|

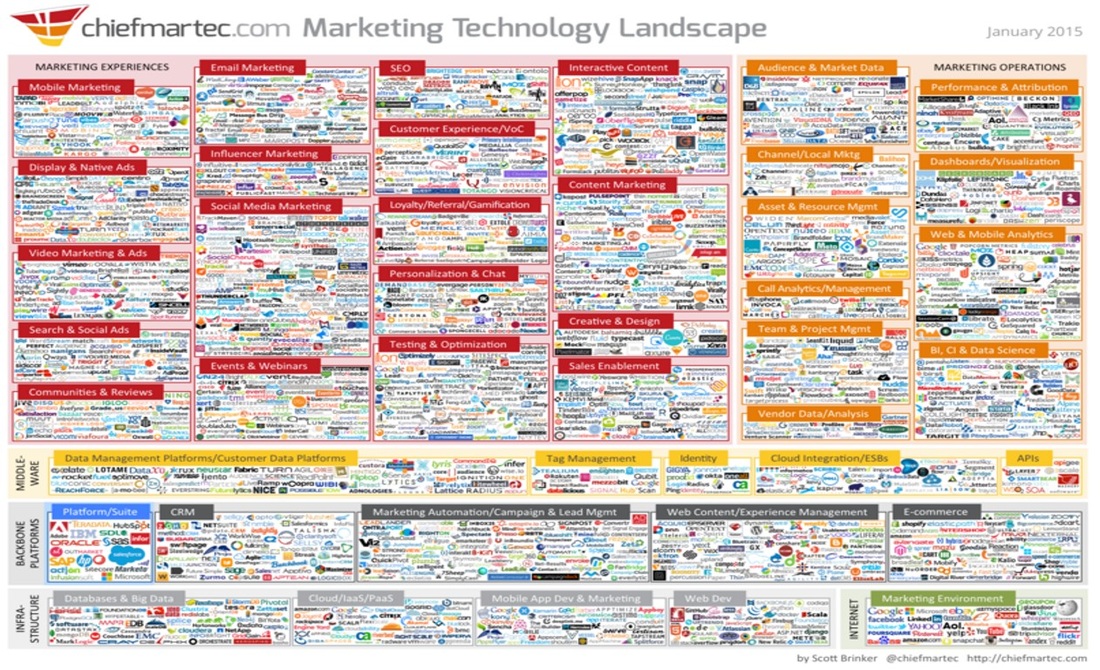

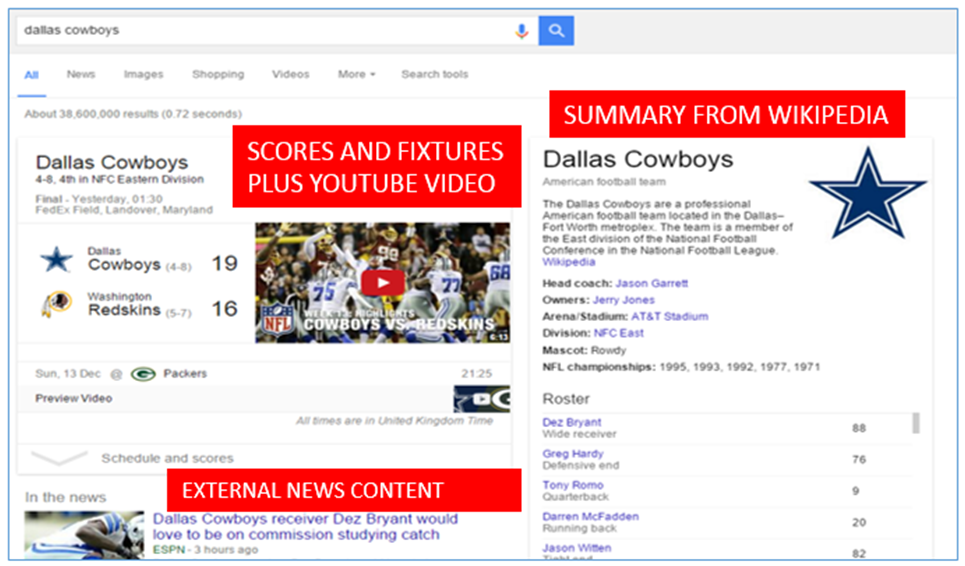

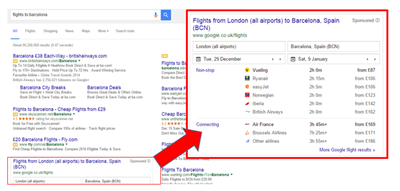

So, as the festive period approaches, it is now the custom to both look back at the last year as well as forward to what the next year holds. I’ve personally decided to look forward to next year (with a nod to 2015 too) and outline 6 interesting trends that I think we’ll see during 2016 in the worlds of digital, marketing, ecommerce and media. By no means comprehensive (that would take a list of 16, if not 216), but hopefully an interesting list nonetheless. I’d also love to hear what you think too via comments below or on Twitter… 1. DIGITAL MARKETING TECHNOLOGY WILL CONTINUE TO CONSOLIDATE Next month is likely to see the latest update of Scott Brinker’s always helpful Marketing Technology Landscape; principally helpful to form an indicative view of how just how many different providers and channels/categories are out there due to its sheer scale. Typically updated annually, January 2015’s update featured a huge 1876 companies, double the 947 featured in January 2014. However, despite this growth in marketing tech providers, there is also an increasing rise in usage of the enterprise suites (“all in one/many in one” solutions from Adobe, IBM, Salesforce etc) as many businesses are understandably adopting a less is more approach and trying to simplify their marketing tech stack as far as they can, especially in pursuit of the nirvana of the ultimate multi-channel single customer view. Adobe for one expect this to continue into 2016, recently forecasting revenues from its digital marketing cloud to grow by 20% next year. IMPLICATION/PREDICTION: With a fair bit of merger and acquisition activity in the sector, I would expect 2016’s Marketing Technology Landscape “Supergraphic” to feature perhaps a similar number of companies; I’ll certainly be very surprised if the number doubles again from last year! More interest will come from the categorisation used and any key changes there year on year. In any case, I fully expect to see consolidation continue on both fronts; with the enterprise suites continuing to grow by acquisition/new product development and businesses themselves striving to use a smaller amount of powerful tools to help with simplicity and also greater data integration. In essence, the desire is obviously there to spend more time not worrying about the tools themselves and their implementation, but to focus instead on maximising what these tools can do now and for future development; easy to say, often harder to do! 2. GOOGLE CONTINUES TO DEVELOP ITS ECOMMERCE AND MEDIA AMBITIONS Any digital list looking forward to the New Year of course has to have an opinion on Google (and in particular search innovation) so here is mine. As ever, Google have of course rolled out a plethora of developments during 2015, with the news that Google are now indexing in-app content amongst the most interesting along with the usual ongoing algorithm updates, including April’s change to encourage mobile friendly websites. However, the area I’m going to highlight is the increasing amount of real estate and utility on Google’s main search page itself. Google’s Knowledge Graph continues to provide an increasing amount of information (and so take up an ever larger part of the SERP) helped no doubt by the recent RankBrain update, thus reducing the need to visit other websites; as an example, have a look at the search results below, returned for the “Dallas Cowboys” NFL team. All the likely most popular information from this general search term is freely available within this one Google page: latest result, upcoming fixtures, even video highlights from the last match (via YouTube of course). Additionally, Wikipedia content here is providing a summary of other key information/history etc directly on the SERP, which is actually leading to declining traffic to Wikipedia itself.  IMPLICATION/PREDICTION: Looking into the ecommerce space, Google Shopping changes and the increasing prevalence of PLAs over the past couple of years have very much encroached onto the main SERP and other new developments such as the recent launch of Google Compare for products like mortgages will see this continuing to spread to most if not all key ecommerce sectors. For example, how long will it be before the “Google flight results” section of this search for “flights to Barcelona” rises to the top and above the 3 standard PPC ads? The way that Google Shopping has hugely reduced the popularity of price comparison sites like Kelkoo and Pricerunner means that all ecommerce businesses obviously need to be aware of changes to the Google “shop window”. Google are certainly keen to own more and more of the customer experience where they can up to the point of distribution (for now!). This means that the need to provide a strong and unique customer experience remains ever more important, as I also expanded on in this recent blog. 3. COULD MOBILE (AND THE “BUY BUTTON”) DRIVE THE SECOND COMING OF SOCIAL/F-COMMERCE? “F-Commerce” (ie: "Facebook Commerce"). Now there is a phrase to drive dread into my heart. Rewind 5 or more years and with Facebook’s huge user growth at the time coupled with its then “new kid in town” status, there was a stampede from retailers (and tech providers too) to see if/how Facebook itself could drive sales directly. Most typically, this was by offering a cut down version of an ecommerce site within Facebook itself, which I always thought was a bit like setting up a market stall in a busy pub despite having a great store 3 doors down. Anyway, as a launch partner around that time for the short lived Facebook Deals initiative, I have to say pretty much everyone in ecommerce was jumping on the social/Facebook bandwagon. Therefore, it is fair to say that I have a certain amount of cynicism about selling on social networks (albeit a big fan of “social commerce” in the form of customer reviews etc but that’s for another day). However, perhaps this was just at the “peak of inflated expectations” on Gartner’s Hype Cycle and maybe we are now moving into the “slope of enlightenment” where there may actually be a way to drive sales via Facebook and other social channels, with Pinterest in particular also coming to mind. I say this not just because of the ongoing introduction of the “buy button” to Facebook, Twitter etc, but also because of the continuing shift to mobile usage too (and with its accompanying heavier social media usage, especially via apps). Indeed, this logic seems to be behind Facebook’s recent announcement “Connecting People to Brands and Products on Mobile” and purchasing directly from your news feed rather than being heading elsewhere may prove attractive – at least for some customers and some brands. IMPLICATION/PREDICTION: This will be an interesting one to watch. As Facebook in particular starts to resemble more and more the portals of “Web 1.0” (see my point 5 below too) with it moving beyond simply sharing photos and gossip with friends and developing further into a one stop shop for areas such as news and discovery, it would be foolish to neglect the increasing time that your customers may be spending there, especially on mobile. However, for retailers, their different dynamics such as product, price etc will all need careful consideration – buying an impulse buy of some music or a small gift from your news feed, compared to a more considered purchase such as a TV or laptop, will of course be fundamentally different. The opportunity may actually be greater for smaller retailers with minimal mobile/app presence, as Facebook may offer a more streamlined payment procedure too, which can often be a challenge to get right on mobile. Watch this space then. 4. NATIVE ADVERTISING WILL CONTINUE TO GROW IN LINE WITH ITS SIBLING, CONTENT MARKETING

IMPLICATION/PREDICTION: Although this extreme Pepsi example may be a bit too sickly for many UK brands, the blurring between branded and non-branded content will continue to blur as publishers and media owners continue to diversify their revenue streams out of necessity. The ongoing difficulty to maximise advertising effectiveness both digitally, due to factors like the rise in ad blocking, and also with TV, due to increasing usage of streaming services like Amazon Prime as well as more watching via PVRs such as Sky+, means that brands are equally keen to make use of these new opportunities. Indeed, household names such as Stella Artois and Samsung are already taking advantage of product placement in Netflix original programming such as House of Cards. 5. ARE FACEBOOK AND OTHER “FRENEMIES” SPEARHEADING THE RETURN OF THE PORTAL? Remember the “early days” of the Internet (I’m talking mid to late 90s here)? For the mainstream, there could often seem to be only about 20 websites, most of which were large one stop shop portals: the likes of Yahoo, AOL and MSN, all with multiple news/sports/entertainment etc channels, as well as a range of “Partner” shopping channels featuring a selection of most large retailers. Then, Google’s search revolution at the start of the millennium and the rise of the open web led to a decline in popularity of these “walled gardens”. However, could we be seeing a return to the portal in the guise of Facebook in particular? Actually, could it be argued that we are already there? The Huffington Post’s new CEO Jared Grusd thinks so, recently commenting: “Companies like Facebook and Snapchat are saying: ‘We have already attracted one billion people in the world to our platform. Rather than refer them back to your site, we actually want to keep them…So post-social is, in many respects, coming full circle to where we began in the old days when people would go to AOL and Yahoo and you would just consume all your content on their portals.” IMPLICATION/PREDICTION: As outlined above in points 2 and 3, the big beasts of the internet are keen to increasingly own more and more of both consumers’ quest for information (a threat to media and content companies) and more of the purchase cycle, which ecommerce companies need to carefully consider. Often referred to as “frenemies”, a core presence on Google, Facebook etc is of course essential to pretty much any business due to their scale, but the need to add something additional to your customer’s experience of your brand therefore becomes ever more important. Here, examples such as The Guardian’s membership scheme and accompanying live events plus Hamleys’ plans to create even more excitement and entertainment in-store help to demonstrate ways forward to compete. 6. THE “AGE OF THE CUSTOMER” AND INCREASING COMPETITOR THREATS MEANS A NEED FOR EVER GREATER CUSTOMER OBSESSION

Perhaps not just new for 2016, but the ever increasing demands of the customer, helped by social media’s democratisation of information flow, mean that the need to provide a much better experience for your customers than ever before is paramount. I expanded on these developments (defined as the “age of the customer” by Forrester) at the end of this recent blog. Also, as we’ve seen above, the competitor set is ever widening – be that content distributors increasingly becoming content providers too, or large digital hubs wanting to own more of the ecommerce journey. In addition, the likes of Uber and Airbnb saw the much used term of “digital disruption” bandied about in 2015, a term that is unlikely to go away in 2016, as start-ups will continue to look for innovative business models as well as gaps to exploit in established markets. IMPLICATION/PREDICTION: This particular prediction is really pulling together a lot of the earlier forecasts so tough to summarise in a paragraph. That said, understanding and validating your customer needs and wants, keeping close to market and competitor trends, along with embracing and implementing the right levels of change (technology, product development, new channels etc) all remain key to a successful year in 2016. Oh yes and a couple of final predictions to finish off with: Ipswich Town to be promoted via the play-offs and Leicester City to win the Premier League. Well, one can dream… What do you think too? Would love to know any thoughts or comments, either below or via Twitter @clrdigital

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Jim ClearLead blogger and founder of Clear Digital: talking about ecommerce, digital, marketing and media. Categories

All

Archives

December 2020

|