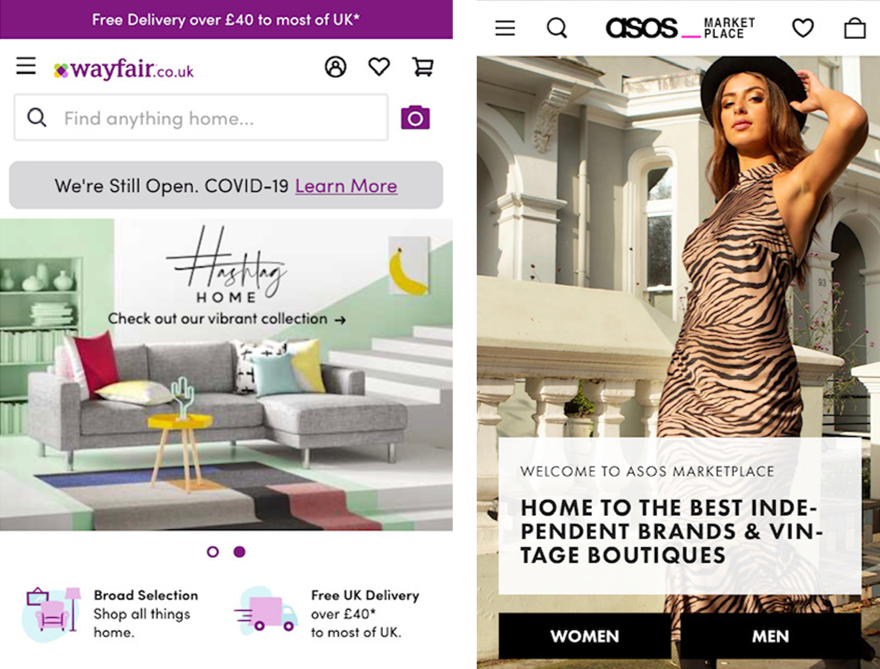

The UK marketplace sector is responsible for a significant slice of the UK ecommerce sector, with sales of £26.2bn in 2019 accounting for just over a third of the £76bn ecommerce market in 2019. And marketplace sales are forecast to grow by 50% over the next 5 years to reach £39.3bn by 2024*. 2020’s unfortunate events have seen marketplace sales on the rise – for both the giants Amazon and eBay as well as more niche players – as online shopping for home delivery has understandably rocketed in popularity. The enforced shutdown has seen many traders expanding online out of necessity and marketplaces offer a fast and practical route to market; for example ASOS Marketplace introduced twice as many independent boutiques in April as usual. Community-driven marketplaces as varied as Etsy, Depop and Discogs had already been experiencing substantial recent growth driven by an increasing appetite for unique and sustainable purchasing, and a desire to shop directly from independent traders and artists. This blog explores further the size and dynamics of the UK marketplace sector, delving beyond just Amazon and eBay (who do account for a huge 90% of sales), with a particular focus on community-driven marketplaces to examine the winners and what we can learn from them.

THE UK MARKETPLACE SECTOR Amazon and eBay dominate the UK marketplace sector of £26.2bn, with 90% of sales but the rest of the UK marketplace sector is worth a still significant £2.6bn. With total UK online retail sales for 2019 standing at £76bn, £1 in every £3 spent online is via a marketplace. The table below shows the top 15 marketplaces in the UK, ranked by monthly visits. This is a useful starting point to assess the UK marketplace, albeit it may under-represent the reach of m-commerce first platforms such as Depop, as app traffic is not recorded. The top 15 UK marketplaces can be split into 3 distinct sectors:

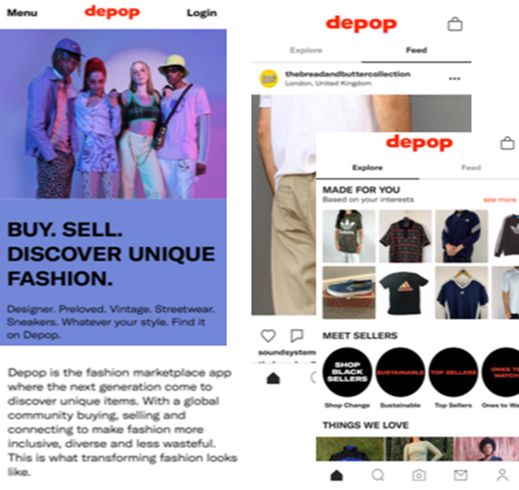

UK MARKETPLACE SIZE AND SHARE: DOMINATED BY AMAZON AND EBAY The research in the table below looks at the top 6 marketplaces by UK visits (plus Discogs, Bandcamp and Depop) and calculates the UK sales made through each marketplace, as well as the “take” or commission generated by each marketplace. As outlined earlier, Amazon and eBay dominate sales, with 90% of the £26.2bn UK marketplace sector. Established global players in Etsy and Wayfair are next in sales generated, with in excess of £250m each in 2019. The % of commission taken ranges from 8% for Discogs to 25% for Not On The High Street, with a median average of 12%. Wayfair does not disclose a take or commission rate in its annual reporting and will vary greatly based on merchant and product category. Please note that the table below is also featured on page 7 of the full "The UK marketplace sector - and the role of community" article, downloadable here. AMAZON AND EBAY Amazon’s UK revenue of £13.4bn soared by 23.2% in 2019. This figure includes all directly Amazon sold products (approx. 50% of its revenue) and commission paid by its third-party marketplace sellers but not the overall customer spend on these products, which is estimated at £14.5bn. See page 8 of the detailed article for more information on Amazon’s revenue breakdown. 7% of Amazon’s total revenue comes from Amazon Prime and it has now has 150m members worldwide, 15m in the UK. With Amazon’s convenience becoming ever more impressive – and many marketplace sellers piggybacking on the Fulfilled By Amazon (FBA) service to take advantage of this – Amazon is widening the gap in marketplace sales from the other giant of the sector, eBay. eBay’s growth has slowed in recent years, with global sales of $85.5bn actually declining by 5% YOY in 2019. The UK accounts for 13.3% of eBay’s global commission*, so this equates to $11.38bn or £9.1bn in sales. eBay’s sales do remain significant of course – 35% of all marketplace sales and 12% of all UK ecommerce sales. CATEGORY SPECIALISTS: WAYFAIR AND ASOS Wayfair and ASOS Marketplace’s category specialisms have led to recent continued growth; Wayfair’s 2019 global sales of $9.1bn grew by 35% year on year, while ASOS doubled its usual number of new sellers in April due to the Covid19 lockdown. Wayfair also offers logistics services to its retailers, helping smaller players with bulky furniture items in particular. It is this service specialism – and focus on “drop ship” items - that helps to differentiate Wayfair in the market and makes them a preferred partner for furniture/home product traders. The curated nature of ASOS’ marketplace, piggybacking off its huge ecommerce specialist fashion site and brand has helped it establish its own niche. However, the fashion sector moves notoriously quickly as can be seen by the emergence and continuing growth of new concepts such as Depop. COMMUNITY-DRIVEN MARKETPLACES Depop is a buzzy example of a new community-driven marketplace, with its social mobile app first approach very different to a traditional retail website. London based but with global reach, Depop has over 15m users, most under 26 and has sold over $500m of clothing on its platform since its launch. Depop is an example of a true “m-commerce first” brand – you are strongly advised to download the app to encounter the full experience, which is very reminiscent of Instagram. You are then encouraged to follow other users and see what they’re posting via your feed; a “new” way to shop online but using very familiar methods for Gen Z digital natives. And it is Gen Z sensibilities that are increasingly interested in the more sustainable options that Depop’s “pre-loved” marketplace offers – as Depop CEO Maria Raga states: “There are reports that show that in five years resale will be as big as fast fashion…We’re extending the life of the garment, which resonates.” Etsy and Not On The High Street (NOTHS) are both arts/gifts focused community marketplaces, but Etsy’s recent sales growth has been much more impressive, with $5bn global sales in 2019 growing by 27%. Etsy’s non-US sales are 36%, of which UK is estimated at 7.3% (based on website visits share), which would equate to $348m/£290m UK sales. When reporting first quarter results in early May, Etsy also stated that sales through its marketplace globally had grown by over 100% in April, with cloth face masks an understandably large seller, but all categories seeing significant uplifts. NOTHS’s sales transacted of £139M for Y/E 31st March 2019 were down 4% YOY, but NOTHS’s active customer base did increase, with 2.57m making at least one purchase, +3% YOY. Although previously seen by some as “the British Etsy”, NOTHS has not kept pace with recent Etsy sales and has looked to concentrate more heavily on its gifting credentials recently, with new tagline “the home of thoughtful gifts”. NOTHS’s recent lack of growth will likely not have been helped by its curated approach to introducing new sellers plus significantly higher commission compared to Etsy’s simpler on-boarding process and more advantageous rates. NOTHS will be hoping their new focus on gifts will arrest this decline. A potent mixture of Wikipedia, IMDB, eBay and Pokemon for music fans, Discogs was originally established in 2000 by Kevin Lewandoski purely to catalogue dance records but now describes itself as “the world's foremost Database, Marketplace, and Community for music”. Discogs Marketplace was launched in late 2005 after customer demand and has expanded since to become a key player in the used records market, selling 14.6m records in 2019, up 34% year on year. The complementary Clear Digital research “Discogs: The Digital Success Story Of The Vinyl Revival” explores Discogs and the wider music market in much more detail – click here to find out more. CLOSING THOUGHTS Convenience is always a key factor in any shopping decisions; “location, location, location” as the old retail adage explains. Competing with Amazon’s Prime shipping options is impractical for most, so generalist marketplace traders have used this to their advantage, which has been to eBay’s detriment with their recent declining sales. However, convenience is not purely related to fast, flexible delivery; as we have seen, other marketplaces’ success has included convenient browsing and purchasing options… Instead, marketplaces as diverse as Etsy, Wayfair, Depop and Discogs have harnessed a sense of community and different online shopping experiences to build successful niche experiences serving a variety of dedicated, engaged customers with quirky/unique product selections, a strong sense of usefulness and fun, all underpinned by strong trust and ethical credentials, increasingly important for younger consumers in particular... Product Selection: Specialising in product sectors that are not as suited to Amazon’s model, for example vintage merchandise (Depop, Discogs), bulky items (Wayfair) or artisan hand-crafted products (Etsy), has seen these niche marketplaces thrive in recent times – and with the warm feeling engendered by supporting smaller/local businesses. Usefulness/Fun: Creating a sense of usefulness or fun in the online shopping experience, especially when looking to non-retail digital presences, is also proving successful – whether that’s using Discogs’ IMDB/Wikipedia type music resources, or gaining inspiration from Depop’s Instagram style User Experience and community. Trust: When purchasing from any marketplace, the slightly faceless aspect of the ultimate seller can be disconcerting, which is again why reliability factors such as user reviews and strong trust in both the marketplace brand and overall community are highly important for both initial and repeat purchases. Ethics/Sustainability: The trend for ethical trading and purchasing sustainable products continues to be a growing concern, especially for younger consumers – Depop have stated that “there are reports that show that in 5 years resale will be as big as fast fashion”, while the built to last wares of Etsy products and second hand records from Discogs also fit comfortably into being ethical, sustainable purchases from like-minded traders. This blog is a summary of the accompanying deeper dive on “The UK marketplace sector – and the role of community” which is available to download here

|

Jim ClearLead blogger and founder of Clear Digital: talking about ecommerce, digital, marketing and media. Categories

All

Archives

December 2020

|

||||||||||||||||||||||||