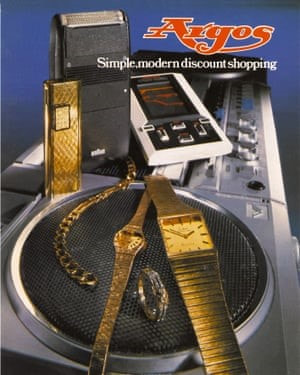

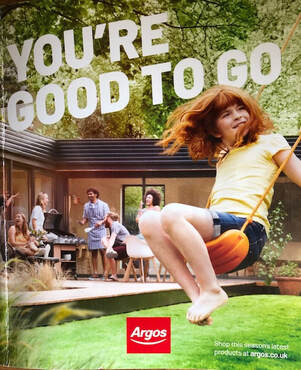

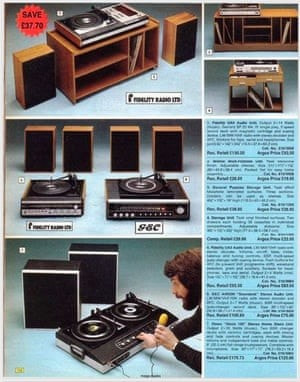

Clear Digital Digest: Argos catalogue RIP, retail tie-ups, Q2 updates and soccer supervillains3/8/2020 Today’s Clear Digital Digest starts with a look back at the beloved Argos catalogue before looking forward to the growing impact of another Argos innovation in Click & Collect, as well as other retail partnerships. Then we turn our attentions Stateside to review Q2 updates from Amazon, Facebook and Google plus the latest digital innovation in sports watching… END OF AN ERA – GOODBYE ARGOS CATALOGUE So RIP the Argos catalogue – as one wag noted, much easier to say than to actually do. As was widely reported on Thursday, Argos have stopped producing their twice yearly catalogue, meaning that January’s Spring/Summer 2020 edition will be its final print version. Argos now say that online shopping offers “greater convenience” than flicking through a catalogue, part of the continuing wider shift to ecommerce sales. Having previously spent 8 years in various roles within Argos’ ecommerce operation, during which time the catalogue’s ubiquity (estimated to have been in approx. 75% of British homes at one time) certainly helped to mutually drive web sales, there’s definitely a sense of nostalgic regret to see the “laminated book of dreams” bid farewell. However, it appears that less and less were being printed, with 3.9m of the last edition down from a peak of over 10m a decade ago. And with each catalogue costing roughly £3 to produce back when I was working there, changing shopping habits will have made ceasing production an increasingly attractive option for the huge potential cost savings; something that has been frequently reviewed over the years. Nostalgia for kids being able to choose their favoured Christmas presents will be partly assuaged by the news that Argos plans to continue to print its Christmas Gift Guide, still generally a sturdy 300 pages or so, albeit well down on the 1800 page behemoth that was the main catalogue. Before then, for anyone after a quick nostalgic fix, the Guardian pulled together a selection of vintage covers and catalogue pages, count me in for 1976’s Home Stereo Disco Unit (item 7 below…) CLICK AND COLLECT/RETAIL PARTNERSHIPS Of course, there are other retail channels that Argos pioneered which remain highly relevant and continue to grow in popularity, none more so than Click & Collect. In line with all ecommerce sales, Click & Collect orders have been growing rapidly since the start of lockdown, with more and more brands partnering together for mutual benefit. Argos have offered a collection service for selected eBay customers since 2014, while the introduction of Argos collection points into many Sainsburys stores since being bought by the grocer in 2016 meant that Argos was able to continue offering C&C services throughout lockdown. Amazon entered into a similar partnership with Next last year with their Amazon Counter initiative, while John Lewis have recently announced plans to extend their C&C tie-up with the Co-op to over 500 stores. John Lewis have also just stated that they expect 60% of their sales to be online, up from 40% pre-Covid. In an update to all John Lewis partners, chair Sharon White said “We have two of the best loved and trusted brands in the UK, rated highly for our personal service and expert, impartial advice. Customers are, however, shopping in very different ways – younger people especially – with the pandemic accelerating the importance of digital. We expect John Lewis to be a 60% online retailer, from 40% pre-Covid-19, and Waitrose to rise above 20%, from 5%.” Such uncertain times do certainly seem to be leading to a much wider array of complementary brands working together, with another recent example seeing Sainsburys starting to provide a range of 3000 products to the garden centre retailer Dobbies. Q2 UPDATES: AMAZON, FACEBOOK, GOOGLE Three of the tech giants have provided their latest global Q2 updates in the last few days, with varying results. Of course, Q2 2020 is the first quarter since the world has been in lockdown, so one would certainly not expect standard trends from these updates.

AND FINALLY…

In a week when it was announced at the last minute that planned pilot sporting events were not allowed to admit limited spectators as originally planned, technology continues to serve up increasingly sinister options instead. After previously highlighting Japanese robotic baseball fans last month, MLS in the US have now seemingly opened applications for the world’s next supervillain…

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Jim ClearLead blogger and founder of Clear Digital: talking about ecommerce, digital, marketing and media. Categories

All

Archives

December 2020

|