|

It’s now been 5 months since we entered lockdown and then slowly started to re-emerge as restrictions began to ease, bit by bit. It would be trite to say the world has changed in a way previously unrecognisable to all of us; of course it has and constantly so. In fact the pace of change makes it increasingly difficult to keep up, especially with a seemingly never-ending deluge of data and information and data being provided. Looking at these awful events from an ecommerce perspective, I’ve highlighted 5 key trends from these last 5 months to help understand the seismic shifts we’ve been experiencing with regards to how customers have been shopping during this unique period:

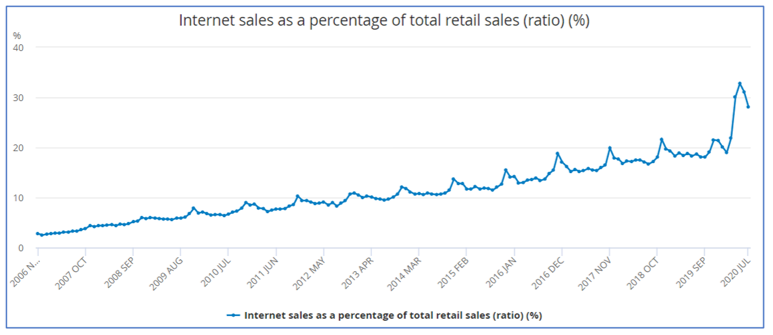

This Clear Digital Digest takes a look at each of these trends in turn, as well as providing some retro gaming light relief at the end… 1. ONLINE SALES HAVE ACCOUNTED FOR AS MUCH AS A THIRD OF TOTAL RETAIL SALES DURING LOCKDOWN This insightful chart from the Office for National Statistics (ONS) shows the huge growth in ecommerce sales during lockdown, with internet sales peaking at 32.8% of all retail sales in May.

2. ECOMMERCE DROVE £658M OF ADDITIONAL GROCERY SALES JUST LAST MONTH

According to Nielsen’s head of retailer and business insight Mike Watkins:

3. SUCH DYNAMIC ECOMMERE GROWTH IS SPEEDING UP SECTOR INNOVATION This step change in customer behaviour is seeing a never faster pace of innovation within the market, with recent developments including:

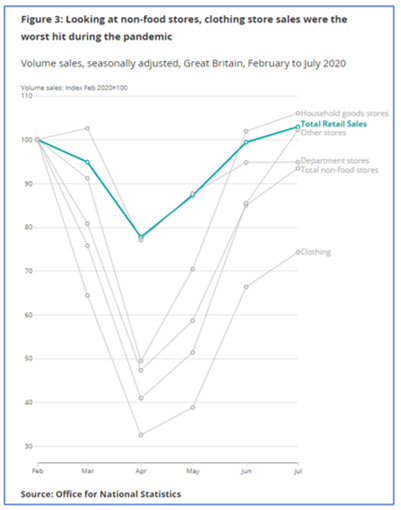

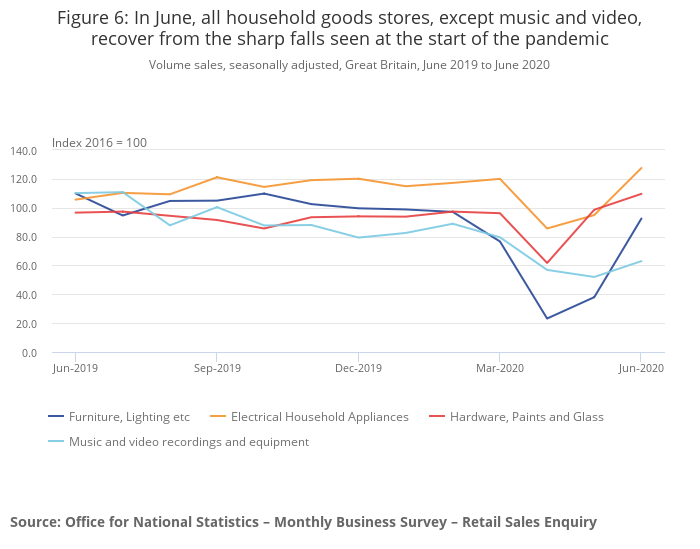

4. SPENDING IS VERY SQUEEZED IN OTHER SECTORS, ESPECIALLY CLOTHING AND MID-MARKET BRANDS

5. AS WELL AS ECOMMERCE INNOVATION, OTHER NEW CHANNELS ARE BEING INTRODUCED, SUCH AS PRODUCT RENTAL

AND FINALLY… As an 80s kid that loved arcade gaming and a 90s student who used part of his student loan to buy a Sega Mega Drive, before then becoming involved professionally as a PS2/Xbox buyer in the 00s, I really enjoyed watching the new Netflix video games history docuseries “High Score” - well the first two episodes I have thus far encountered anyway…

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Jim ClearLead blogger and founder of Clear Digital: talking about ecommerce, digital, marketing and media. Categories

All

Archives

December 2020

|