|

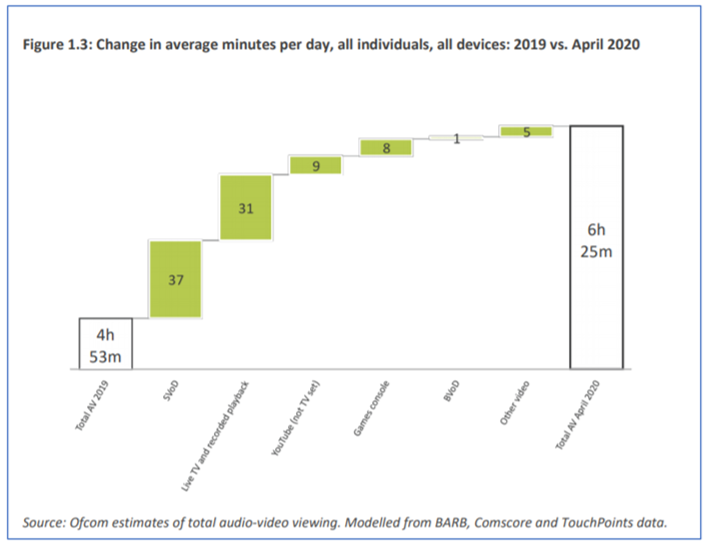

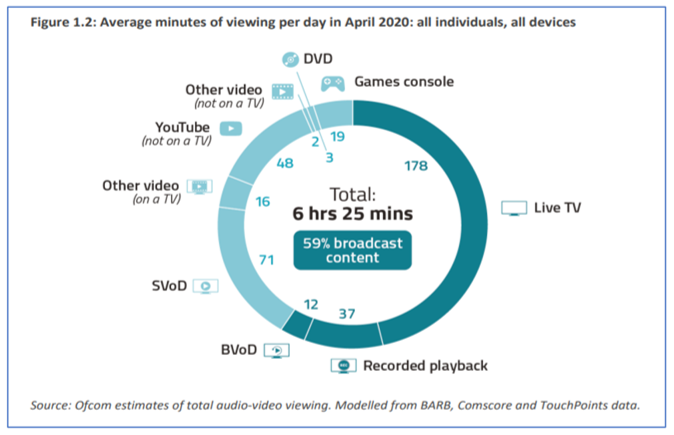

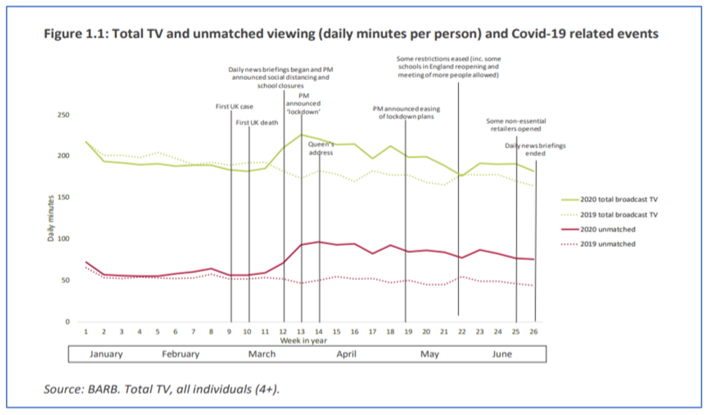

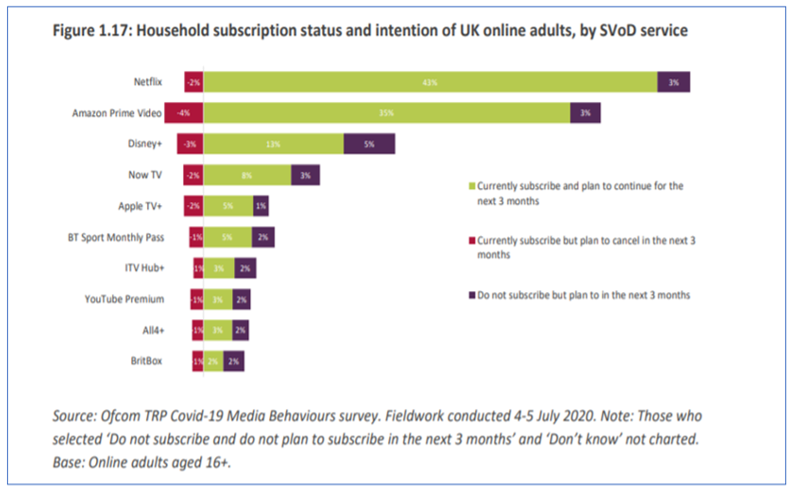

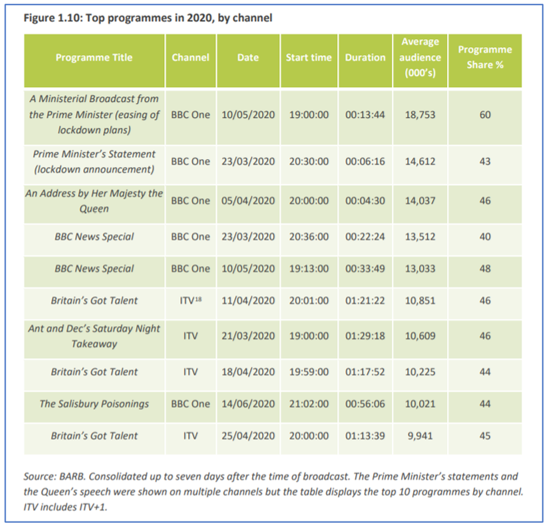

Today’s Clear Digital Digest reviews a recent Ofcom report about our changing TV and video viewing habits since lockdown. We also take a look at changes in the ecommerce world, covering both shopper attitudes plus news from Amazon, Aldi and the mooted return of a familiar old retail brand, Comet… CHANGING VIEWING HABITS Ofcom have just released their latest annual Media Nations research report, examining how we consume TV, video, radio and audio content. This year’s events have unsurprisingly seen quite significant changes since March, so Ofcom have added two chapters to their report examining Covid-19 related trends. Some key highlights from this are:

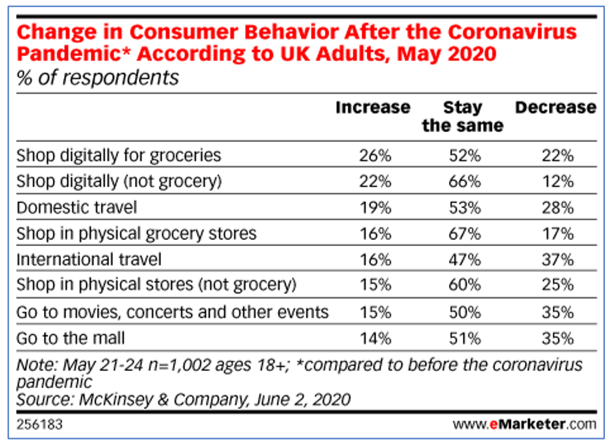

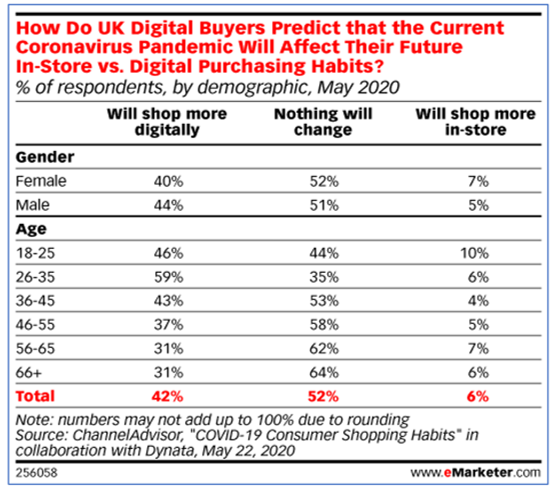

CHANGING SHOPPING HABITS As well as changing our viewing habits, Covid19 has also fundamentally changed our shopping habits with the well documented growth in online shopping. eMarketer have taken a look at what these shifts may mean in the longer term.

Looking at other ecommerce stories, a week never seems to go by without some significant Amazon news and the last seven days are no exception.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Jim ClearLead blogger and founder of Clear Digital: talking about ecommerce, digital, marketing and media. Categories

All

Archives

December 2020

|