|

Today’s varied Clear Digital Digest round-up includes:

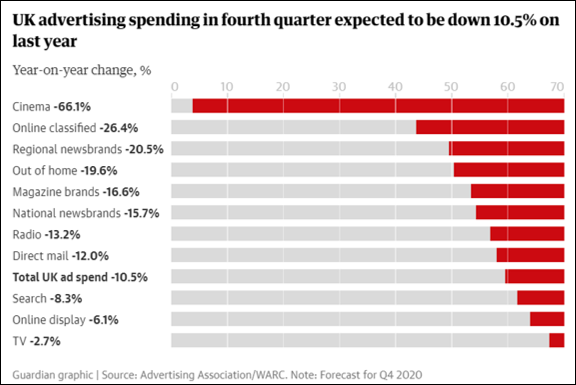

HERE COMES CHRISTMAS: BUT AD SPEND FORECAST TO BE £724M LESS THAN LAST YEAR With half term coming to a close this week and Christmas products all over the high street, November is typically when the large retail brand campaigns come to life, with large TV spend supported by a variety of other media. Of course 2020 is not a typical year, so there will certainly be all kinds of challenges creatively this year, as well as with regards to available budgets.

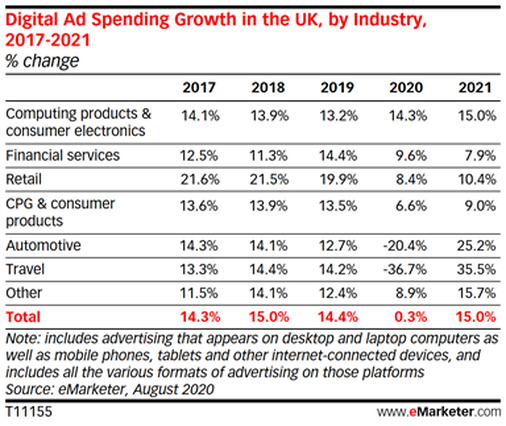

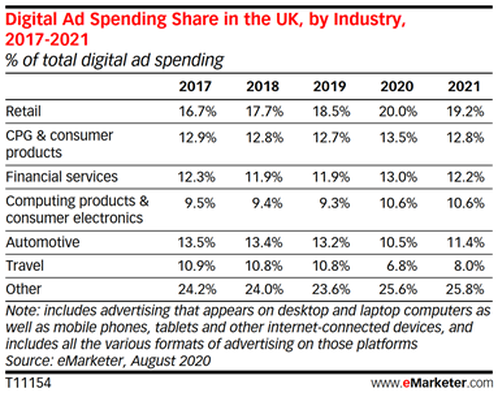

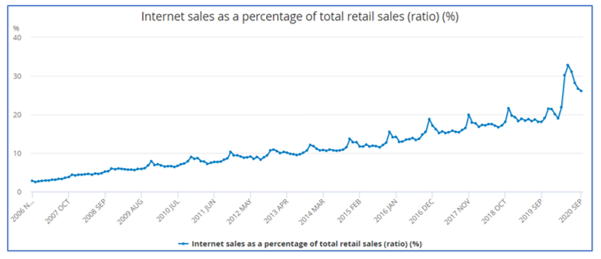

ECOMMERCE: SALES UPDATE - AND BLACK FRIDAY IS GETTING EARLIER EVERY YEAR Despite all this year’s uncertainty, one trend that can be confidently predicted for Christmas 2020 is that ecommerce sales will take a significant larger share of total retail sales, but how much larger exactly?

CHANNEL SHIFT: SHOPIFY, TIK TOK, ROYAL MAIL, AO, SKY, JOHN LEWIS Here are a few recent stories that caught my eye regarding channel purchasing shifts, including developments from AO and Sky which demonstrate how digital first brands continue to consider the ways that a physical presence can help them engage further with customers…

AND FINALLY… One brand that won’t be returning to the high street – despite a flurry of excitement earlier this week – is the old childhood favourite Woolworths.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Jim ClearLead blogger and founder of Clear Digital: talking about ecommerce, digital, marketing and media. Categories

All

Archives

December 2020

|