Clear Digital Digest: subscription coffee, Amazon ads, retail sales update and cricket data18/9/2020 Today’s Clear Digital Digest looks at some recent stories regarding Pret A Manger and Amazon, reviews today’s new ONS retail data and learns how the data revolution is transforming the world of cricket.

PRET A MANGER: ALL YOU CAN DRINK

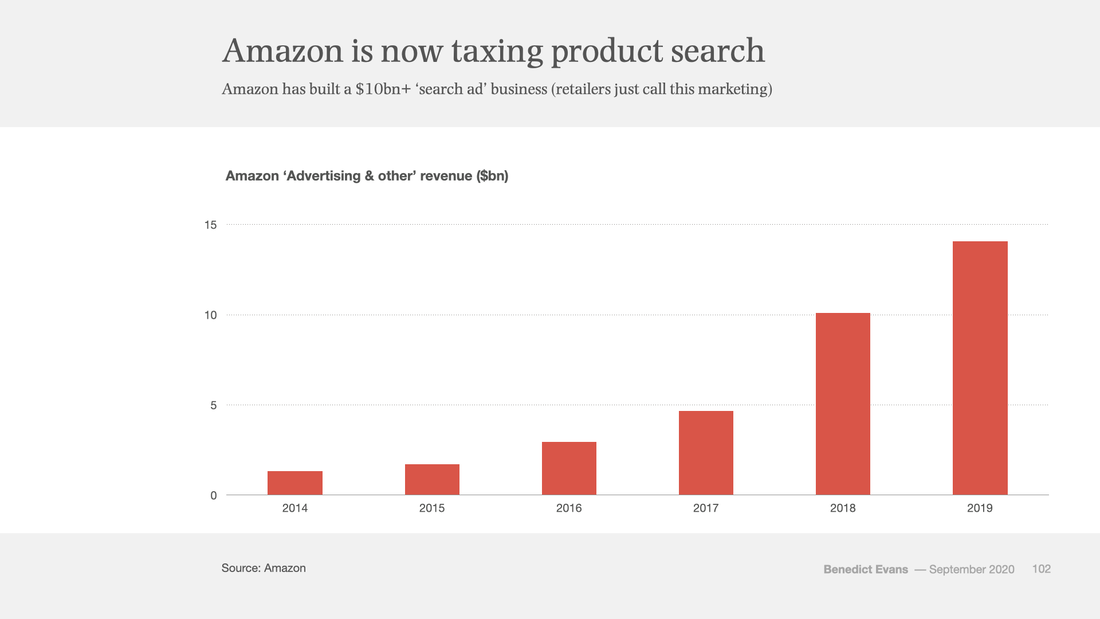

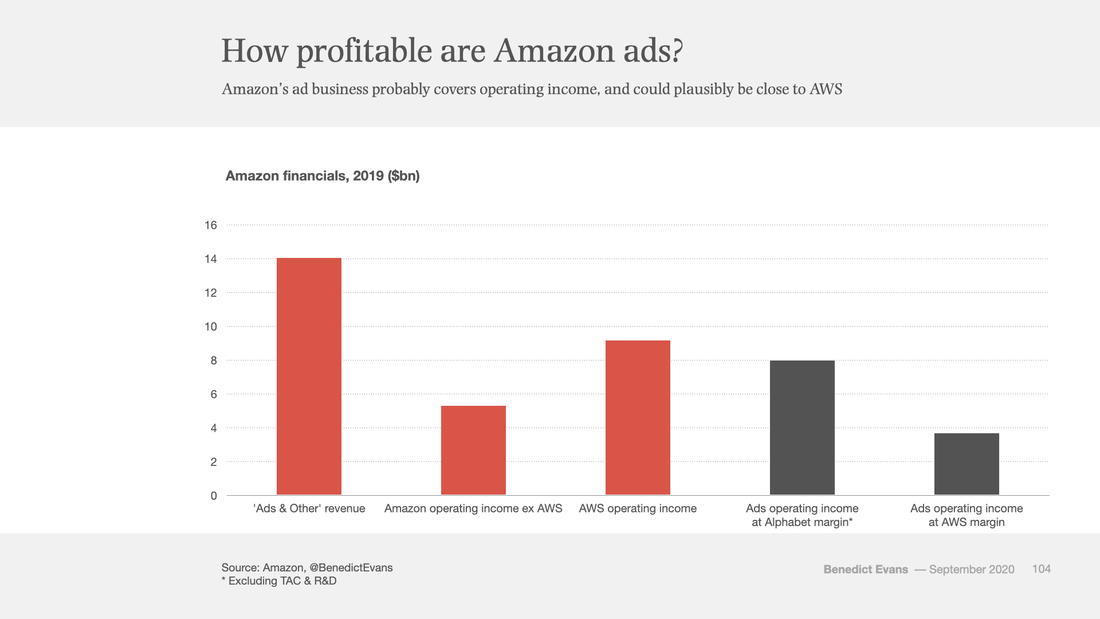

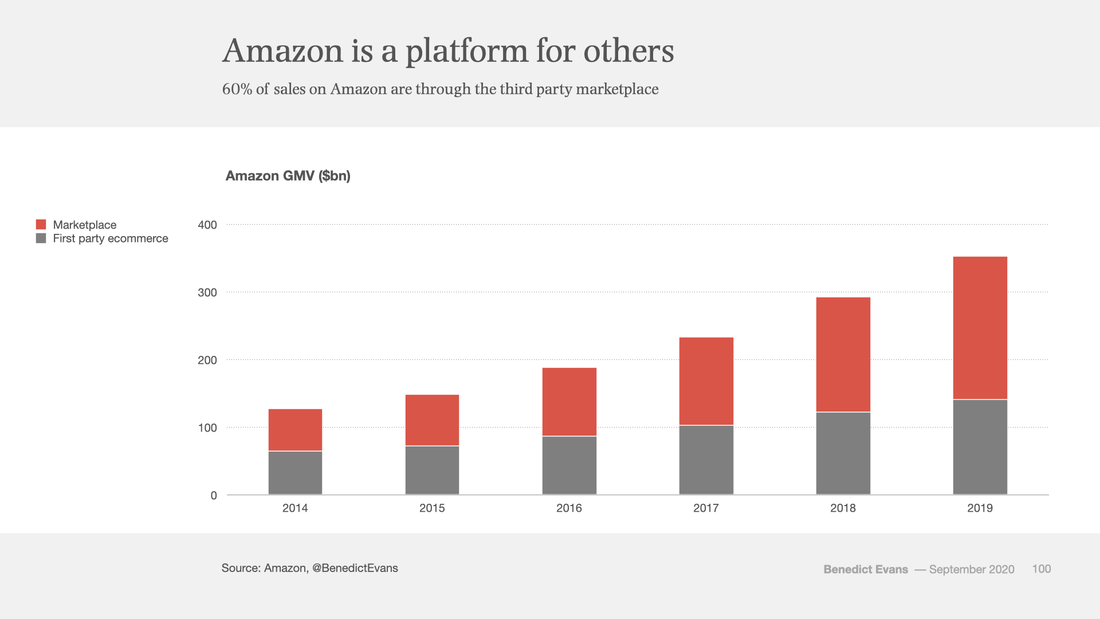

AMAZON’S PROFITABILITY: INCREASINGLY DRIVEN BY ITS ADVERTISING Well worth a read is this fascinating article about Amazon and its profitability, courtesy of Ben Evans.

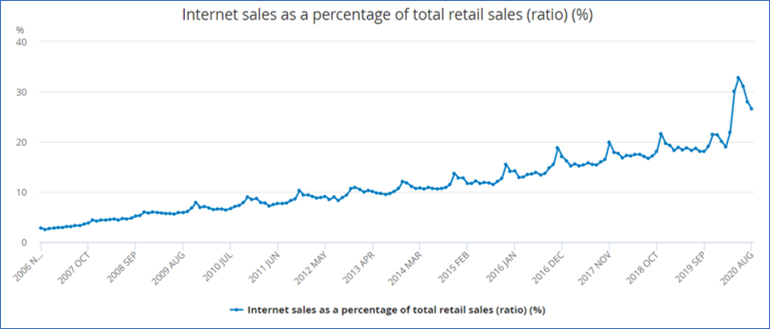

RELEASED TODAY: ONS RETAIL SALES UPDATE FOR AUGUST The Office for National Statistics (ONS) have today released their latest retail sales figures for August. We reviewed July’s data in a Digital Digest last month, so here’s a quick update, one month on…

AND FINALLY... When my subscription copy dropped through my letterbox this week, I was surprised to see The Cricketer magazine (now in its centenary year) highlighting “The Data Decade” on its front page. With the relevant articles exploring how increasing use of digitised data has fundamentally changed recent cricket coverage and some future predictions on how this may evolve, it’s a timely reminder than even such a traditional pastime as cricket is experiencing unprecedented change with its own digital/data revolution.

But this also demonstrates that there is still a place for more traditional media…yes I do still read some print magazines as well…

0 Comments

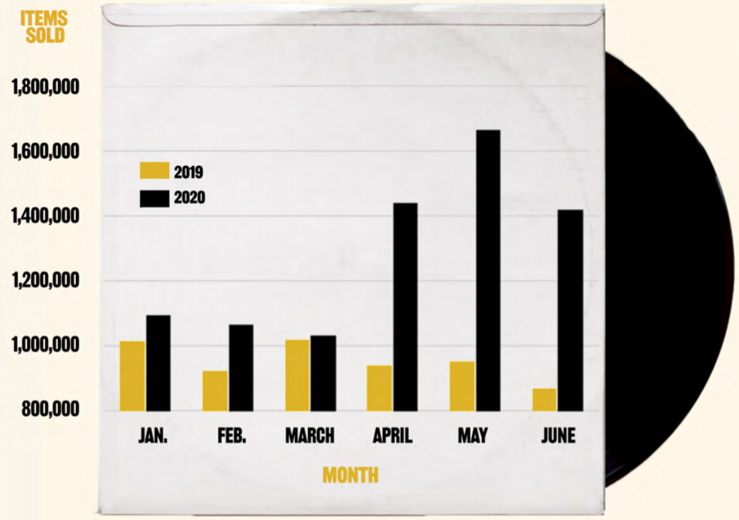

Today’s Clear Digital Digest round-up looks at:

OCADO LAUNCHES WITH MARKS & SPENCER: PERCY PIGS FOR ALL (WELL, SOME…) Ocado launched their much publicised partnership with Marks & Spencer on Tuesday (Percy Pig branded vans et al) and with such a highly anticipated launch, perhaps unsurprisingly there were teething troubles as some disgruntled customers were not happy that their day one orders were cancelled. Those of us who have been around the block won’t be surprised that there were one or two problems with a new service launch, and time will tell how short-term or significant these issues were. However, Ocado chief executive Tim Steiner was perhaps bullishly tempting fate the weekend before when he told the Sunday Times: “They [Waitrose] have done an advert saying ‘we’ll take it from here’ or something. Well, they can’t take it from here because they don’t have the technology, the infrastructure or the systems.” “Taking it from here” referred to the fact that previous Ocado partners Waitrose were already running their own parallel Waitrose.com delivery service, generally despatched from local Waitrose stores rather than Ocado’s regional distribution hubs. Waitrose also recently announced plans for a 12 week trial with Deliveroo, joining brands such as Morrisons and the Co-Op already on the platform in selected locations. Sainsburys also continue to expand and promote their similar new ChopChop service, as the choice and variety of grocery home delivery options expands to keep up with this year’s step change in customer demand. VINTAGE/USED ITEMS CONTINUE TO DRIVE SALES ON EBAY AND DISCOGS There were two updates from key marketplaces this week, both showing the increasing appetite for vintage/second hand items, a trend we explored in much more depth in our recent deep dive on “The UK Marketplace Sector – And The Role Of Community”. eBay UK have stated that sales of used goods jumped 30% between March and June this year leading to an overall 10% rise in the first half of 2020 compared with last year. Secondhand and vintage fashion is by far their biggest category, but sales of secondhand chairs, sofas and TVs also shot up by 41%, 30% and 17% respectively during June and July compared with February and March. Music community Discogs (the 10th most visited marketplace in the UK) have also released their mid-year report this week. In the first six months of 2020, 4.3m orders were placed globally through the Discogs marketplace (+30% year on year) for a total of 7.7m items (+34% YOY). Vinyl records remain by far the largest sellers for Discogs, with 5.8m sold (+34% YOY) although CD sales also grew by a similar amount, with 31% YOY growth for the 1.7m sold. As the chart above shows, Discogs sales growth really accelerated as lockdown fully kicked in around the world, although January and February were already showing healthy sales growth. This is in line with more recent trends for Discogs, who sold a total of 14.6m records in 2019, growing by 34% on 2018. We explored the Discogs marketplace – and the community that underpins it – in more detail in our recent deep dive “Discogs: The Digital Success Story Of The Vinyl Revival”. NETFLIX TRIALS FREEMIUM Netflix this week revealed plans to offer some of its original movies and shows to non-subscribers. Free films available include Bird Box and The Two Popes, while original series include Stranger Things and Our Planet. The real hook to this new initiative is the fact that it’s only the first episode of each show that is available, although Netflix newbies can still get a month’s free trial to then continue watching. This type of freemium model seems to make perfect sense for a lower risk trial for anyone that hasn’t yet succumbed to Netflix’s charms; as we reported last month, 43% of UK households currently subscribe to Netflix, ahead of Amazon Prime Video’s 35%. A full list of “free” Netflix shows and movies is available here. AND FINALLY...

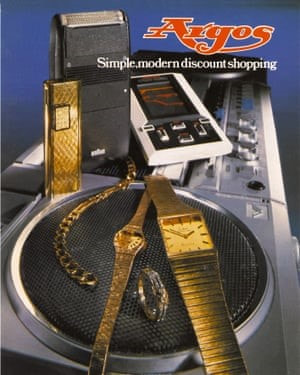

In a week when the future of another certain Argentinian footballing genius remains up in the air, this tweet raised a chuckle (and makes perfect sense with the final touch)… Clear Digital Digest: Argos catalogue RIP, retail tie-ups, Q2 updates and soccer supervillains3/8/2020 Today’s Clear Digital Digest starts with a look back at the beloved Argos catalogue before looking forward to the growing impact of another Argos innovation in Click & Collect, as well as other retail partnerships. Then we turn our attentions Stateside to review Q2 updates from Amazon, Facebook and Google plus the latest digital innovation in sports watching… END OF AN ERA – GOODBYE ARGOS CATALOGUE So RIP the Argos catalogue – as one wag noted, much easier to say than to actually do. As was widely reported on Thursday, Argos have stopped producing their twice yearly catalogue, meaning that January’s Spring/Summer 2020 edition will be its final print version. Argos now say that online shopping offers “greater convenience” than flicking through a catalogue, part of the continuing wider shift to ecommerce sales. Having previously spent 8 years in various roles within Argos’ ecommerce operation, during which time the catalogue’s ubiquity (estimated to have been in approx. 75% of British homes at one time) certainly helped to mutually drive web sales, there’s definitely a sense of nostalgic regret to see the “laminated book of dreams” bid farewell. However, it appears that less and less were being printed, with 3.9m of the last edition down from a peak of over 10m a decade ago. And with each catalogue costing roughly £3 to produce back when I was working there, changing shopping habits will have made ceasing production an increasingly attractive option for the huge potential cost savings; something that has been frequently reviewed over the years. Nostalgia for kids being able to choose their favoured Christmas presents will be partly assuaged by the news that Argos plans to continue to print its Christmas Gift Guide, still generally a sturdy 300 pages or so, albeit well down on the 1800 page behemoth that was the main catalogue. Before then, for anyone after a quick nostalgic fix, the Guardian pulled together a selection of vintage covers and catalogue pages, count me in for 1976’s Home Stereo Disco Unit (item 7 below…) CLICK AND COLLECT/RETAIL PARTNERSHIPS Of course, there are other retail channels that Argos pioneered which remain highly relevant and continue to grow in popularity, none more so than Click & Collect. In line with all ecommerce sales, Click & Collect orders have been growing rapidly since the start of lockdown, with more and more brands partnering together for mutual benefit. Argos have offered a collection service for selected eBay customers since 2014, while the introduction of Argos collection points into many Sainsburys stores since being bought by the grocer in 2016 meant that Argos was able to continue offering C&C services throughout lockdown. Amazon entered into a similar partnership with Next last year with their Amazon Counter initiative, while John Lewis have recently announced plans to extend their C&C tie-up with the Co-op to over 500 stores. John Lewis have also just stated that they expect 60% of their sales to be online, up from 40% pre-Covid. In an update to all John Lewis partners, chair Sharon White said “We have two of the best loved and trusted brands in the UK, rated highly for our personal service and expert, impartial advice. Customers are, however, shopping in very different ways – younger people especially – with the pandemic accelerating the importance of digital. We expect John Lewis to be a 60% online retailer, from 40% pre-Covid-19, and Waitrose to rise above 20%, from 5%.” Such uncertain times do certainly seem to be leading to a much wider array of complementary brands working together, with another recent example seeing Sainsburys starting to provide a range of 3000 products to the garden centre retailer Dobbies. Q2 UPDATES: AMAZON, FACEBOOK, GOOGLE Three of the tech giants have provided their latest global Q2 updates in the last few days, with varying results. Of course, Q2 2020 is the first quarter since the world has been in lockdown, so one would certainly not expect standard trends from these updates.

AND FINALLY…

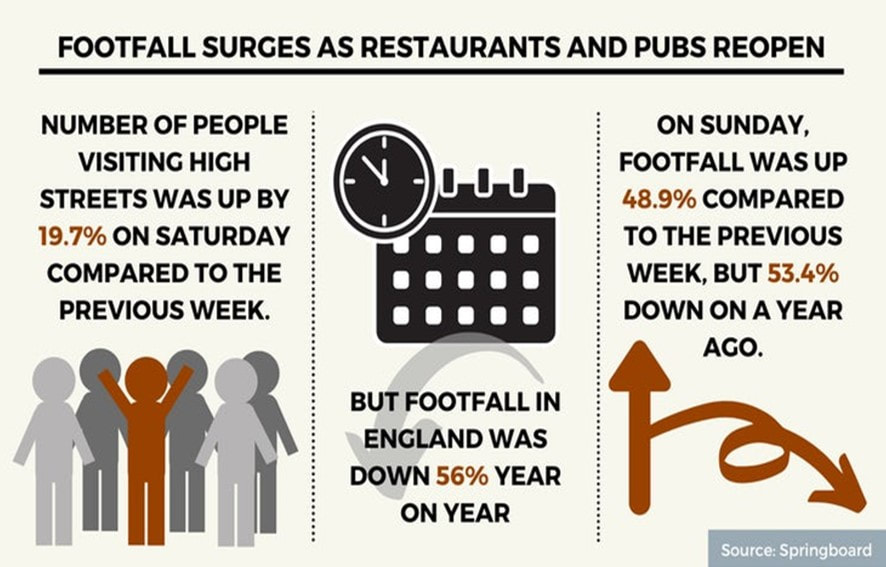

In a week when it was announced at the last minute that planned pilot sporting events were not allowed to admit limited spectators as originally planned, technology continues to serve up increasingly sinister options instead. After previously highlighting Japanese robotic baseball fans last month, MLS in the US have now seemingly opened applications for the world’s next supervillain… Today’s Clear Digital Digest looks at the early impact of the lockdown slightly easing last week, some updated ecommerce sales trends, Ofcom’s research regarding online usage habits and perceptions plus perhaps the scariest sports supporters seen for many a year. HAIRCUTS BEFORE HEINEKEN One of the biggest changes in the UK in the last week has obviously been the lockdown easing last Saturday (4th July) for both pubs and restaurants as well as for some other service retailers, most notably hairdressers.

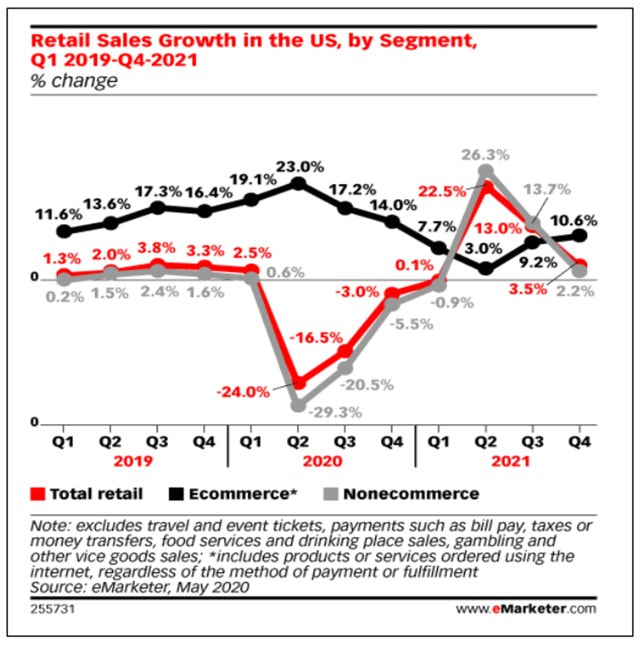

ECOMMERCE SALES UPDATES

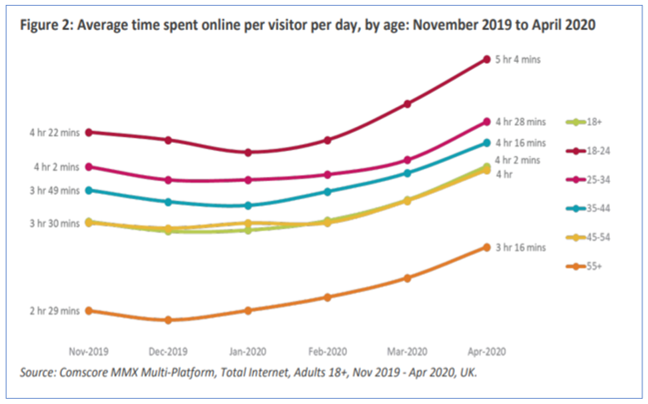

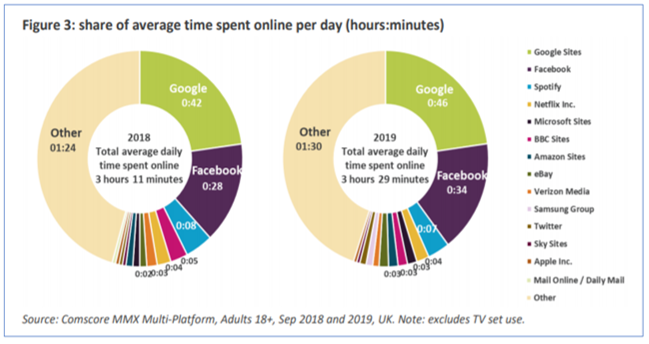

ONLINE NATION Ofcom last week released their latest report “Online Nation” that looks at what people are doing online as well as their attitudes to and experiences of using the internet.

AND FINALLY… In the week that cricket was the latest sport to return behind closed doors, its sporting cousin baseball showed off an imaginative replacement for supporters in the stadium. Japanese baseball team Fukuoka SoftBank Hawks unleashed 2 different types of robotic fans for their match against Rakuten Eagles on Tuesday, who arguably look scarier than Millwall fans from the 1980s… It’s now just 3 weeks to go till Euro 2016 kicks off in France on Friday 10th June, and while the tournament itself will have some way to go in order to match the still incredible story of Leicester City’s domestic Premier League triumph, the extra home nation interest this year will undoubtedly see passion levels run high once Euro 2016 actually starts. Summer football events such as the Euros are now also an established part of the marketing and promotion calendar for many brands – for both official sponsors and other companies – so I’ve taken a look at how some of them have so far embraced this opportunity. It was estimated that the 2014 World Cup contributed £2.5bn to UK consumer spending and it is believed that Euro 2016 will generate a similar amount, with food, drink, retail and betting sectors seeing the greatest benefits. Over 60% of pubs are predicting like for like sales increases of more than 10% through June, with the England v Wales group match on Thursday 16th June unsurprisingly highlighted as a particularly large opportunity. The nature of big sporting tournaments like Euro 2016 lends itself to a variety of different objectives for brands, in particular:

OFFICIAL SPONSORS: CARLSBERG EARLY PACE-SETTERS UEFA have 10 official sponsors for Euro 2016; ranging from the usual suspects such as Adidas, Coca-Cola and McDonalds to emerging brands which won’t be as familiar to European consumers. These include the Chinese consumer electronics company Hisense and the seemingly aptly named Socar. Socar is actually the State Oil Company of the Azerbaijan Republic, so in reality this organisation is perhaps not such a natural fit for football tie-ins as Carlsberg for example. Amongst official sponsors, Carlsberg have certainly been to the fore with their activation plans, with a range of initiatives all following the “if Carlsberg did…” strapline, seemingly both in domestic markets and pan European too. This week, Carlsberg have been trailing online a new ad campaign starring Marcel Desailly, one of France’s World Cup 98 and Euro 2000 winning heroes. “If Carlsberg Did La Revolution” will undoubtedly feature heavily in June during TV coverage, with many hidden references in there for football geeks as well. Amongst the standard ticket giveaway competitions, Carlsberg have also been using more creative methods ahead of the tournament in the UK, including Chris Kamara looking at what would happen “if Carlsberg did substitutions” and rewarding generous Tube travellers with tickets to the Euros. Other UK focused campaigns include experiential activity, with Carlsberg rebranding 19 English pubs as the patriotic “The Three Lions”. Some other selected highlights from official sponsors include:

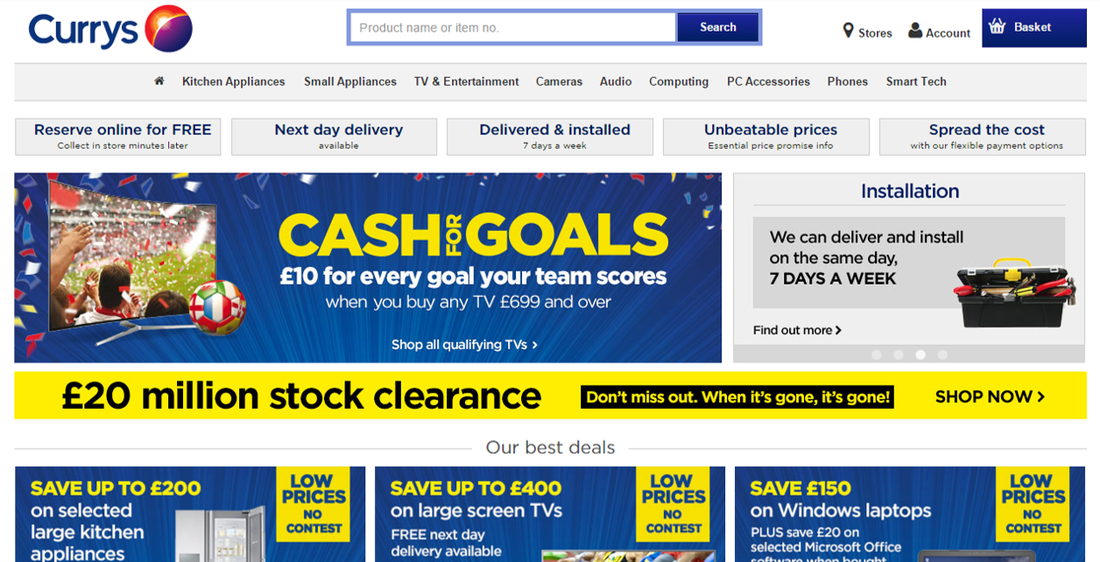

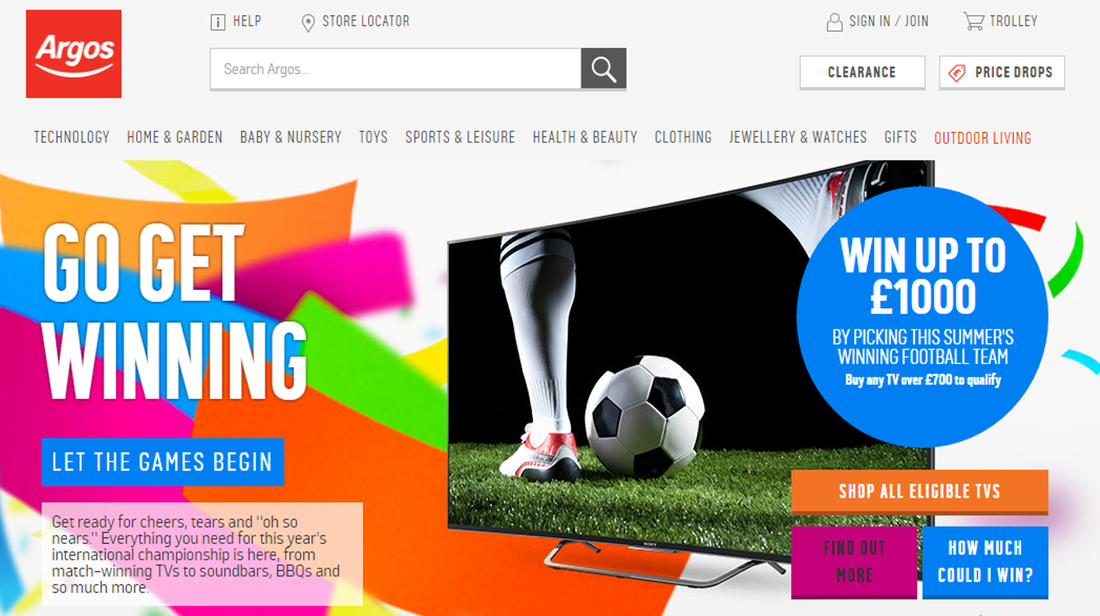

“UNOFFICIAL” CAMPAIGNS: PREDICT THE WINNER 3 weeks out and it may be a bit early to stock up on essentials like food and drink if planning a barbecue party, but it is the perfect time for more considered purchases to enhance your Euro 2016 viewing pleasure, such as a shiny new TV. And full disclosure here: I did once buy a new TV in time for Euro 2004, so this does actually happen! However, with governing bodies such as UEFA monitoring and protecting their trademark rights to enhance the aforementioned sponsorship deals, this tends to result in some creative descriptions by the vast majority of brands that are not filling UEFA’s coffers; leading to the use of many generic campaign titles such as the “summer of sport" rather than the trademarked "Euro 2016" or similar. A couple of good examples here are provided by Currys and Argos, both of whom are offering TV promotions with a prediction element based around "this summer’s big football tournament" (aka Euro 2016). To the fore on Currys’ homepage is their “Cash for Goals” promotion, backed up by a range of accompanying media both online and offline. This is a deal that Currys have run in similar form during previous summer football tournaments, and means that should you spend over £699 on a TV, Currys are offering £10 cashback for each goal that either England, Wales, Northern Ireland or Republic of Ireland score during the tournament. Customers can pick their team and with more choice amongst British Isles teams than usual, it will certainly be interesting to see if customers patriotically pick their own home nation, or go for another team based on their perceived chances. Argos are also focusing on upper end TVs by offering customers a chance to win up to £1000 by “picking this summer’s winning football team” when you buy a TV over £700 in their “Go Get Winning” promotion. Further investigation shows that for those heartened by the Leicester fairytale, you can win £1000 back if you plump for an outsider like Albania or Slovakia (or Northern Ireland/Wales), down to £100 for France, Germany or Spain. An England win, unlikely as it may seem, would net you £250 cashback. AND FINALLY… As well as official Euro 2016 sponsors maximising their activity with glossy campaigns and giveaways, plus retailers looking to sell appropriate seasonal products, multi-national sporting events generally also see a few more esoteric tie-ins as well. Expect to see some of these to the fore as the tournament approaches, but as a tasty example, the Amazon listing below provides some food for thought… |

Jim ClearLead blogger and founder of Clear Digital: talking about ecommerce, digital, marketing and media. Categories

All

Archives

December 2020

|