|

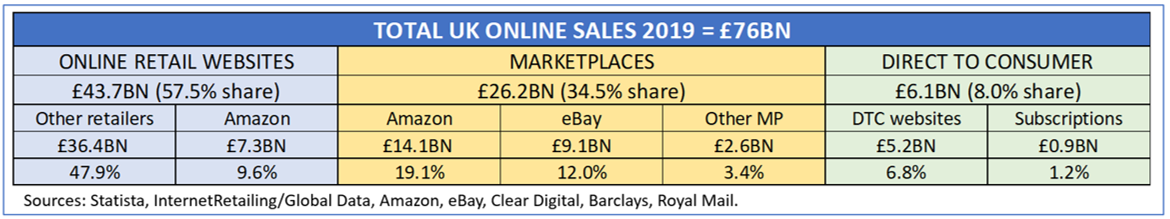

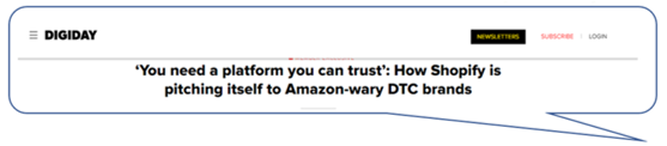

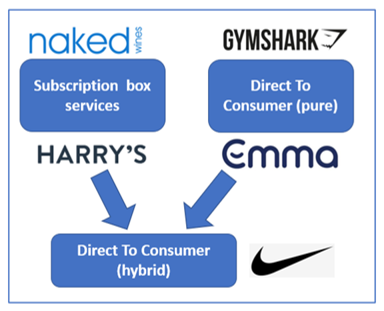

One of the most talked about developments for both ecommerce and general retail in recent years has been the rise of “Direct To Consumer” (DTC), whereby brands are bypassing traditional retail outlets/websites and selling direct to customers. 2020’s unfortunate events have led to a well documented large increase in home deliveries, including DTC brands generating record sales across sectors as diverse as food kits, mattresses and sportswear. The rise in marketplace sites (especially Amazon and eBay) has certainly played a part in increasing DTC sales, and Clear Digital recently explored this in the deep dive “The UK marketplace sector – and the role of community”. However, DTC websites are also rapidly expanding, particularly on the Shopify ecommerce platform. This blog explores further the size and dynamics of the UK DTC sector, as well as examining Shopify (and similar ecommerce solutions) in order to understand more about DTC winners and their growth drivers, including expanding onto other channels...

THE UK DIRECT TO CONSUMER (DTC) MARKET

SHOPIFY, AMAZON AND DEVELOPING MULTIPLE CHANNELS

CLOSING THOUGHTS

Please note that this blog is a summary of the accompanying deeper dive on "The growth of Direct To Consumer, Shopify – and developing multiple channels", which is available to download here.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Jim ClearLead blogger and founder of Clear Digital: talking about ecommerce, digital, marketing and media. Categories

All

Archives

December 2020

|

||||||||||||